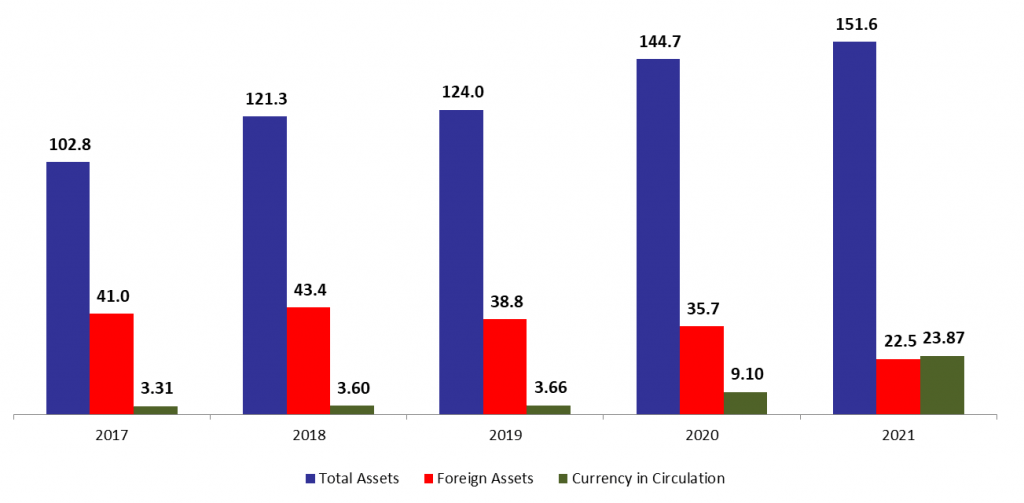

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 4.78% compared to last year, to reach $151.58B mid of March 2021. The increase was mainly due to the 14.39% rise in gold price compared to last year to reach $1,731.83/ounce mid of March 2021. As a result, the “gold” account, composing 10.52% of BDL’s total assets, increased by 9.22% to $15.94B. In addition, “Other assets”, grasping 30.35% of BDL’s total assets, rose by 58.88% year-on-year (YOY), to reach $46B. In fact, BDL balance sheet have been in spotlight since 2018; Lebanon’s central bank boosted the institution’s assets by using unusual accounting measures as the country’s economic situation careered towards collapse. Not to mention that the governor turned to adopting new financial engineering to boost reserves, and to steady the banking sector and maintain the currency peg.

Our “survival tool” is BDL’s foreign assets (grasping 14.87% of total assets) which decreased by 36.95% YOY to stand at $22.54B mid of March 2021. In details, this account mainly includes Eurobonds held by BDL, and reserves that BDL possesses with foreign correspondents. In fact, this account doesn’t totally reflect the real situation. For instance, Eurobonds are estimated to be $5.03B, however those Eurobonds are currently trading on average at 15 percent per dollar, which raises questions about the real value of Eurobonds on BDL’s balance sheet.

On the liabilities front, financial sector deposits (71.06% of BDL’s total liabilities) recorded a downtick of 4.87% YOY to settle at $107.71B mid of March 2021, of which more than two thirds are denominated in dollars.

Looking at Currency in Circulation outside of BDL (15.75% of BDL’s total liabilities) it increased from $9.1B mid of March 2020 to $23.87B mid of March 2021. In fact, depositor’s preference for cash is growing amid the uncertainty and lack of trust in the economy. In addition, BDL’s circular 151 facilitated cash withdrawals at the rate of 3,900 LBP per USD, which in turn supported the uptrend in the currency circulated and impacted the value of the Lebanese pound.

We cannot deny the fact that foreign currency reserves is under major threat reaching dangerously low levels. With the situation in Lebanon continuing its down way to the depth, there won’t be a floor for the collapse, but despite everything we have not reached the bottom yet. The first step toward not reaching the bottom is the formation of a new cabinet and putting a stop to the dissolution of foreign reserves currently taking place in the ongoing subsidy process.

BDL Total, foreign assets and currency in circulation as mid of March ($B)

Source: BDL, BLOMINVEST BANK