Source: BLOMINVEST calculations

In an interesting article published by the Annahar newspaper two days ago[1], the financial gap at BDL in USD is estimated at $77 billion (all fresh), based mostly on data acquired from the Ministry of Finance. As interesting, out of this $77 billion, only $50 billion is accounted for, whereas the remaining $27 billion are not and they are presumably under investigation by the Audit Bureau (Diwan Almouhasabeh).

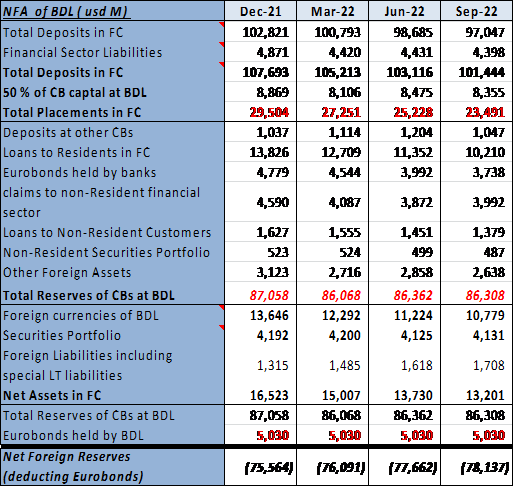

What we want to do in this story is to answer two questions: first, is the financial gap of $77 billion accurate?; second, how can we account for the missing $27 billion, at least on a preliminary basis? For the first question, the table above shows that the financial gap at BDL (Net Foreign Reserves) was at $75.6 billion (excluding gold) by December 2021; and as the article’s figure refers to data for end 2021, then we can infer that the $77 billion figure quoted by the article is slightly overvalued by about $1.5 billion, which makes its missing amount — more accurately — at $25.5 billion not $27 billion.

Before we answer the second question, it is useful to list – based on the article — how the $50 billion that is accounted for was spent:

As you see, the above list adds to $50 billion, with expenses on energy-related services taking the lion’s share at $25.5 billion, not to mention the $8 billion due to the disastrous subsidy policy of the Diab government. So these are the expenditures that we know. What about the missing $25.5 billion: where did they go? The Audit Bureau does not seem to have the answer (or does not want to!). At any rate, we suggest the following as a probable, but partial, answer:

The above figures add to $17.5 billion[4]. So this means that the missing amount could be reduced down to $8 billion from $25.5 billion. It is obviously a much smaller amount, though still a considerable one.

Lastly, we would like to conclude with the following observation: any serious, impartial audit of where the missing $8 billion have gone should also, perhaps more crucially, look into how the $50 billion were spent, especially the huge energy-related expenditures.

[1] “Financial Gap in Numbers”, Annahar, 12/12/2022

[2] The balance of payments deficits were $10.5 billion in 2020 and $2 billion in 2021.

[3] The 158 Circular was issued on 8/6/2021.

[4] Notice that we haven’t included USD fresh spending by BDL on Sayrafa transactions, as the Sayrafa platform has started on January 2022, and has totaled $10.2 billion by November 2022. In this respect, it is crucial to add that these USD payments by BDL were more than compensated for by BDL’s absorption of USDs in the FX market, such that by late 2022 its liquid foreign reserves started to increase reaching $10.6 billion at end November 2022