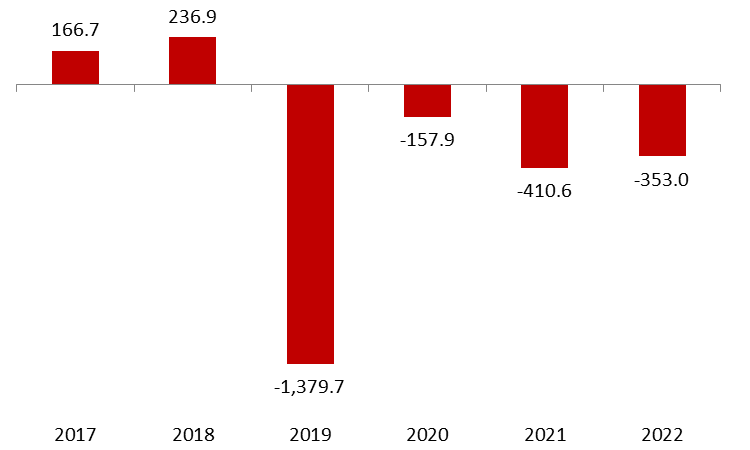

According to BDL’s latest monetary report, the BOP recorded a deficit of $353M in the first month of the year 2022, compared to a deficit of $410.6M over the same period last year. Accordingly, Net foreign Assets (NFAs) of BDL fell by $609M, as BDL has continued to make some intervention on Fx market through the “Sayrafa” rate while the NFAs of commercial banks added $255.9M by January 2022.

For a meaningful analysis, we examine the NFAs of commercial banks. For the month of January, the reduction in foreign liabilities was larger than the decrease in foreign assets. On the liabilities side, “Non-resident customers’ deposits” witnessed a reduction by $259M, to reach $24.28B by January 2022. On the asset side, “Claim on non-resident customers” has decreased by $63.41M to reach $2.77B by January 2022.

On a related note, BDL issued Circular 161 on 16 December 2021 which allows banks to sell dollars provided by BDL at the “Sayrafa” exchange rate. It was modified on 11January 2022 by setting no limits on the amount dollars sold by the banks. The impact of the circular was to reduce BDL FX reserves, but also to lower the parallel market rate close to “Sayrafa” rate at almost 22,000 LBP per USD.

Balance of Payments (BoP) by January (in $M)