Today, Lebanon is witnessing the fallout of years of political and financial mismanagement. The economic structure adopted supported a financial model defined by shoring up foreign reserves, attracting external currency and supporting a fixed exchange rate regime. This model has left the financial system in accumulated losses and made BDL’s foreign currency reserves on everybody’s mind. Despite the importance of the latter, however a superior or an equally important parameter to consider is “BDL’s Net Foreign Reserves” (NFR).

The Net Foreign Reserves of the Central Bank catches the position of the whole banking system because it combines the balance sheets of the commercial banks with the Central Bank in order to calculate the losses of the financial system. In short, the net foreign reserves of BDL refer to the net assets held on reserve by the Central Bank in foreign currencies minus the total reserves of the commercial banks (CB) at the central bank after deducting the Eurobonds held by Banque du Liban. So, the following model is used to calculate the NFR:

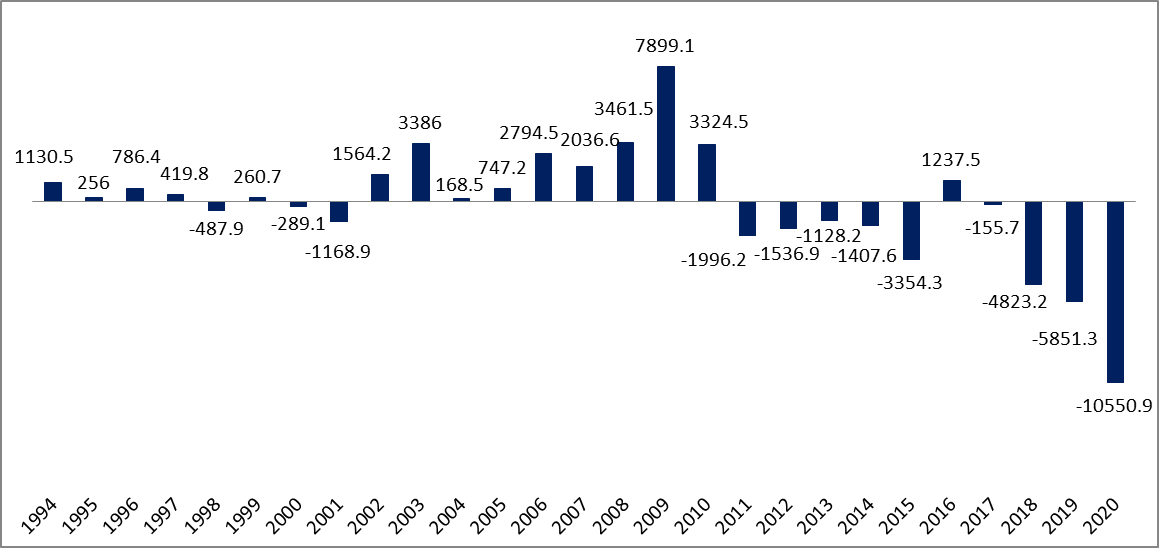

For a meticulous explanation of the current crises, we will examine the historical data of the balance of payment, NFR of BDL, and total reserves of commercial banks at BDL in three different time phases.

Pre-start of the alarming phases – year of 2011 onwards:

Source: BDL, BLOMINVEST

A look into the Lebanese recent financial history can detect that the signs of trouble were there. Year 2011 onwards signaled the starting year of Lebanese financial problems. In more details, the balance of payment recorded its first deficit since a decade and reached a shortfall of $1.99B at Dec 2011. This trend continued until end of 2015 where the BoP registered the biggest drop of $3.35B. The worsening of country’s external position is the result of lower capital inflows following the unrest in neighboring Syria and local turmoil. Year of 2016, the BoP gained up due to BDL’s financial engineering and recorded a surplus of $1.23B by the end of the year. However this trend didn’t last for a long period as it fell back on recording accumulated deficit till date.

