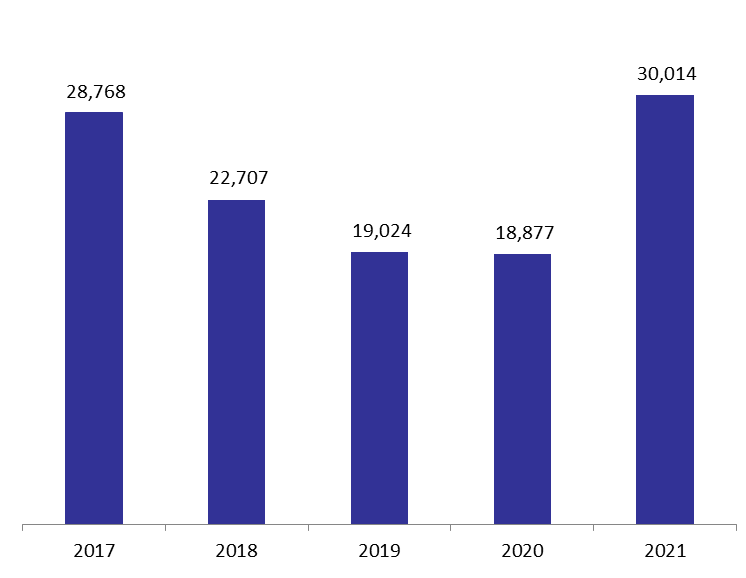

According to the data from the General Directorate of Land Registry and Cadastre (LRC), the number of Real estate (RE) transactions which may include one or more realties, went up by a yearly 59% to stand at 30,014 transactions by May 2021. In its turn, the value of total RE transactions stood at $4530.90M by May 2021, compared to $3718.65M in the same period last year, up by 21.84%. However, the value of those transactions are not quite accurate as we need to know more about the selling process of what was paid via bankers checks and cash to know the correct values of those transactions.

Monthly speaking, the number of RE transactions stood at 7,434 in the month of May 2021, compared to 4,036 transactions on May 2020. For instance, a substantial 1,575 transactions, or 21.19% of total RE transactions, were concentrated in the region of the Baabda alone in the month of May 2021. North, South and Zahle followed, each grasping the respective shares of 15.29%, 12.64%, and 11.80% of the total RE activity in May 2021.

Moreover, the breakdown of RE activity regionally showed that Beirut is the one that grasped the lion’s share of the total value of RE transactions, equivalent of 20.78% and worth $941.73M, while Baabda and Metn followed, constituting 16.42% and 12.10% of the total, each worth $743.81M and $548.19M, respectively.

A brief about the Real Estate sector’s evolution can be a proof why it is considered as a safe asset. Real estate prices had slumped in 2018 and were selling at discount prices in contrast to 2015 at a time housing loans were ceased by Lebanese banks. Just after October revolution, a spike in purchases had been driven by depositors’ frightfulness. This is due to the buyers’ appetite to hedge their deposits, while property developers were willing to sell quickly to settle their debts. However, by end of 2020, most developers had repaid their loans, and prices had gone back to the same level as before if calculated on the fresh dollars instead of the dollar banker checks.

The outlook will depend on Lebanon’s political and economic crises. On one hand, the devaluation of the local currency could attract foreign investments as well as more cash inflows. As a result, new projects could be kick started which lead to increase in real estate transactions. On the other hand, should the collapse remains as a long term situation, the discount of lollars is widening and prices could increase and readjust to fresh dollars. However, if reforms are put in place, the real estate sector would stabilize and result in investments in new projects.

RE transactions by May 2021

Source: Cadastre, BLOMINVEST bank