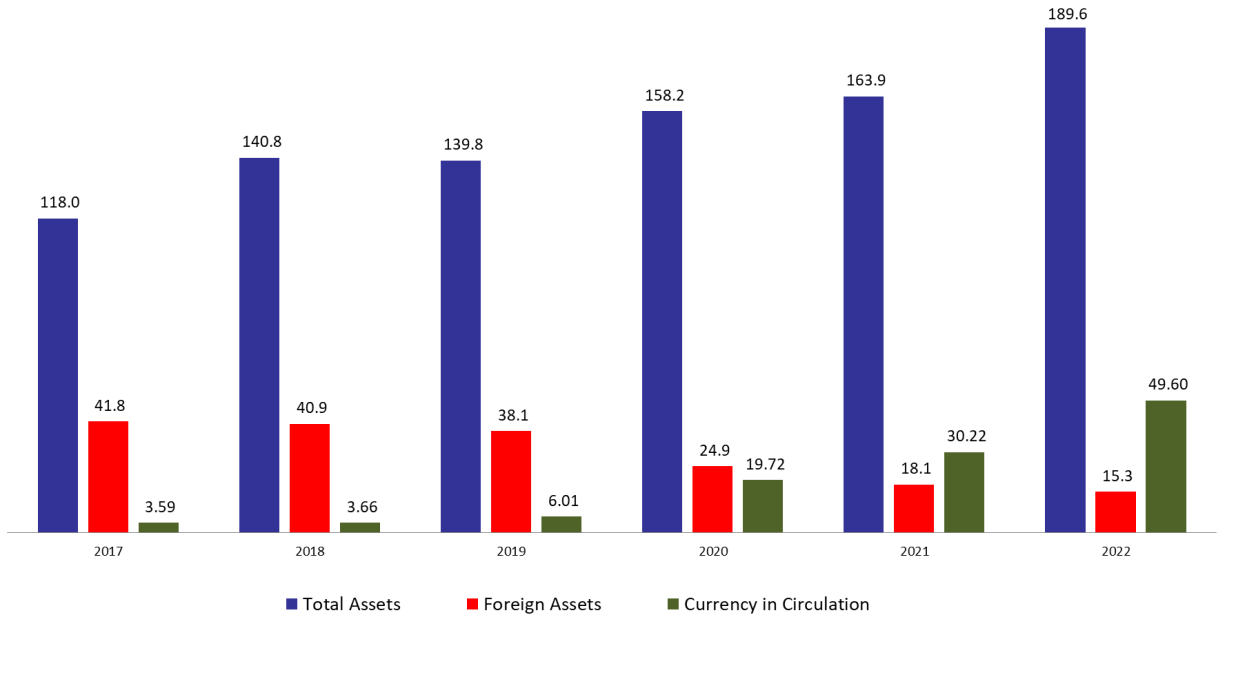

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 15.73% compared to last year, to reach $189.64B by mid of December 2022. The increase was mainly due to the 50.28% year-on-year (YOY) rise in other assets, grasping 49.31% of BDL’s total assets and reaching $93.51B by mid of December 2022. Furthermore, the gold account, representing 8.64% of BDL’s total assets, increased by 0.47% yearly to reach $16.38B by mid of December 2022.

BDL’s foreign assets, consisting of 8.04% of total assets dropped by 15.69% YOY and stood at $15.25B by mid of December 2022, noting that BDL holds in its foreign assets $5B in Lebanese Eurobonds. Meanwhile, total volume of dollars injected into the market through Sayrafa platform reached $411M in the first two weeks of December, while the foreign assets of BDL increased by $63.44M during the same period. In more details, Sayrafa traded volume reached $11.21B since year start, whereas BDL’s foreign assets seem to have decreased at a slower path as they declined by $2.57B only.

On the liabilities front, financial sector deposits, representing 55.85% of BDL’s total liabilities, decreased by 0.57% and reached $105.91B by mid of December 2022 compared to last year, of which more than two thirds are denominated in dollars.

Lastly, currency in Circulation outside of BDL, consisting of 26.15% of BDL’s total liabilities, added 64.12% annually to reach $49.60B by mid of December 2022.

BDL Total, Foreign assets and Currency in Circulation by mid-December ($B):

Source: BDL, Blominvest