After years of sharp economic deterioration, month of April brought a whiff of hope that the situation in Lebanon might change. The Lebanese Government reached a staff-level agreement with the IMF that could lead to a Fund assistance over four years. However, series of reforms are crucial for its approval and by far the tax system is the most sector that is in need for structural reforms as it does not raise sufficient resources, both because of the way it is structured and it is excessively leaky, and it is moreover un-equalizing.

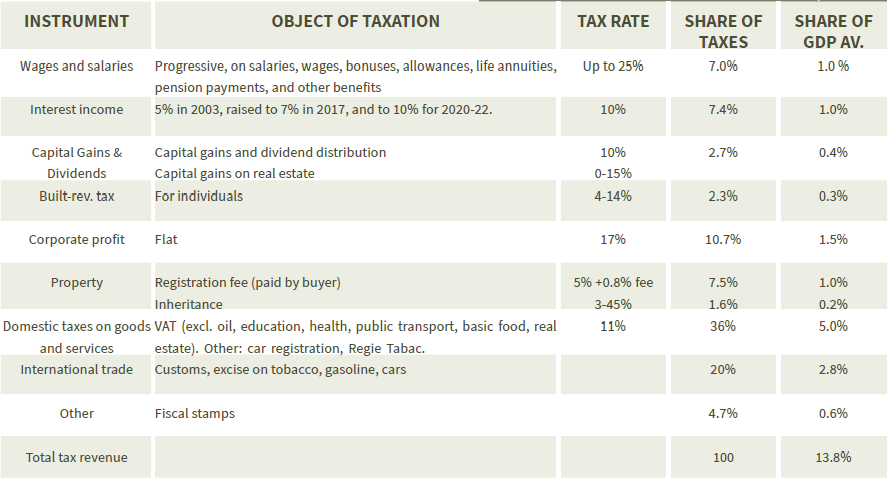

Tax rates and revenue in Lebanon, 2015:

Source: Ministry of Finance, Arab Reform Initiative

As indicated in the paper of the Arab Reform Initiative titled “Which Tax Policies for Lebanon[1]”, the main adjustment should start by tightening the fiscal deficit. The sharp contraction of the GDP is surely preventing the expansion of Government expenditure not to mention the enormous debt overhang which Lebanon, a defaulted State, cannot internationally borrow at any interest rate. As an alternative, Lebanon should regain its creditworthiness and work on the growth of its fiscal consolidation again.

Up till now, the ultimate way for Lebanon to finance its fiscal deficit would be through resorting to international creditors such as IMF, as well as stabilizing and eliminating the primary deficit over a period of 3-5 years as a crucial step. To do so, the Government must balance between spending cuts and revenues increases and most importantly implementing an austerity measures for an effective recovery. These relate especially to transfers to EDL, size of the public sector and the totally unproductive political spending. Moreover, the level of several types of expenditures would have to be adjusted to the lower standards of living of post-crisis Lebanon. Most importantly, Lebanese society would not likely to accept the large burden of taxation until the adjustments gain credibility and start seeing improvements in the quality of expenditures.

Tax system in Lebanon is un-equalizing, unfairly targeting the middle class and the poor with very limited incidence on the rich class; thus generating quick money from a massive increase in VAT rates is not favorable in this case. As such, reforms that target the richer in society are needed so that the taxation structure becomes gradually fairer at the same time as the economy regain stabilization. Half of the necessary tax increase can be achieved by improving compliance mainly from VAT and customs, taxes on revenues for firms and individuals. An additional 0.5% of GDP can result from increasing VAT revenues by rationalization its base to be more progressive than it currently is. Moreover, a tighter collection of the income tax is also necessary as well as taxing capital held by Lebanese resident abroad must take place.

Towards equitable and efficient taxation system. The main proposal of the Arab Reform Initiative article is to profoundly reform the personal income tax system by shifting to a general income tax system that taxes all sources of income together called the Whole of revenue. This proposed system has a higher level of progressivity and pave the way to reorganize exemptions in ways to promote the public good, broaden tax base by combating fraud and tax evasion.

The proposal of moving to a “whole of revenue” entails an ambitious tax harmonization effort through the regrouping of disparate fiscal provisions in a General Tax Code. The target of this reform is to increase the marginal tax rate to at least 30% on top range of income. Important to note that those rates are still below the international rates and should not act as disincentive for highly skilled Lebanese to stay and work in Lebanon.

Corporate tax income in Lebanon is low. At 17% currently is surely inferior to regional and global corporate tax rates that range at 20-25%. Increasing corporate tax rates must be held very carefully to ensure promoting private investment, however tax provisions promoting particular types of investments would be needed and managed for performance that is far from being driven by rent seeking.

Tax to rental income is below rates of taxes on salaries and wages ranging between progressive rates of 4-14%. The Arab Reforms Initiative proposes to apply a larger rate on vacant property to stimulate their use for productive activities as done in several countries.

Taxes on Capital income must be rapidly increased to levels similar to what labor income pays. Tax the return on capital such as tax property rental, interest and dividends revenue must be harmonious with the taxation of labor income so that it pushes to rehabilitate the value of hard work compared to rent income.

Lebanon is known to have a high level of wealth inequality therefore calls for taxing wealth is extremely important. One-off tax on wealth could be introduced as part of the whole package that aims to deal with the ongoing fiscal-cum-banking crisis. Once the situation is stabilized and losses have been properly assessed, a regular progressive wealth tax should be considered.

As for the Municipal revenues, the system of tax sharing must be adapted and it is very essential to review the current sharing formula. In addition, waste management costs must be revised as it leaves municipalities with so little resource. Build property tax must be collected directly at the local level to reduce corruption.

The 11% of VAT rate in Lebanon is not excessively large, however the proportion of tax revenue derived from regressive indirect taxes is large. In turn, overall reorganization of the tax system is needed to become more progressive and in order to achieve 20% GDP in tax revenues so that the rate of VAT could be moderately increased in the upcoming years.

Combating tax evasion and avoidance. Becoming digital is a need in Lebanon; however it could pave the way for further risks of tax evasion. That is why Lebanon should join the initiative of Base Erosion and Profit Shifting (BEPS) which propose that profit must be taxed where economic activities that generates it is performed. Moreover, the tax base needs to expand considerably toward the richest in the country, as compliance is extremely low for the wealthiest society. In this context, mobilizing revenues more efficiently is crucially important; same for educating small taxpayers and changing their behavior to promote knowledge and information, to improve rule of law, and more essentially, to establish confidence in the State requires progress in effectiveness and fairness.

In short, the old performance of the taxation system in Lebanon highlighted the inconsistency and contradiction of a ruling political regime that served their power. Consequently, rebuilding the taxation system on the principles of effectiveness and fairness requires reestablishing of political support so as to become a central part of their concerns to both insure the ability to respond to the current crisis, and to create a dynamic and sustainable growth path.

[1] Lessons from the past for a challenging future – Arab Reform Initiative by Alain Bifani, Karim Daher, Lydia Assouad, and Ishac Diwan.