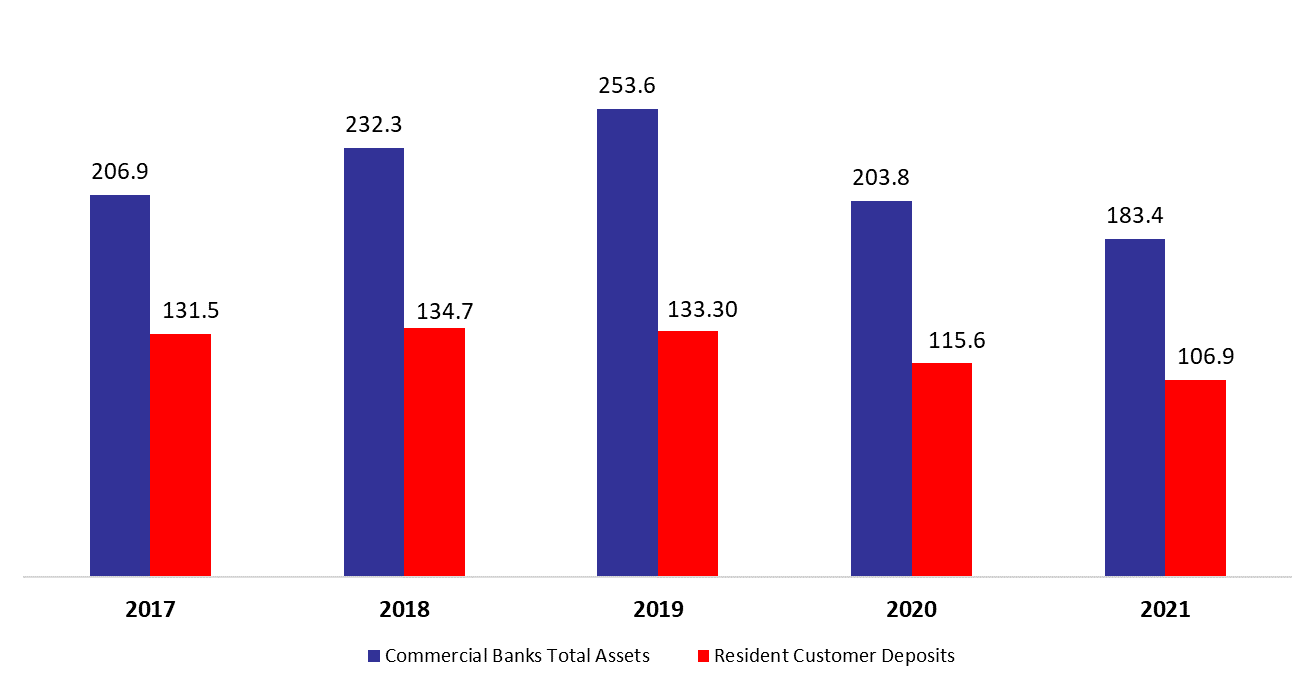

Lebanese Commercial banks, BDL and the Lebanese government incurred high losses as a result of the financial crisis, and will continue to suffer as long as the Lebanese Lira currency is unpegged. In consequence, total assets of Lebanese commercial banks decreased by 2.49%, year-to-date (y-t-d), and stood at $183.35B in May 2021, according to Lebanon’s consolidated commercial banks’ balance sheet.

In details, resident customers’ deposits (which grasp 58.28% of total liabilities) decreased since December 2020 by 3.07% to $106.86B in May 2021, with deposits in LBP down ticked by 3.86% to $23.48B while the deposits in foreign currencies declined by 2.84% to stand at $83.37B.

As for Non-resident customers’ deposits grasping 14.56% of total liabilities, they recorded a drop of 2.38% and stood at $26.70B over the same period. In fact, the deposits in LBP retreated by 2.72% to reach $2.20B while deposits in foreign currencies declined by 2.35% and totaled $24.51B in May 2021. More importantly, the dollarization ratio for private sector deposits increased from 80.43% in April 2021 to 80.50% in May 2021. In addition, Non-resident financial sector Liabilities held 2.88% of total Liabilities and dwindled by 19.91% to reach $5.27B y-t-d.

On the assets side, Reserves, constituting 60.46% of total assets, recorded a y-t-d downtick of 0.61% to settle at $110.85B in May 2021. Deposits with the central bank (BDL), grasping 98.57% of total reserves, witnessed a slight y-t-d decrease of 1.05% to reach $109.27B.

Meanwhile, Claims on resident customers, constituting 15.64% of total assets, shrank by 9.73%, to stand at $28.67B in May 2021. The drop in the loans portfolio followed the early settlement of some loans from related customers’ deposits through a netting process in fear of a haircut on deposits or a formal devaluation of the currency. Moreover, Resident Securities portfolio (11.62% of total assets) dropped by 5.14% during May to stand at $21.31B. Specifically, the subscriptions in T-bills in LBP dropped by 1.79% to reach $11.25B in May 2021 while the subscriptions in Eurobonds recorded a decline of 12.30% and totaled $8.27B for the same period, as banks are selling their Eurobond holdings to shore up their foreign currency liquidity. In addition, claims on non-resident financial sector added 3.50% to record $4.88B in May 2021, perhaps to settle some of the non-resident financial sector liabilities mentioned above.

For years, the banking system in Lebanon has provided short-term solutions to long-term problems. In this context, the Central Bank published its basic circular 158 effective in Mid-July; which opens the way for depositors to receive gradually part of their foreign currency deposits. This circular may ease the situation for the small depositors; however, it may contribute to increase ‘money in circulation’ as well as may impose more pressure on the Lebanese pound.

Commercial Banks Assets and Residents Customer Deposits by May ($B)