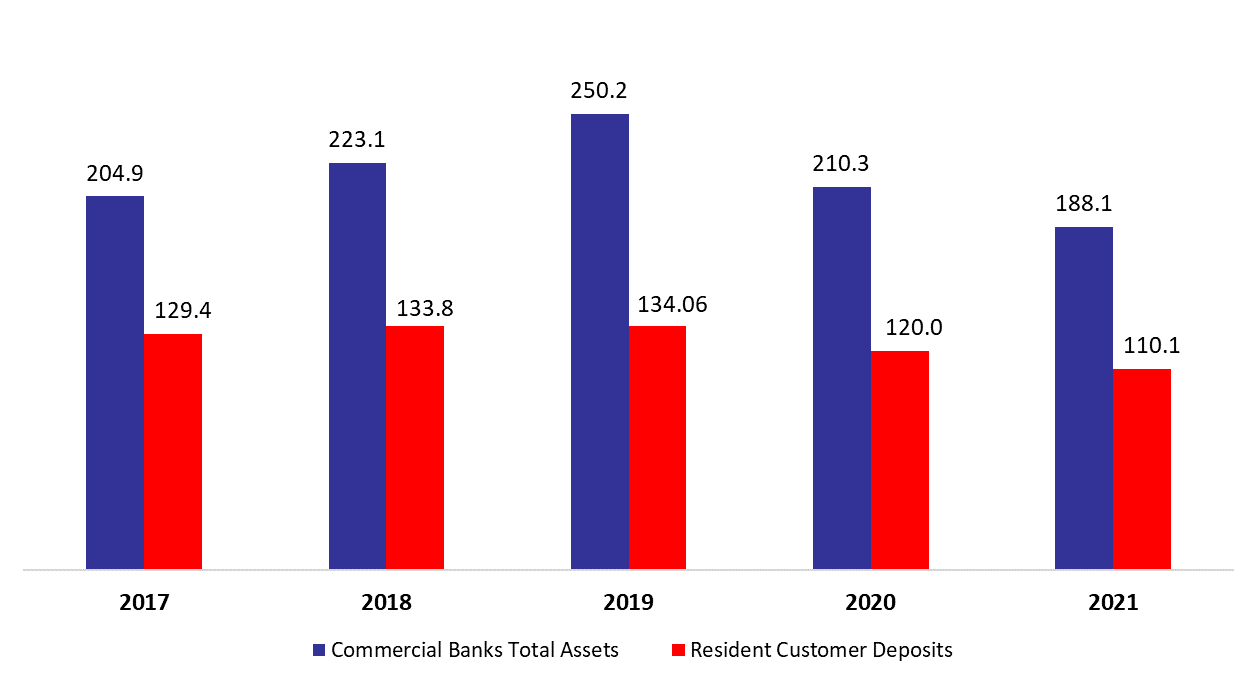

Along with the financial crisis and political uncertainty, Lebanese banks are continuously restrained. Total assets of Lebanese commercial banks increased by 0.05%, year-to-date (y-t-d), and stood at $188.13B in February 2021, according to Lebanon’s consolidated commercial banks’ balance sheet. The uptick can be explained by the Central Bank’s circular 154 which is related to the increase of banks’ external liquidity by 3%, in addition to circular 567 associated with the increase of commercial banks’ capital by 20%, equivalent to around $4 billion. However, it is not yet known how many banks will meet the Central Bank’s target after the Lebanese Banking Control Commission assesses each separately.

In details, resident customers’ deposits (which grasp 58.51% of total liabilities) decreased since December 2020 by 0.15% to $110.07B in February 2021, with deposits in LBP increasing by 1.72% to $24.85B while the deposits in foreign currencies declining by 0.68% to stand at $85.22B.

As for Non-resident customers’ deposits grasping 14.48% of total liabilities, they recorded a downtick of 0.42% and remained at $27.24B over the same period. In fact, the deposits in LBP retreated by 1.45% to reach $2.224B while deposits in foreign currencies declined by 0.33% and totaled $25.01B in February 2021. More importantly, the dollarization ratio for private sector deposits increased from 77.63% in February 2020 to 80.04% in February 2021. In addition, Non-resident financial sector Liabilities held 3.43% of total Liabilities and recorded a downtick of 1.93% to reach $6.45B y-t-d.

On the assets side, Reserves, constituting 59.30% of total assets, recorded a y-t-d uptick of 0.02% to settle at $111.56B in February 2021. Deposits with the central bank (BDL), grasping 98.95% of total reserves, witnessed a slight y-t-d decrease of 0.04% to reach $110.39B.

Meanwhile, Claims on resident customers, constituting 16.68% of total assets, shrank by 1.19%, to stand at $31.39B in February 2021. The drop in the loans portfolio followed the early settlement of some loans from related customers’ deposits through a netting process in fear of a haircut on deposits or a formal devaluation of the currency. Moreover, Resident Securities portfolio (11.99% of total assets) added 0.41% during January to stand at $22.56B. Specifically, the subscriptions in T-bills in LBP recorded decline of 0.03% to reach $11.45B in February 2021 while the subscriptions in Eurobonds added 0.75% and totaled $9.46B for the same period. In addition, claims on non-resident financial sector rose by 4.41% to record $4.92B in February 2021.

In addition, Banque du Liban recently issued a statement in which it decided to launch an electronic currency exchange platform built to register all transactions with the help of the commercial banks and licensed exchange dealers. The new statement shows the effort of BDL in helping banking sector overpass the current situation and to reduce the Lebanese pound’s exchange rate against the dollar that reached 12,000 LBP/USD last week.

Commercial Banks Assets and Residents Customer Deposits by February ($B)