The BSE has recorded high volumes of transactions during the financial crisis that started in October 2019. The banking sector was hit badly during this crisis leaving the capital market a fragile alternative for most of the investors. One of the most stocks traded was Solidere, as this company is considered less shaky and more reliable compared to other stocks presented in the BSE, and it backed by real asset that are observable, which is real estate.

Fundamentally, Solidere has succeeded to improve its financial performance, as its revenue increased by 345% in 2019, and 39.53% in 2020. It was obvious that the depositors where trying to liberate their money from the banks, by buying real estate through Solidere. The crisis was a good opportunity for this company to increase their sales and improve its debt ratios.

Based on Fundamental analysis, the stock price of Solidere has every right to increase, due to the great improvement on its financial statement. However, and looking at a macro level, there is other factors that can affect the price of this stock, like the unstable economic and political environment in Lebanon, and the devaluation of Lebanese lira against the dollar, as this is the most important factor that affects the price of Solidere stock.

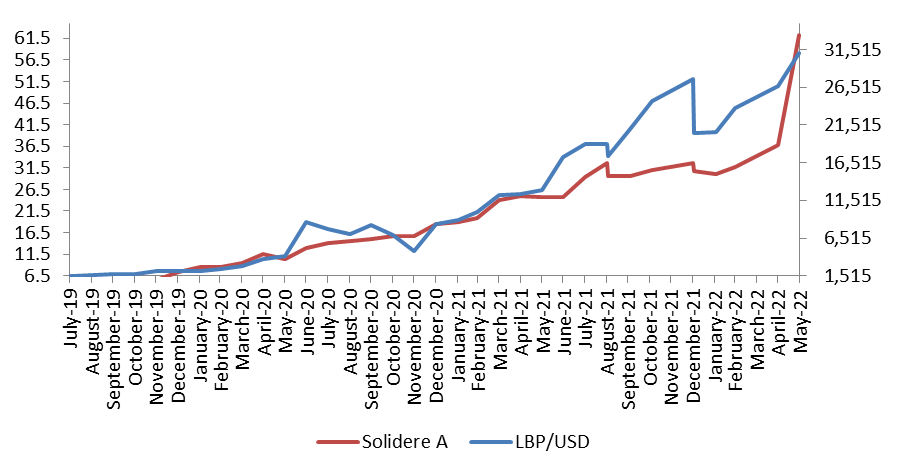

As per our previous equity reports, we have mentioned that a strong negative correlation exist between the FX black market rate of the national currency and Solidere stock price. In details, when the Lebanese lira depreciate the price of Solidere stock increase so as to correct for the value of this stock. It’s true that the price of Solidere on the BSE are priced in dollar, however the real value of this stock is much lower. (See graph below)

Solidere (A) observable price at BSE and LBP/USD of Black Market rate (2019-2022)

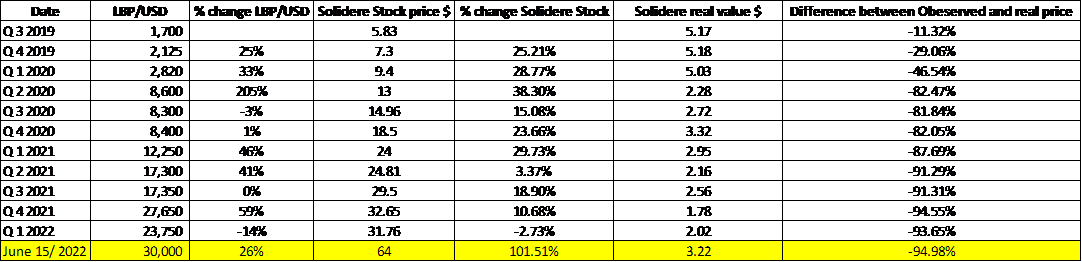

As to the real value of Solidere Stock, we will calculate it by taking into consideration the black market rate.

As we can see from the table above, we have calculated the real value of Solidere stock by multiplying the observable price by the official rate (1,507.5) and then dividing it by the black market rate in each quarter. We can notice that the depreciation of the national currency is much higher than the increase in percentage of the observable price of Solidere in the BSE. However, on June 2022 Solidere observable price has increased from 31.76$ on March 2022, to 64$ in 15 June 2022; an increase above 100%, while the national currency has depreciated by only 26% from March 2022 to 15 June 2022. The attractive price of Solidere stock has encouraged investors to go long regarding this stock, as going long can be used by hedging against the depreciation of the national currency, despite the low real value of Solidere price that is only 3.22$.