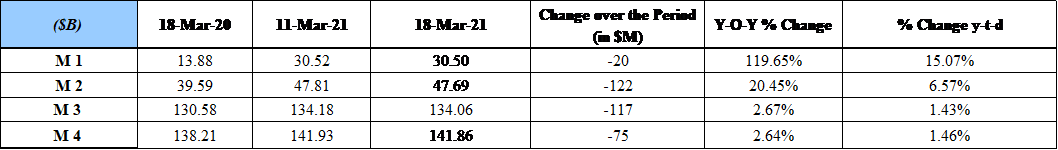

BDL’s latest statistics on money supply revealed that Broad Money (M3) decreased slightly by LBP 177B ($117M) to stand at LBP 202,100B ($134.06B) by the week ending March 18, 2021. As such, on an annual basis, M3 increased by 2.67% Year over year and by 1.43% since year-start (YTD).

In details, M1 contracted by a weekly LBP 30B ($20M) to settle at LBP 45,976B ($30.50B) by March 18, 2021. The contraction is mainly attributed to the decrease in demand deposits of LBP 187B ($124.04M) and an increase in Currency in circulation by LBP 157B ($104.14M)

In turn, total deposits (excluding Demand deposits) decreased by LBP 146.55B ($97.21M), owing to a decrease in Terms and saving deposits in LBP by LBP 153B ($101.49M). In addition, deposits denominated in foreign currencies progressed by $4M.

As such, the rate of broad money dollarization slightly increased from 64.37% in the week ending March 11, 2021 to 64.42% in the week ending March 18, 2021.

Looking at interest rates, the average rate on deposits in LBP and in USD, at commercial banks, decreased from 5.81% and 3.22% in February 2020 to 2.11% and 0.54%, respectively, in February 2021. As for the average lending rate in LBP, it went down from 9.33% in February 2020 to 7.59% in February 2021, while the average lending rate in USD declined from 9.11% in February 2020 to 6.92% in February 2021.

Analytically, the money supply M3 can be derived from combining the balance sheet of BDL with the balance sheet of banks to arrive at the monetary survey of the banking system. The resulting M3 would be equal to the sum of: net foreign assets (NFA), credit to the private sector (CPS), net credit to the public sector (NCPS), and other items net (OIN). Latest data show that in February 2021, M3 stood at $133.87B, 2.10% more than February 2020; NFA were $16.11, less by 40.75% YOY; CPS was $34.04B, less by 21.98% YOY; NCPS was $40.47B, less by 9.36% annually; and OIN were $43.97B, higher by an annual 159.10%, and comprising mostly (in BDL’s terminology) other assets which include open market operations and seigniorage, considered to be a controversial account by some.

In its treasury bills (T-Bills) auction dating March 18, 2021, the Ministry of Finance (MoF) raised LBP 162.48B ($107.78M) through the issuance of T-Bills maturing in 3 months (3M) and in 1 year (1Y) and notes maturing in 5 years (5Y). The highest demand was recorded on the 5Y notes which grasped 79.53% of total subscriptions, while 1Y T-bills and 3M T-bills accounted for the remaining shares of 11.77% and 8.70%, respectively. In details, the yields on 3M T-bills and 1Y T-Bills stood at 3.50% and 4.50% while coupon rate on the 5Y notes stood at 6.5%.

Source: BDL; MoF