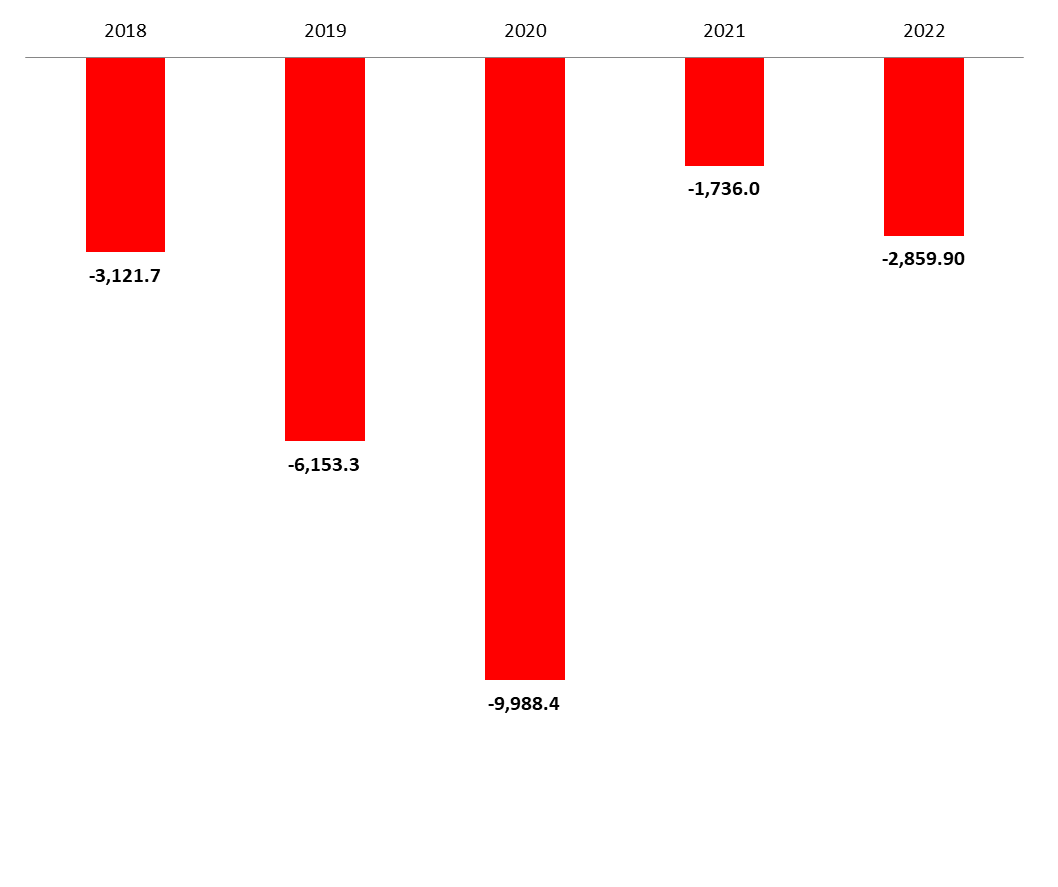

According to BDL’s latest monetary report, the BOP recorded a cumulative deficit of $2.85B by October 2022, compared to a deficit of $1.73B over the same period last year. Accordingly, Net foreign Assets (NFAs) of BDL fell by $2.94B, as BDL has continued to make some intervention on Forex market through the “Sayrafa” rate while the NFAs of commercial banks increased by $84.5M by October 2022.

On a monthly basis, the BOP recorded a surplus of $192.8M; as NFAs of BDL increased for the second month in a row by $377.6M while that of Commercial banks fell by $184.9M.

For a meaningful analysis, we examine the NFAs of commercial banks. For the month of October, it was dominated by the decrease in foreign liabilities and a smaller decrease in foreign assets. On the liabilities side, “Non-resident financial sector liabilities” decreased by only $42.86M, to reach $4.30B, while “Non-resident customers’ deposits” declined by $64.16M, to reach $23.35B by October 2022. On the asset side, however, “claims on non-resident customers” dropped by $122.13M to stand at $2.23B by October 2022, while “claims on non-resident financial sector” added $361.27K to reach $3.99B for the same period.

Staying with the BoP but its current account part, the World Bank estimated that remittance transfers coming to Lebanon in 2022 will reach about $6.8B, up from $6.6B in 2021, placing Lebanon in third regional position ahead of only Egypt and Morocco with the respective amounts of remittances of $32.3B and $11.4B. But Lebanon will have the second highest remittances ratio to GDP at 37%.

Balance of Payments (BoP) by October (in $M)

Source: BDL, BLOMINVEST