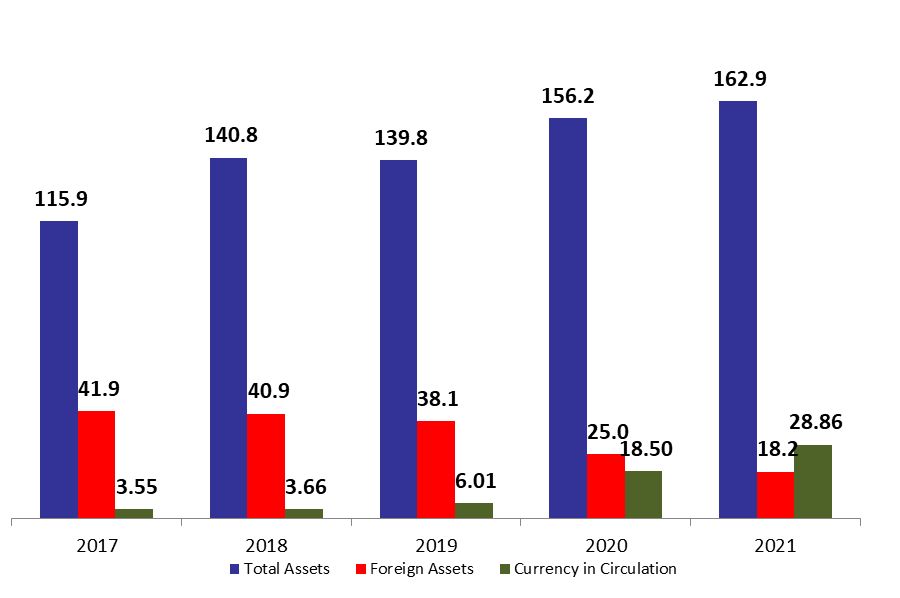

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 4.18% compared to last year, to reach $162.928B by November 2021.The increase was mainly due to the 29.38% year-on-year (YOY) rise in other assets, grasping 37.39% of BDL’s total assets and reaching $60.92B by November 2021. Meanwhile, the gold account, composing 10.17% of BDL’s total assets, decreased by 4.45% yearly to reach $16.57B by the same period as the international gold price is decreasing globally.

BDL’s foreign assets (grasping 11.19% of total assets) decreased by 27.80% YOY to stand at $18.23B by November 2021. Despite lifting a large shares of subsidies on essential goods, the foreign assets of BDL is still decreasing due to government expenses for some essential services like “Ogero” and “EDL” that required payments in foreign currency; in addition to the funding of imports at the “Sayrafa” exchange rate platform.

On the liabilities front, financial sector deposits (65.11% of BDL’s total liabilities) recorded a downtick of 1.46% YOY to settle at $106.086B by November 2021, of which more than three are denominated in dollars.

Looking at Currency in Circulation outside of BDL (17.72% of BDL’s total liabilities) it increased by 59.52% jumping from $18.094B by November 2020 to $28.86B by November 2021, while the exchange rate in the parallel has increased from LBP/USD 4,800 in November 2020, to LBP/USD 24,700 in November 2021, as the increase of currency in circulation has contributed in the deterioration of the national currency.

BDL Total, Foreign assets and Currency in Circulation of November ($B)