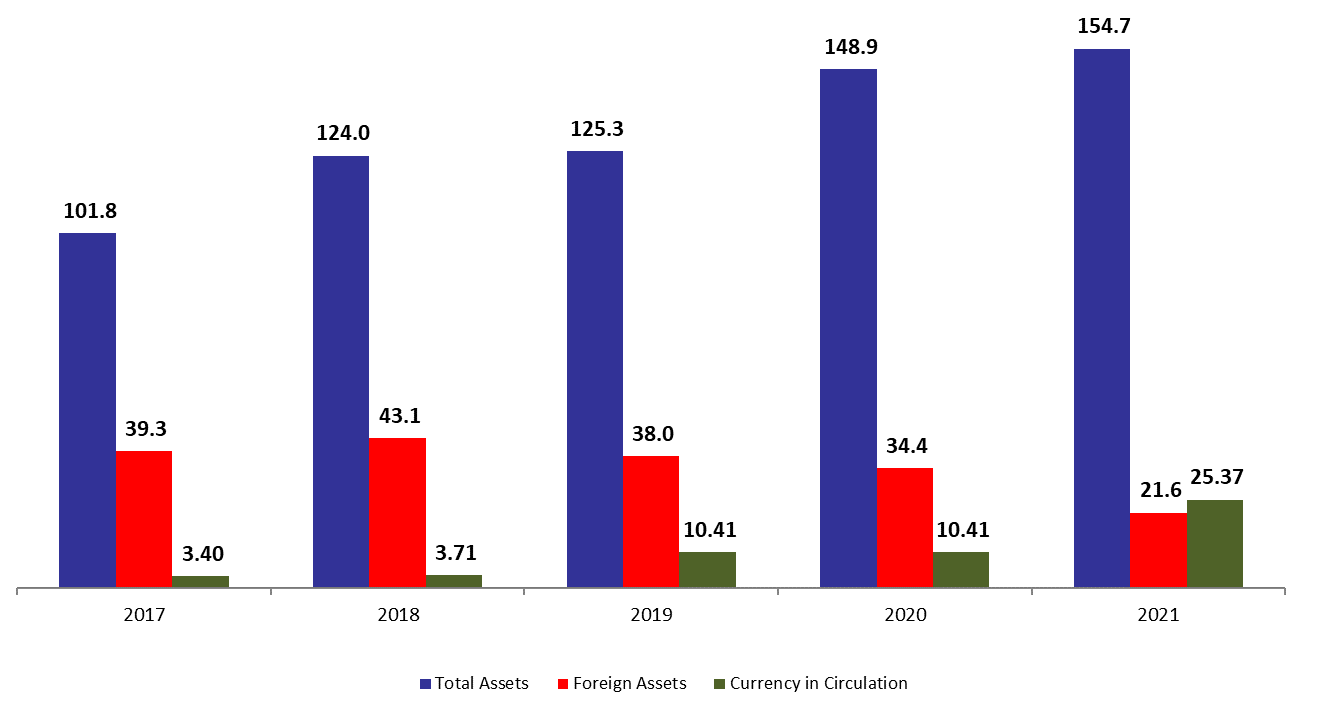

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 3.93% compared to last year, to reach $154.71B by end of April 2021. Reasons behind the increase include the 4.17% rise in gold price compared to last year to reach $1,776.04/ounce by April 2021. As a result, the “gold” account, composing 10.59% of BDL’s total assets, increased by 3.31% to $16.37B. In addition, “Other assets”, grasping 31.96% of BDL’s total assets, rose by 49.37% year-on-year (YOY), to reach $49.45B.

BDL’s foreign assets (grasping 14.26% of total assets) decreased by 37.13% YOY to stand at $21.64B by April 2021. In details, this account mainly includes Eurobonds held by BDL, and reserves that BDL possesses with foreign correspondents and other short-term instruments. Interesting to note that Eurobonds estimated to be $5.03B, are currently trading on average at 15 percent per dollar, which raises questions about the real value of Eurobonds on BDL’s balance sheet.

On the liabilities front, Financial sector deposits (69.79% of BDL’s total liabilities) recorded a downtick of 4.41% YOY to settle at $107.97B by April 2021, of which more than two thirds are denominated in dollars.

Looking at Currency in Circulation outside of BDL (16.40% of BDL’s total liabilities) it increased from $10.41B in April 2020 to $25.36B in April 2021. In fact, depositor’s preference for cash is growing amid the uncertainty and lack of trust in the economy. In addition, BDL’s circular 151 facilitated cash withdrawals at the rate of 3,900 LBP per USD, which in turn supported the uptrend in the circulated currency and impacted accordingly the value of the Lebanese pound.

In fact, the currency lost 80 to 90 percent of its value even though the official exchange rate is still 1,507.5 pounds to the dollar, despite its trading in the parallel market in the range of 11,000 and 15,000 over the last month.

Moreover, the Central Bank recently announced that it was looking into a system through which depositors could have access to their funds by granting depositors up to $25,000 of their money in instalments. However, the mechanism would be granted for deposits in all currencies dating before October 2019 and as they stood at end of March 2021, but it is unknown yet whether it will be adopted, especially as a substitute for subsidies.

It is worth noting that Lebanon will run out of money beyond required reserves to fund basic imports by the end of the month of May, and delays in launching a plan to reduce subsidies are costing $500 million a month.

BDL Total, Foreign assets and currency in circulation as of April ($B)