The data released by the Ministry of Finance (MoF) recently, indicated that Lebanon’s gross public debt hit $99.21B in September 2021, thereby recording an annual increase of 4.6%.

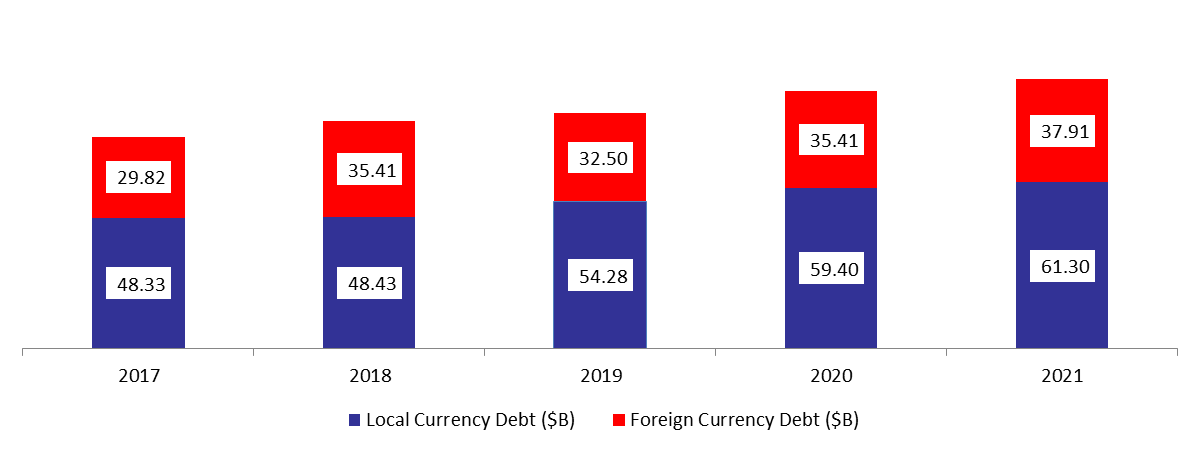

The rise is mainly attributed to the annual increase in both local and foreign currency debt by 3.21% and 7.05%, respectively. In details, debt in local currency (denominated in LBP) stood at $61.30B in September 2021. As such, domestic debt constituted 61.79% of the total public debt.

Meanwhile, total debt denominated in foreign currency (namely in USD) reached $37.91B over the same period. Therefore, total foreign debt grasped a stake of 38.21% of the total public debt by September 2021. It is worth mentioning that $7.39B represents the unpaid Eurobonds, their coupons and accrued interests, due to the default on government Eurobonds in March 2020. Interesting to add that measured at the market exchange rate of around 22,000 LBP per 1 USD, local currency debt would amount to $2.78B, thus making total debt equal to $40.69B, or about 187% of GDP.

Looking at net domestic debt, which excludes public sector deposits with the central bank and commercial banks, it increased by 0.49% YTD to $49.74 in September 2021.

As part of its preparations for an IMF deal, the Lebanese Government has released a 2022 State budget with deficit of 20.8% in terms of expenditures. However, the budget is considered at best a transitory budget till a final agreement is signed with the IMF. Consequently, all eyes are at the rescue and reform program that this deal will entail and what it means to a future deal on restructuring the foreign debt with creditors and a future state budget as well.

Domestic and Foreign Debt by September ($B)

Source: MoF, BLOMINVEST Bank