In complete absence for any economic reforms, lack for corrective measures and amid continuous political bickering, the Central Bank issued on December 16, 2021 the Basic Circular No 161 regarding exceptional procedures for cash withdrawals.

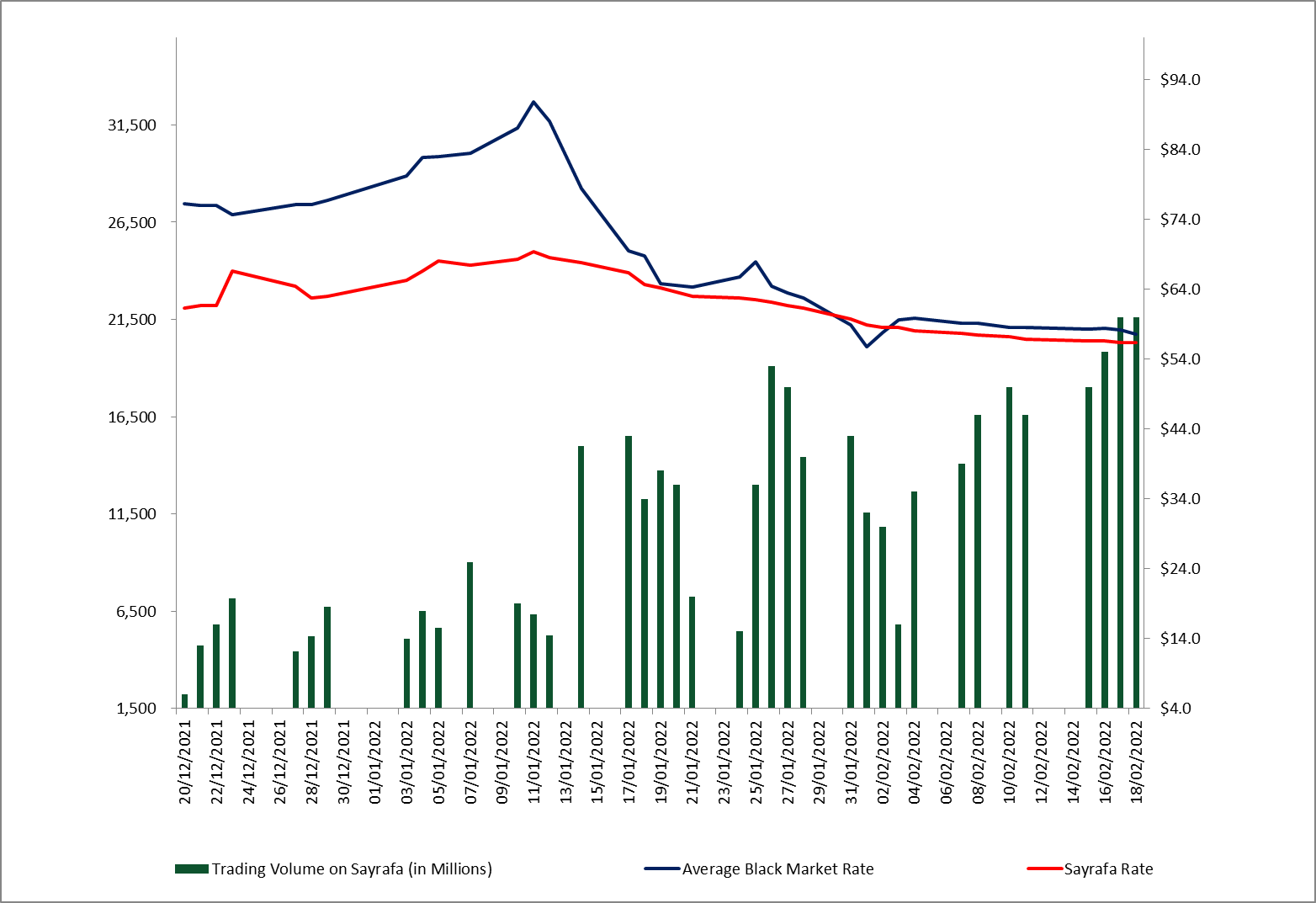

This initiative aimed to strengthen the fast-devaluating currency by injecting dollars into the market through Sayrafa platform. Despite the Central Bank’s effort, the Lebanese pound remained unperturbed and continued its downtrend from 28,000 LBP/USD to an all-time low of LBP 33,800 against the dollars. As a result, the Central Bank adjusted the Circular to unlimited quotas on January 11, 2022 in order to halt the free-fall of the Lebanese currency.

Accessible dollar banknotes in unlimited amounts seem to have thrived in breaking the brutal devaluation of the national currency. As such, the currency rose 24.17% in a period less than one week to be traded at around 24,800 LBP/USD by January 17, 2022 and regained 36.54% within a month to settle at around 20,740 LBP/USD by February 18, 2022.

Moving to the traded volume on Sayrafa platform, changes in volume were remarkably noticeable after the modification of BDL Circular. For instance, before mid-October 2021, average daily volume of transactions was less than $2 M per day. Nevertheless, the latter’s attempt to increase traded volume on Sayrafa succeeded by adding banks and OMT to the group. In turn, between December 16 and January 11, 2022, average traded volume of transactions stood at $15.85 M while average exchange rate on the parallel market hovered at around 28,650 LBP/USD. Furthermore, average daily volume significantly picked up as BDL adjusted the circular to unlimited quotas by January 11, 2022. As such, average traded volume amounted to $38.48 M for the period between January 12 and February 18, 2022 with an average exchange rate swinging at around 20,900 LBP/USD.

On a different note, BDL’ foreign assets dropped by 4.77% or exactly $862 M since mid-December 2021 to $17.22B by mid-February 2022 while total volume of dollars injected into the system through Sayrafa amounted to $1.22B for the same period, the difference might be explained by BDL’s measures to absorb dollars from the market, especially in a climate of diminished LBP liquidity. However, injecting dollars through sayrafa is like pegging the Lebanese currency, both require ongoing interventions of Central Bank that lead to the diminishing of the foreign currency reserves.

Overall, Central Bank tactic succeeded in unifying the multiple exchange rates for the Lebanese pounds and had a closer step to fulfilling an IMF’s condition for financial assistance. However, total reliance on BDL to maintain the national currency is not a long-lasting solution without sound monetary and fiscal reform policies and a strategy to replenish the dollar reserves. As such, Sayrafa could be only a temporary vehicle for currency stability.

Trading volume on Sayrafa, average parallel market rate and Sayrafa rate for the period between 16/12/2021 and 18/02/2022:

Source: BDL, BLOMINVEST, Lirarate.org