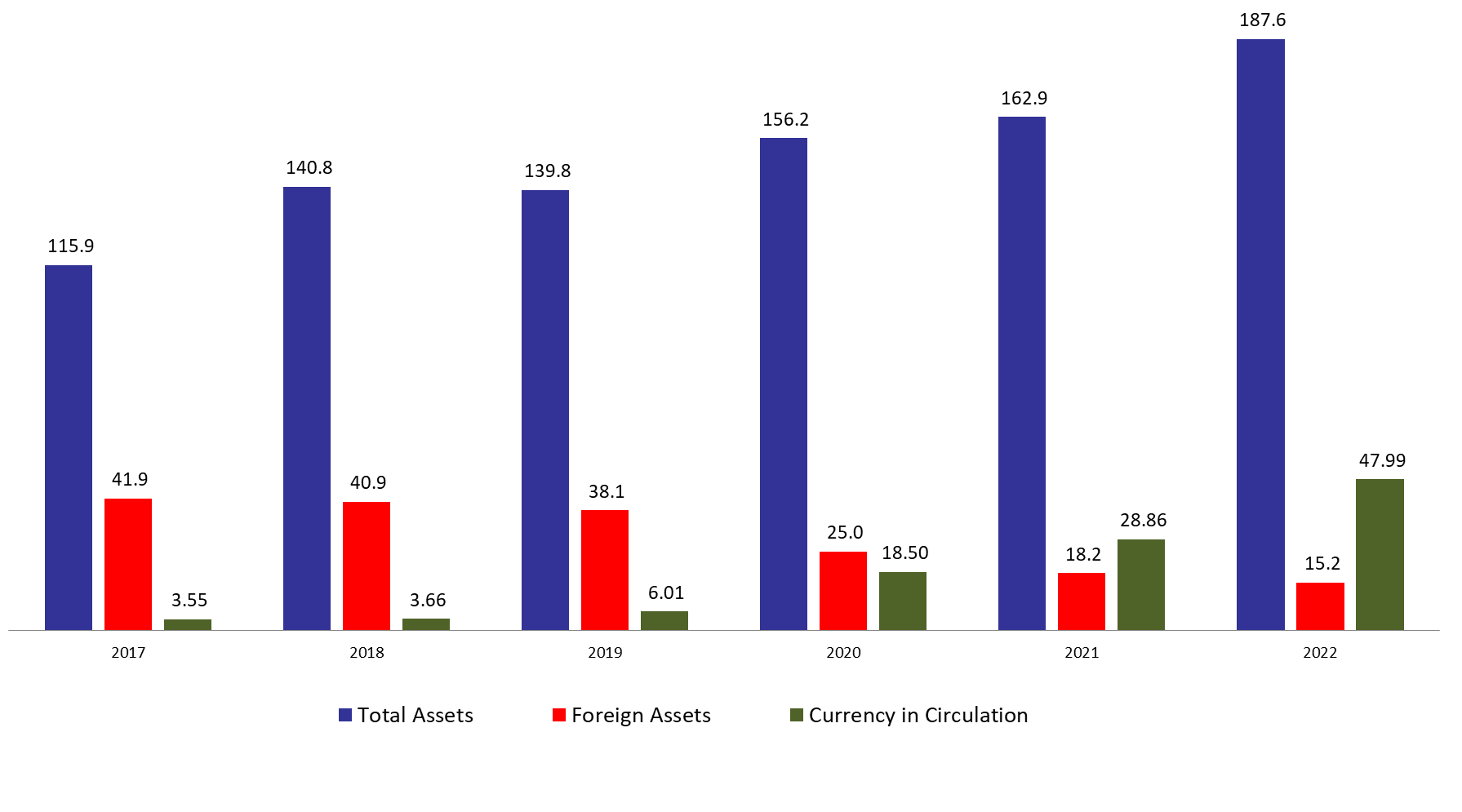

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 15.13% compared to last year, to reach $187.58B by end of November 2022. The increase was mainly due to the 49.91% year-on-year (YOY) rise in other assets, grasping 48.68% of BDL’s total assets and reaching $91.32B by end of November 2022. Furthermore, the gold account, representing 8.65% of BDL’s total assets, decreased by 2.05% yearly to reach $16.22B by end of November 2022.

BDL’s foreign assets, consisting of 8.10% of total assets dropped by 16.69% YOY and stood at $15.18B by end of November 2022, noting that BDL holds in its foreign assets $5B in Lebanese Eurobonds. Meanwhile, total volume of dollars injected into the market through Sayrafa platform reached $377M in the last two weeks of November, however, the foreign assets of BDL decreased by 87.82M during the same period. In more details, Sayrafa traded volume reached $10.80B since year start, whereas BDL’s foreign assets seem to have decreased at a slower path as they declined by $2.64B only.

Crucially, the Central Bank declared 172,128 customers have profited from circular 158 with the amount withdrawn totaled $1.168B by August 2022, out of which $584.37M equally paid in cash dollars by commercial banks and the Central Bank. Moreover, 74,362 bank accounts have been totally settled by the commercial banks by end of August 2022, while 97,766 customers’ accounts where still benefiting from the circular by September 2022. In more details, 93.3% of account holders were resident whereas 6.7% were non-resident, and male account holders held the biggest share of 55.4% of total accounts while female account holders held the rest of 44.6% of total.

On the liabilities front, financial sector deposits, representing 56.43% of BDL’s total liabilities, decreased by 0.23% and reached $105.84B by end of November 2022 compared to last year, of which more than two thirds are denominated in dollars.

Lastly, currency in Circulation outside of BDL, consisting of 25.58% of BDL’s total liabilities, added 58.08% since year start and 66.25% annually to reach $47.98B by end of November 2022. Interesting to note, for the first two weeks of November, currency in circulation surprisingly registered a significant drop of $2.69B while BDL’ foreign assets recorded a remarkable increase of $1.23B. However, the trend reversed in the last two weeks of November where currency in circulation added $896.38M, and inversely, foreign assets of BDL declined by $143.96M.

BDL Total, Foreign assets and Currency in Circulation by mid-November ($B):

Source: BDL, Blominvest