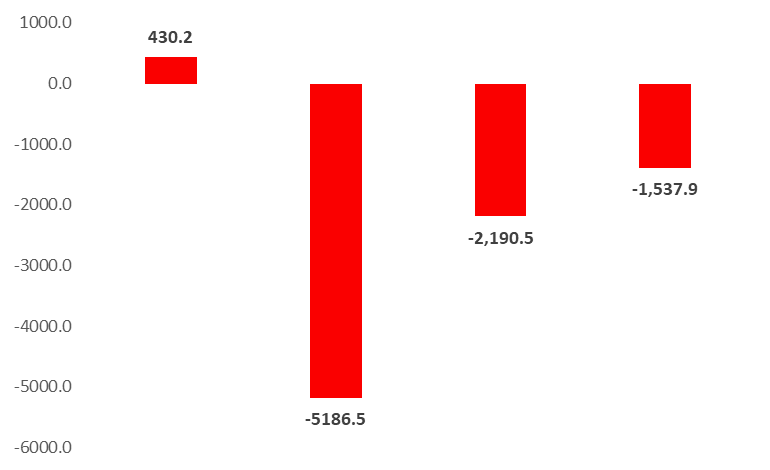

According to BDL’s latest monetary report, the BOP recorded a cumulative deficit of $1,573.9M by May 2021, compared to a deficit of $2,190.5M over the same period last year. Accordingly, Net foreign Assets (NFAs) of BDL fell by $2,914M,while the NFAs of commercial banks added $1,340M for May 2021.

On a monthly basis, the BOP deficit stood at $180.7M, as NFAs of BDL fell by $543.6 and Commercial banks rose by $362.9.

For a meaningful analysis, we examine the NFAs of commercial banks. For the month of April, the decline in foreign liabilities can be largely attributed to the monthly reduction in the “Non-resident customer deposits” by $124.70M to $26.70B and the reduction in “Non-resident financial sector Liabilities” by $108.03M to $5.27B.Foreign assets mainly increased owing to an increase in claims non-resident financial sector by $564.19M to $4.88B, while decreased due to reduction in other foreign assets by $4.34B.

On a related note, BDL issued Circular 158 hat provides binding instructions to banks to pay back gradually their customers’ foreign currency deposits. The circular applies to all accounts opened before 31/10/2019 and calculated based on the accounts as of 31/3/2021, on the condition that the accounts do not exceed those available at 31/10/201. The accounts are also calculated after netting out all claims that the banks have against their customers. This circular will certainly decrease the foreign assets of the commercial banks.

Balance of Payments (BoP) by May (in $M)