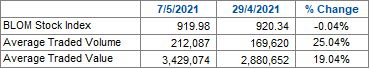

The BLOM Stock Index (BSI) compiled by BLOMInvest Bank on a daily basis slightly decreased by 0.04% since April 29, 2021 to reach 919.98 on May 07,2021. The Market capitalization on the Beirut Stock Exchange (BSE) decreased from $9.43B to $9.42B on May 07, 2021. Moreover, the average volume and value of trades during the week ending May 07, 2021 totaled 212,087 shares worth $3,429,074 compared to 169,620 worth $2,880,652 during last week.

Regionally, the major Arab markets witnessed worsening performance this week. In details, the S&P AFE 40 Composite index remained stable during this period. In contrast, the MSCI index and the S&P Pan Arab index both decreased weekly by 1.74%, 0.66%. In addition, the bourse of Tunisia, Bahrain, and Morocco were the top gainers this week, they increased by 2.57%, 2.39%, and 1.48%, respectively. On the other hand, the bourse of Saudi Arabia and Qatar were the worst performers for this week declining by 2.83% and 0.41% each.

On the Beirut Stock Exchange (BSE), the real estate sector grasped the lion’s share of the BSE’s trading value with a stake of 88.19%, while the banking grasped 11.81% and the industrial sector grasped 0.01%. The most noteworthy trades throughout the mentioned period included:

As for the BLOM Preferred Shares Index (BPSI), it retreated by 0.52% to stand at 45.63 points by the end of this week.

This week, Beirut Stock Exchange (BSI) had a downtick caused by the retraction in Solidere stock prices. But undoubtedly, the real estate sector is still bucking the Lebanese economic situation and it is defined by a stable outlook for this period. However those who can afford will invest to hedge against the devaluation of the Lebanese pound. Moreover, early this week S&P Dow Jones indices had announced that it will consider removing stocks of Lebanon’s largest companies from its indexes given the country’s worst economic crisis in decades. In addition, S&P Dow Jones Indices suggested to reclassify Lebanon from a frontier market to a stand-alone market.