Fitch Ratings affirmed on 12 Aug 2022 Lebanon’s Long-Term ForeignCurrency Issuer Default Rating (IDR) at ‘Restricted Default’ (RD) and Long-Term Local-Currency IDR at ‘CC. Key Rating Drivers were mentioned as: Eurobond Default Continues; IMF Staff-level Agreement remains uncertain as the political landscape complicates the enactment of prior actions needed for IMF Board approval; Difficult Reform Agenda; Domestic Political Divisions; FX Shortfall as BdL’s readily available foreign-currency reserves were only about USD11 billion as of June 2022, excluding gold valued at about USD17 billion (which BdL would need parliamentary approval to sell); Deteriorating Macroeconomic Conditions; High Public Debt; Uncertainty Around Local-Currency Debt Restructuring; Lack of Budget, Financing; Current Account Deficits; and severe ESG (environment, social, and governance) problems.

In addition, Fitch indicated that the factor “that could, individually or collectively, lead to negative rating action/ downgrade: the Long-Term Local-Currency IDR would be downgraded if formal plans are announced to restructure the government’s Lebanese pound-denominated debt or following a default on localcurrency denominated debt”. On the other hand, “factors that could, individually or collectively, lead to positive rating action/upgrade: the Long-Term Local-Currency IDR could be upgraded if it becomes clear that Lebanese pounddenominated debt will be excluded from any debt restructuring; and once Lebanon reaches an agreement with bondholders on restructuring its long-term foreigncurrency debt and completes that restructuring process, Fitch will assign ratings based on a forwardlooking analysis of the sovereign’s willingness and capacity to honor its new foreign-currency debt obligations”.

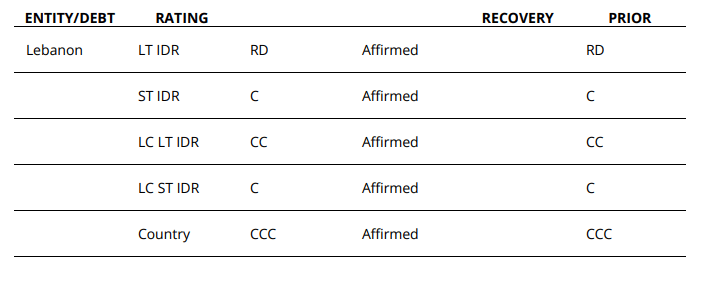

Rating Actions:

Source: Fitch ratings