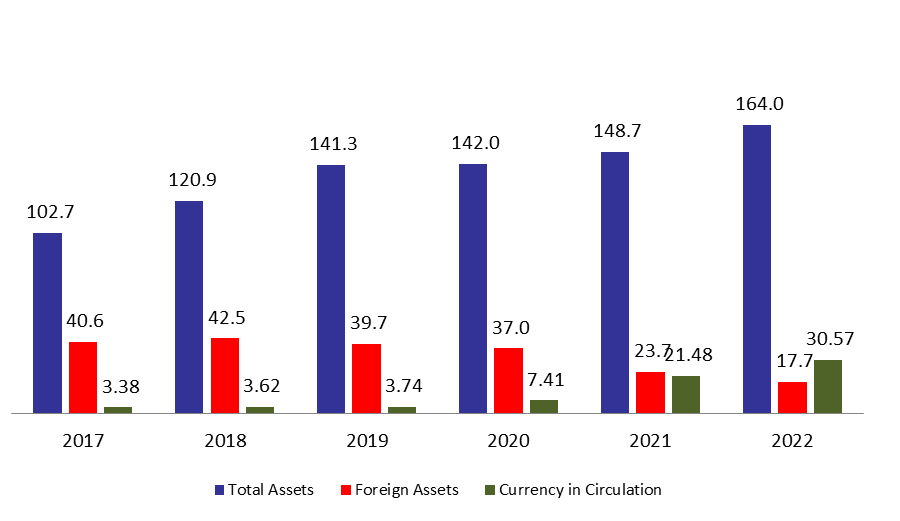

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 10.31% compared to last year, to reach $164B by mid-January 2022. The increase was mainly due to the 51.07% year-on-year (YOY) rise in other assets, grasping 50.58% of BDL’s total assets and reaching $62.21B by mid-January 2022. Meanwhile, the gold account, composing 10.25% of BDL’s total assets, decreased by 1.68% yearly to reach $16.81B by the same period as the international gold price is decreasing globally.

BDL’s foreign assets (grasping 10.80% of total assets) decreased by 25.36% YOY to stand at $17.71B by mid-January 2022. Although large part of subsidies on essential products was removed, however the foreign assets are still diminishing as some imports are funded through the “Sayrafa” exchange rate platform and more recently as circular 161 took effect allowing clients to exchange LBPs into USD ( at the “Sayrafa” rate) provided by BDL to commercial banks.

On the liabilities front, financial sector deposits (66.13% of BDL’s total liabilities) slightly increase by 0.83% and reached $108.46B by mid-January 2022 compared to last year, of which more than three are denominated in dollars

Looking at Currency in Circulation outside of BDL (18.64% of BDL’s total liabilities) it increased by 42.33% and reached $30.56B by mid-January 2022. In fact, the currency in circulation will probably increase further this year, as the Lebanese budget for 2022 include one-time raise in remunerations to public sector employees, which will force BDL to print more money.

BDL Total, Foreign assets and Currency in Circulation of mid of January ($B)

Source: BDL, BLOMINVEST

Source: BDL, BLOMINVEST