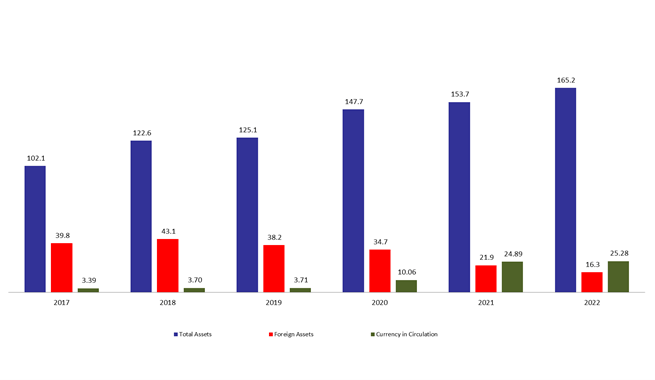

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 7.5% compared to last year, to reach $165.23B by mid-April 2022. The increase was mainly due to the 30.27% year-on-year (YOY) rise in other assets, grasping 38.24% of BDL’s total assets and reaching $63.18B by mid-April 2022.

Moreover, the gold account, representing 11% of BDL’s total assets, increased by 12.63% yearly to reach $18.15B by mid-April 2022, as the international gold price is increasing globally amid the war in Ukraine and universal uncertainty.

Meanwhile, BDL’s foreign assets, grasping 9.89% of total assets, decreased by 25.4% YOY to stand at $16.35B by mid-April 2022. In more details, BDL’s foreign assets dropped by 8.31% since year start with $134.928M drop in only 2 weeks by beginning of April 2022. The Central Bank is most likely taking measures to absorb Lebanese liquidity from the market through Circular 161 (Sayrafa) with the objective to appreciate the local currency.

On the liabilities front, financial sector deposits, 66.75% of BDL’s total liabilities, slightly increased by 2.64% and reached $110.3B by mid April 2022 compared to last year, of which more than two thirds are denominated in dollars.

Currency in Circulation outside of BDL, consisted of 15.3% of BDL’s total liabilities, increased annually by 1.58% and reached $25.28B by mid April 2022. Interesting to note that since the Circular 161 was introduced in December 2021, the money in circulation had been dropping considerably but it increased by $923.7M in the first two weeks of the month of April.

BDL Total, Foreign assets and Currency in Circulation Mid April 2022 ($B)

By: Stephanie Aoun