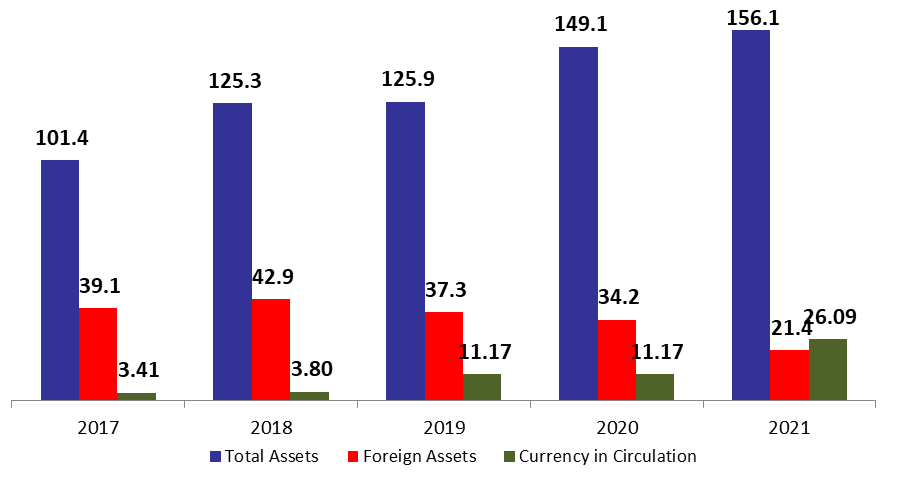

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 4.68% compared to last year, to reach $156.07B by mid-May 2021. The increase was mainly due to the 6.5% rise in gold price compared to last year to reach $1,906/ounce by mid-May 2021. As a result, the “gold” account, composing 10.83% of BDL’s total assets, increased by 7.78% to $16.91B. In addition, “Other assets”, grasping 32.34% of BDL’s total assets, rose by 49.88% year-on-year (YOY), to reach $50.47B.

BDL’s foreign assets (grasping 13.73% of total assets) decreased by 37.37% YOY to stand at $21.43B by end of May 2021. In details, this account mainly includes Eurobonds held by BDL, and reserves that BDL possesses with foreign correspondents and other short-term instruments. In fact, this account doesn’t totally reflect the real situation. For instance, Eurobonds are estimated to be $5.03B, however those Eurobonds are currently trading on average at 15 percent per dollar, which raises questions about the value of Eurobonds on BDL’s balance sheet.

On the liabilities front, financial sector deposits (68.89% of BDL’s total liabilities) recorded a downtick of 4.43% YOY to settle at $107.51B by mid of May 2021, of which more than two thirds are denominated in dollars.

Looking at Currency in Circulation outside of BDL (16.71% of BDL’s total liabilities) it increased from $11.17B at mid of May 2020 to $26.08B in mid-May 2021.

BDL Total, Foreign assets and currency in circulation as of Mid-May ($B)