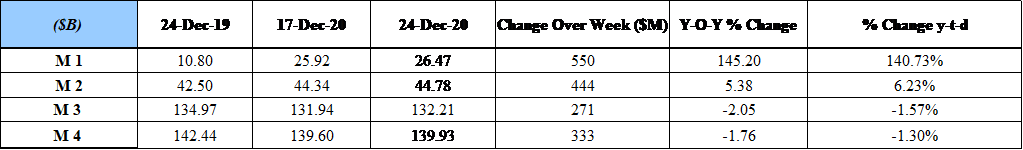

BDL’s latest statistics on money supply revealed that Broad Money (M3) increased by a weekly LBP 409B ($271M) in the week ending December 24, 2020 to stand at LBP 199,312B ($132.21B). As such, on an annual basis, M3 decreased by 2.05% and 1.57% since year-start (YTD).

In details, M1 expanded by a weekly LBP 829B ($550M) to settle at LBP 39,905B ($26.47B) by December 24, 2020. The upsurge is mainly attributed to the weekly increase in Currency in circulation and demand deposits by LBP 472B ($313M) and by LBP 357B ($236.8M).

In turn, total deposits (excluding Demand deposits) decreased by LBP 420.21B ($278.75M), owing to a weekly decline in deposits denominated in foreign currencies by $173M. In addition, Terms and saving deposits in LBP witnessed a weekly drop by LBP 160B ($106.14M).

As such, the rate of broad money dollarization dropped as it went from 66.39% in the week ending December 17 to 66.13% in the week ending December 24, 2020.

Analytically, the money supply M3 can be derived from combining the balance sheet of BDL with the balance sheet of banks to arrive at the monetary survey of the banking system. The resulting M3 would be equal to the sum of: net foreign assets (NFA), credit to the private sector (CPS), net credit to the public sector (NCPS), and other items net (OIN). Latest data show that in October 2020, M3 stood at $132.21B, 1.57% less than year-start (YTD); NFA were $18.45B, less 30.58% YTD; CPS was $36.09B, less by 23.17%; NCPS was $39.82B, less by 15.84%; and OIN were $36.84B, higher by 142.75%, and comprising mostly (in BDL’s terminology) other assets which include open market operations and seigniorage, considered to be a controversial account by some.

In its treasury bills (T-Bills) auction dating December 10, 2020, the Ministry of Finance (MoF) raised LBP 1,589.7B ($1,055M) through the issuance of T-Bills maturing in 3 months (3M) and 1 year (1Y) and notes maturing in 5 years (5Y). The highest demand was recorded on the 5Y notes which grasped 98.9% of total subscriptions, while 1Y T-bills and 3M T-bills accounted for the remaining shares of 0.72% and 0.38%, respectively. In details, the yield on 3M and 1Y stood at 3.50% and 4.50% while coupon rates on the 5Y stood at 6%.

Source: BDL; MoF