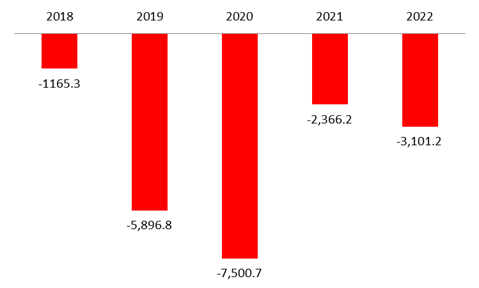

According to BDL’s latest monetary report, the BOP recorded a cumulative deficit of $3.1B by August 2022, compared to a deficit of $2.37B over the same period last year. Accordingly, Net foreign Assets (NFAs) of BDL fell by $3.48B, as BDL has continued to make some intervention on Fx market through the “Sayrafa” rate while the NFAs of commercial banks increased by $382M by August 2022.

On a monthly basis, the BOP deficit stood at $314.3M; as NFAs of BDL fell by $469.4M while that of Commercial banks increased by $155M.

For a meaningful analysis, we examine the NFAs of commercial banks. For the month of August, it was dominated by the decrease in foreign liabilities and the increase in foreign assets. On the liabilities side, “Non-resident financial sector liabilities” increased by only $27.44M, to reach $4.39B, while “Non-resident customers’ deposits” declined by $60.07M, to reach $23.62B by August 2022. On the asset side, however, “Claims on non-resident financial sector” increased by $165.93M to reach $3.99B.

Persistent disequilibrium in the balance of payment for Lebanon is a major concern for the country’s economy as well as additional burden for the national exchange rate. Nevertheless, the Lebanese parliament seems in motion towards completing the conditions set by the IMF, thus it is possible to reach BoP equilibrium by reducing imports, improving exports and recovering the country’s ability to attract financial inflows with the gradual return of confidence.

Balance of Payments (BoP) by August (in $M)

Source: BDL, BLOMINVEST