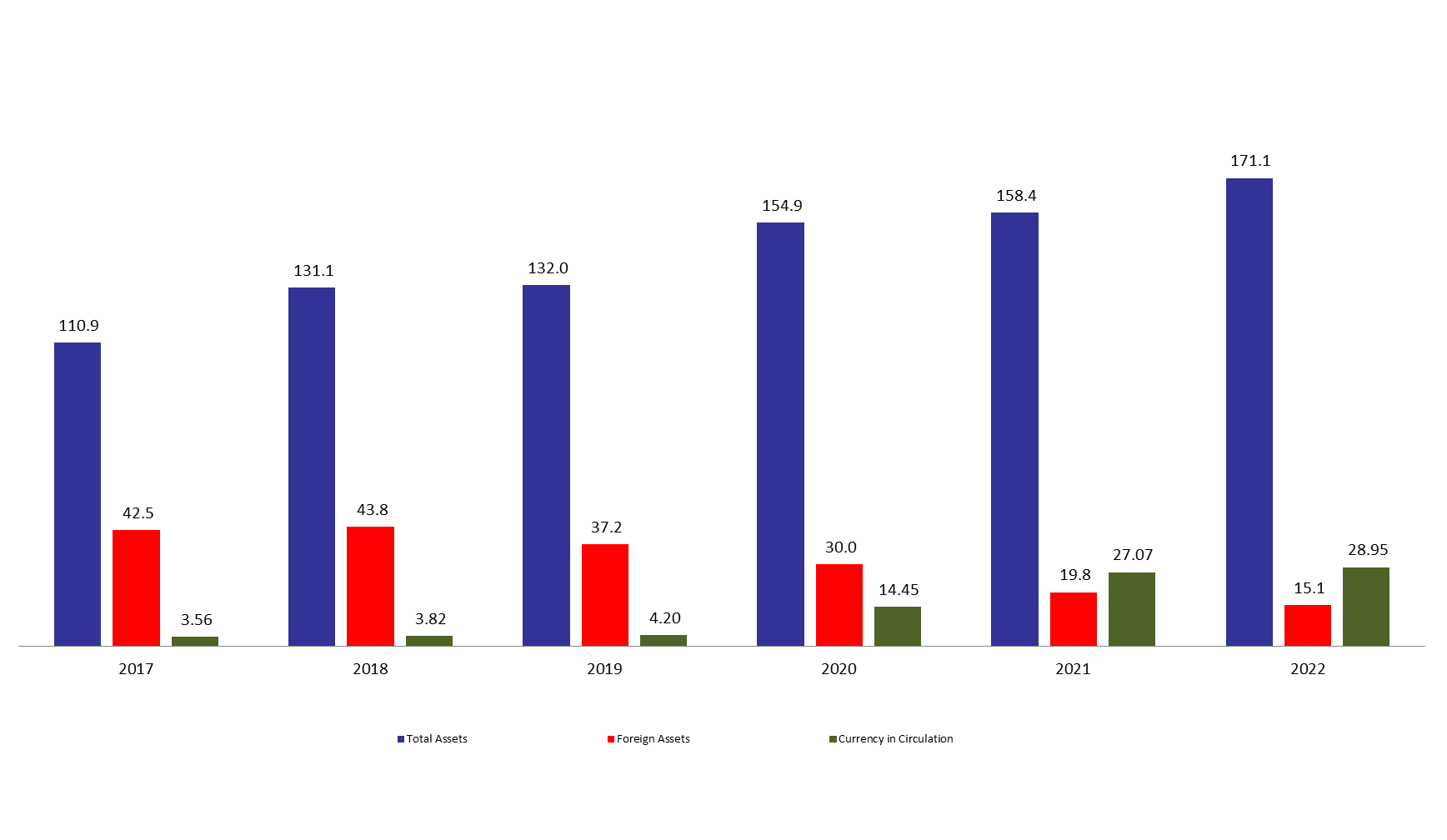

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 8.02% compared to last year, to reach $171.07B by mid of August 2022. The increase was mainly due to the 29.65% year-on-year (YOY) rise in other assets, grasping 42.12% of BDL’s total assets and reaching $72.05B by mid of August 2022. All the same, the gold account, representing 9.63% of BDL’s total assets, increased by 1.76% yearly to reach $16.48B by mid of August 2022.

Meanwhile, BDL’s foreign assets, which grasped 8.85% of total assets, recorded a drop of 15.06% or $2.68B YTD compared to $4.29B same period last year and stood at $15.14B by mid of August 2022, though $5B of those are in Lebanese Eurobonds. Moreover, total volume of dollars injected into the market through Sayrafa platform totaled $393M for the first two weeks of August while foreign assets of BDL dropped by $28.40M during the same period. It is important to note that Sayrafa traded volume reached $7.63B since year start while BDL’s foreign assets seem diminishing at a slower path this year compared to the last one. However, Central Bank’s intervention into the market through Sayrafa is still very costly and will surely pose burden on the exchange rate.

On the liabilities front, financial sector deposits, 64.76% of BDL’s total liabilities, increased by 3.47% and reached $110.78B by mid of August 2022 compared to last year, of which more than two thirds are denominated in dollars.

Currency in Circulation outside of BDL, consisting of 16.92% of BDL’s total liabilities, increased annually by 6.93% and reached $28.95B by mid of August 2022.

BDL Total, Foreign assets and Currency in Circulation by mid of August ($B)

Source: BDL, BLOMINVEST