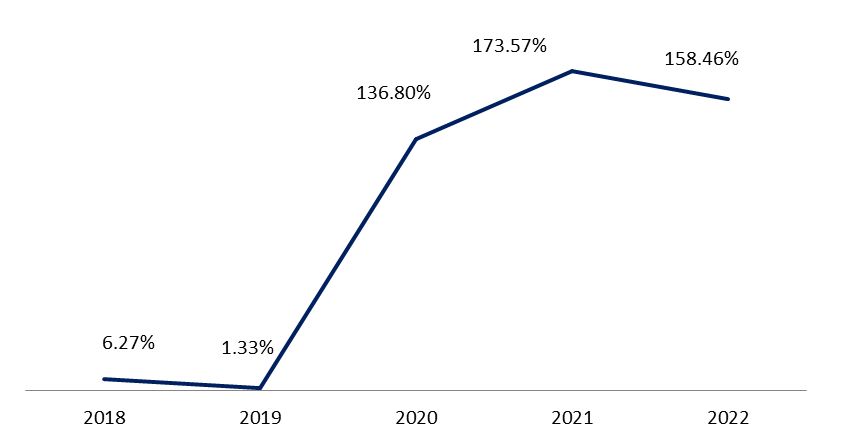

According to the Central Administration of Statistics (CAS), the Consumer Price Index (CPI), representing the evolution of goods and services’ prices consumed by households, revealed that Lebanon’s monthly inflation rate eased from a 173.57% in October 2021 to register softer levels of 158.46% in October 2022, though it remains at a historical elevated level.

In details, the cost of “Housing and utilities”, inclusive of water, electricity, gas and other fuels (grasping 28.4% of the CPI) added a yearly 74.40% by October 2022. Also, “Owner-occupied” rental costs increased by 6.69% year-on-year (YOY) and the prices of “water, electricity, gas, and other fuels” followed a significant increase by 254.05% YOY as subsidies were removed by the Central Bank and prices went up sharply on the global market due to the war in Ukraine.

Looking at the prices of “Food and non-alcoholic beverages” (20% of CPI), it surged by 203.21% yearly. In turn, the average prices of “Transportation” (13.1% of the CPI) and “Health” (7.7% of the CPI) recorded hikes of an annual 195.95% and 269.72% respectively by October 2022. Also, “Restaurant and Hotels” (2.8% of CPI) increased yearly by 189.66% by October 2022 as the hospitality sector had been authorized to adopt prices listed in dollars.

In the same token, costs of “Clothing and Footwear” (5.2% of CPI) surged by 145.73% by October 2022, and the prices of “Communication” (4.5% of the CPI) increased by 228.04%.

Finally, prices of “Furnishings and household equipment” (3.8% of CPI), “Alcoholic beverages and tobacco” (1.4% of CPI), and “Recreation, amusement, and culture” (2.4% of the CPI) increased by 147.20%, 152.34%, and 146.76%, respectively, by October 2022.

Interesting to note, the customs dollar will come into effect first of December which it is expected to fuel a massive increase in prices in Lebanese pounds in a context of an already high running inflation. On the other hand, at this stage, this measure would be coupled with Central Bank’s amendment for dollar’ withdrawing rate from 8,000 to 15,000 LBP thus enlarging the amount of money in circulation. This act could lead to further deterioration of the Lebanese dollar exchange rate if no monetary measures will be taken to prevent such a risk.

Inflation rate by October 2022

Source: CAS, BLOMINVEST