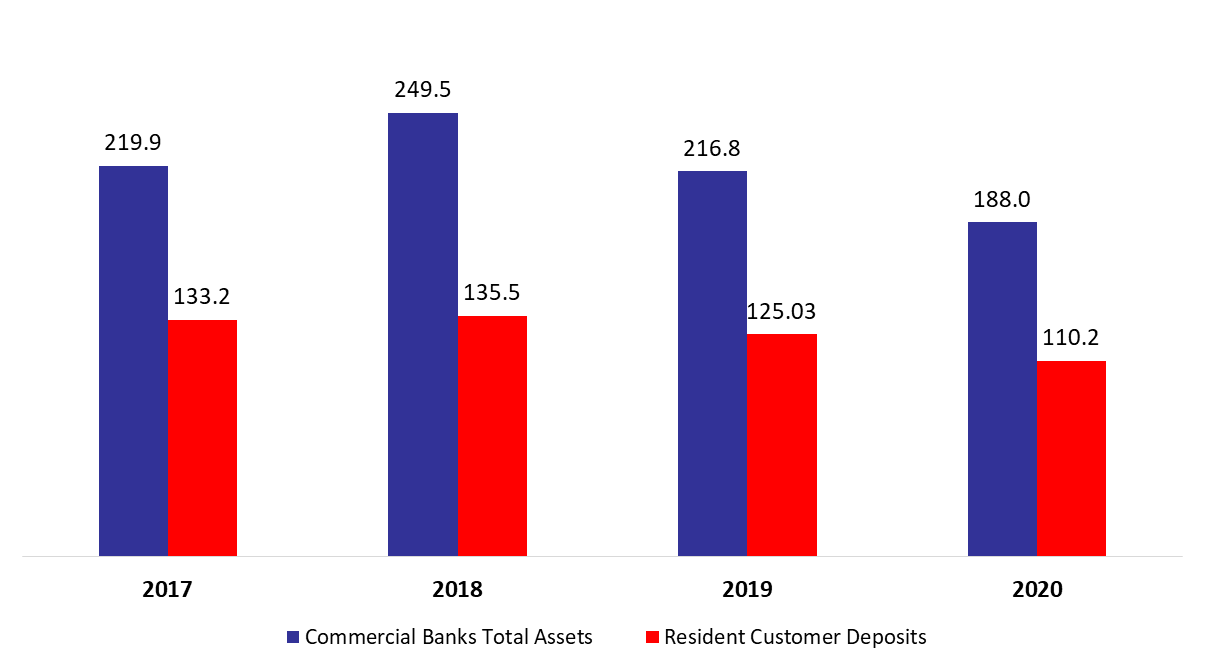

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets decreased by 13.26%, year-to-date (y-t-d), to stand at $188.04B in December 2020. The resources of the Lebanese banks are tightly intertwined with the sovereign, with most of their assets placed with the central bank. In turn, declining confidence in the economy has been raising the depositor’s fear of losing their savings, which imposed a heavy toll on the balance sheets of banks and Lebanon’s central bank.

In details, resident customers’ deposits (which grasp 58.62% of total liabilities) decreased since the start of the year by 11.83% to $110.2B in December 2020, with deposits in LBP and in foreign currencies declining by 29.13% and 5.24% to $24.43B and $85.81B, respectively.

As for Non-resident customers’ deposits (14.55% of total liabilities), they retreated by 15.71% and totaled $27.35B over the same period on the back of drops in deposits in LBP and in foreign currencies by 28.11% and 14.39% to $2.26B and $25.09B, respectively. As such, the dollarization ratio for private sector deposits increased from 76.02% in December 2019 to 80.37% in December 2020.

On the assets side, Reserves (constituting 59.31% of total assets) recorded a y-t-d decline of 5.65% to settle at $111.53B in December 2020. Deposits with the central bank (BDL) (99.01% of total reserves) witnessed a y-t-d drop of 6.19% to reach $110.43B. It is worth mentioning that starting December 2019 (and according to the offsetting criteria in IAS 32 “Financial Instruments: Presentation”), banks have offset their loans taken from BDL in LBP with their corresponding placements at BDL in LBP carrying the same maturities.

Meanwhile, Claims on resident customers (16.89% of total assets) shrank by 27.66%, to stand at $31.77B in December 2020. The drop in the loans portfolio followed the early settlement of some loans from related customers’ deposits through a netting process in fear of a haircut on deposits or a formal devaluation of the currency. Moreover, Resident Securities portfolio (11.95% of total assets) declined by 25.25% during the year to stand at $22.46B. Specifically, the subscriptions in T-bills in LBP and in Eurobonds recorded declines of 21.77% and 32.02% to reach $11.45B and $9.39B, respectively in December 2020. In addition, claims on non-resident financial sector dropped by 30.31% since the start of the year to record $4.72B in December 2020.

With the end of February approaching, panic is bubbling on social media over which banks might be liquidated in case they failed to comply with the central bank requirement of increasing their capital by 20%. So far, rescues funding from the IMF and other countries have not come through due to the lack of implementing the austerity plan and the restructuring of debt, in addition to formal capital controls and the elimination of Lebanon’s multiple currency exchange rates.

The challenges are difficult but we have a history of resilience and we will adapt to the new situation. Nevertheless, almost all banks have abided by the increase in capital, however, bankers are expecting that the central bank will extend the notice period due to little hope of attracting fresh investments.

Commercial Banks Assets and Residents Customer Deposits by December ($B)

Source: BDL, BLOMINVEST.