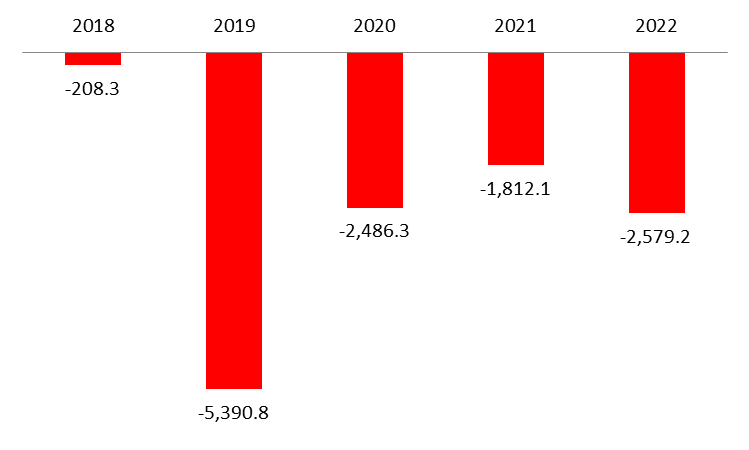

According to BDL’s latest monetary report, the BOP recorded a cumulative deficit of $2.57B by June 2022, compared to a deficit of $1.81B over the same period last year. Accordingly, Net foreign Assets (NFAs) of BDL fell by $2.79B, as BDL has continued to make some intervention on Fx market through the “Sayrafa” rate while the NFAs of commercial banks increased by $214M by June 2022.

On a monthly basis, the BOP deficit stood at $474.1M; as NFAs of BDL fell by $728.3M while that of Commercial banks increased by $254.2M.

For a meaningful analysis, we examine the NFAs of commercial banks. For the month of June, it was dominated by the decrease in foreign liabilities and the increase in foreign assets. On the liabilities side, “Non-resident financial sector liabilities” increased by $48.5M, to reach $4.53B, while “Non-resident customers’ deposits” decreased by $165M, to reach $23.83B by June 2022. On the asset side, however, “Claims on non-resident financial sector” added $40.4M to reach $3.87B.

Meanwhile, the wider deficit observed in Lebanon’s Balance of Payments is mostly attributed to the recovery in importation which has re-picked as Lebanese’s behavior seems to readjust slightly to the levels used to be before the crisis. The major reason driving Lebanese importation could be most likely the summer recovery which boosted the private sector and led to higher import demands that contributed to larger capital outflows and, thus, created a persistent disequilibrium in the BOP.

Balance of Payments (BoP) by June (in $M)

Source: BDL, BLOMINVEST