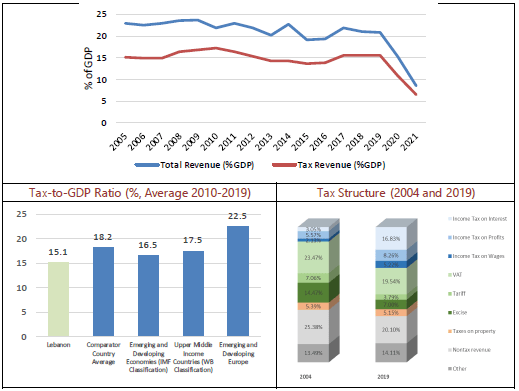

Lebanon has been facing dire economic conditions started in the eruption of October 2019’s upheavals and the historical devaluation of the Lebanese currency followed by the State default on its sovereign debt and the worldwide pandemic. The Lebanese economy registered a 48% negative growth between 2018 and 2021 while tax to GDP ratio fell from its pre-crisis level of 15.5% to 6.6% in 2021 due to significant reduction in Government revenue. In fact, Lebanon had always been lagging behind its regional comparators with tax to GDP ratio being lower than that of Jordan, Morocco, Tunisia or the average of emerging and developing economies.

In this context and in light with the Deputy Prime Minister’s request, the IMF fiscal affairs and legal department conducted a mission in September 2022 to provide Lebanon with a hand in reviewing the taxation policy of the country. As such, a technical assistance report was prepared by the IMF based on the information available at the time it was completed in November 2022, noting that the report was published in January 2023.

Tax Revenue and Structure in Lebanon: trend in Lebanon’s Total Revenue and Tax Revenue (% of GDP):

Sources: IMF staff calculation. Notes: in the right lower panel “Other taxes” include “passenger departure taxes”, car registration fees, and stamp fees, inter alia. Non-tax revenues are mainly dividends from the telecom and fees. Grants are negligible in Lebanon’s public budget.

The IMF report presents studied options to halt the run out of Lebanon’s tax revenue in the short and medium terms and urge the Government to adopt more efficient, effective, and inclusive taxation system. In short, the report underlines the necessity for an all-inclusive review of the taxes in Lebanon as well as stresses the need for a well define approach for a rapid and powerful rise from current problems. In more details, the report includes several recommendations and measures to be adopted by the Lebanese Government on the immediate term, and the short to medium term.

On the immediate term, the report claimed the need for correcting mis-valuation as a single market exchange rate should be adopted for all valuations for tax purposes. For a transition period, a reasonably close rate could be opted but using a lower rate than the Sayrafa rate is strongly recommended against. Moreover, the mis-valuation of taxes is estimated to cause a loss of revenue of 4.8% of GDP in 2022. Furthermore, normal magnitudes should be indexed to inflation. In addition, the VAT threshold should be restored to an appropriate level to ease administrative and compliance costs as well as employment income tax brackets should be modified and indexed to inflation in order to restore the original schedule of increasing average tax rates. Allow the tax administration to access relevant banking information and most importantly, start receiving information on offshore holdings on Lebanese residents for tax purposes through the Global Forum Framework. Ending disproportionately favorable capital income tax treatment and unlocking the potential of property taxation. Also, the IMF team suggested the necessity to limit the exemption from the capital gains tax of gains from the sale of real property by individuals to one primary residence and subject corporate capital gains to the standard corporate income tax (CIT) rate. Regarding the property taxes, it is crucial to use the market exchange rate for all taxes on property transactions that are in any foreign currency and remove the build property tax exemption for vacant properties and the preferential treatment for the for second properties. Adding on, the need to extend the registration fee to transfers of shares that derive their value primarily (50% or more) directly or indirectly from real property.

On the near term measures, the IMF team advised that reforms in 2023 should focus on “making the VAT great again” by ending the tourists refunds scheme and input tax into the exempt sectors or activities specified in article 59, also “making better use of excises” by introducing an excise on diesel and fuel oil of 0.25usd/liter and restore excises on gasoline and kerosene to pre-crisis levels in USD terms, and lastly “closing loopholes and modernizing the corporate income tax (CIT) by taxing professionals in the real profits’ regime and with the use of withholding taxes on payments to professionals for services as well as abolishing the regimes of offshore and non-conform holding companies and wasteful CIT incentives.

On the Medium term, preparation for these measures should be completed by end of 2023 to be effective in 2024 and 2025. The recommendations require an upgrade for income taxes by issuing a new income tax law that should ensure tax neutrality across income sources and legal forms, protect the base with anti-tax avoidance rules, and integrate efficient cost based tax incentives. Among other things suggested by the IMF team, removing the exemption on diesel and improving the design of the cross-border rules is a must for Lebanon.

Overall, government revenue is likely to continue to decline if no immediate actions are taken. Reversing the downtrend in taxation and improving the entire tax policy are key elements of the needed reforms for the country to be pulled out of the rubble. After all, the 2019’ uprising in Lebanon is a reminder of the need to raise revenues through a holistic tax reform that improves income distribution and balances the trade-offs, rather than an approach with ad hoc uncoordinated measures.