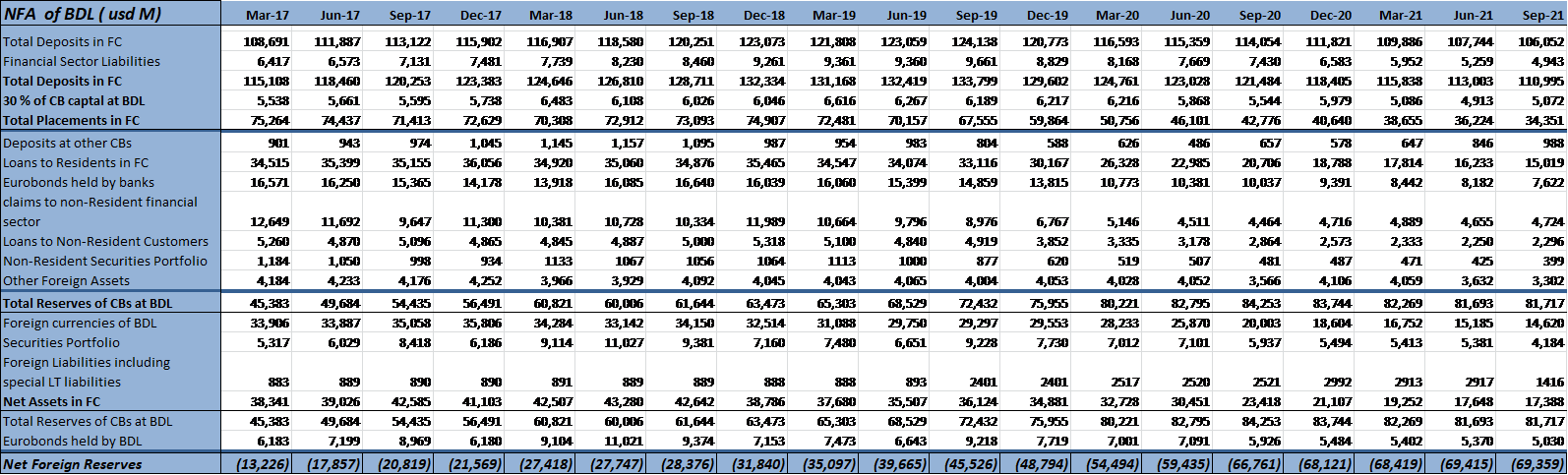

Quarterly Net Foreign Reserves 2017-2021:

Source: BDL, BLOMINVEST Bank

Phase A: Mar 2017 – Dec 2017

This phase endorsed the beginning of an intensified financial engineering period that led to significant increase in Total Reserves of Commercial Banks at BDL from $45.38B by March 2017 to $56.49B by Dec 2017 and foreign currencies of BDL peaked at 35.8B. In parallel, the NFR went from a loss of $13.22B by March 2017 to end up the year at losses of $21.57B.

Phase B: March 2018 – Dec 2018

NFR plunged further and recorded losses of $27.41B by March 2018 at a time foreign currencies of the Central Bank started their downfall trend and remarkably declined from $35.80B at Dec 2017 to $32.51B at Dec 2018. This phase marked by the beginning of loss of confidence in the Lebanese financial sector.

Phase C: March 2019 — Sept 2019

Just before the Lebanese realizing their economy was in trouble, the Lebanese pound began to look shaky and the NFR registered the largest quarterly drop in history and went from losses of $39.66B by June 2019 to $45.52B by September 2019. It also coincided with BDL’s foreign currencies falling below $30B.

As important, in late summer 2019, confidence in the Lebanese financial sector was lost and consequently the peg broke in August 2019. More crucially, this happened at the time when NFR recorded its biggest all-time drop and the foreign currencies of BDL fell below the “critical level” of $30B. These observations lead us to the tentative conclusion that, besides foreign reserves, NFR at BDL is at least an equally good and reliable predictor of the exchange rate crisis in Lebanon, though it has often been neglected, but perhaps not anymore!

Barely a month after, in October 2019, Lebanese gradually recognized their economy was collapsing and social unrest erupted in Beirut and spread nationwide. In March 2020, Lebanon defaulted on its foreign debt and then on August 4 a huge explosion took place in the port of Beirut.

Lastly, the irony today that the economy of Lebanon has collapsed and the Lebanese pound has gone down sharply with it, yet in addition foreign reserves are still evaporating at the same time. That is contrary to most country’s experiences where either event usually takes place: foreign reserves are scarified to maintain and preserve the currency; or foreign reserves survive and are held steady as the exchange rate is scarified through (sometimes needed) depreciations. Unfortunately, Lebanon has lost both and hasn’t reached the bottom yet!