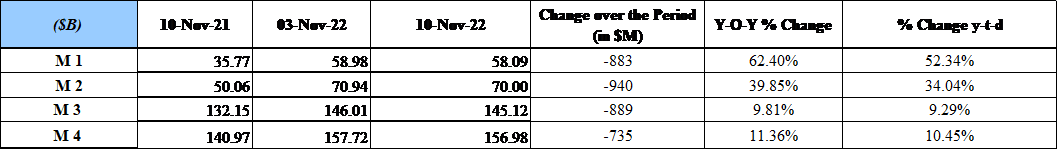

BDL’s latest statistics on money supply revealed that Broad Money (M3) decreased by LBP 1,340B ($889M) to stand at LBP 218,764B ($145.12B) by the week ending November 10, 2022. However, on an annual basis, M3 added 9.81% year-over-year and 9.29% since year-start (YTD).

In details, M1 retreated by LBP 1,331B ($883M) by a week to settle at LBP 87,576B ($58.09B) by November 10, 2022; due to a decrease in currency in circulation of LBP 1,240 billion and in demand deposits of LBP 91 billion.

In turn, total deposits (excluding Demand deposits) decreased by $6.22M, owing to a contraction in Terms and saving deposits by $57.04M while deposits denominated in foreign currencies added $51M.

As such, the rate of broad money dollarization increased from 51.411% in the week ending November 03, 2022 to 51.761% in the week ending November 10, 2022.

Looking at interest rates, the average rate on deposits in LBP at commercial banks decreased from 1.23% in November 2021 to 0.65% in November 2022. Similarly, the average rate on deposits in USD at commercial banks decreased from 0.2% in November 2021 to 0.07% in November 2022. In its turn, the average lending rate in LBP and USD, at commercial banks, went down from 7.2% and 6.75% in November 2021 to 5.3% and 4.35%, respectively, in November 2022.

Analytically, the money supply M3 can be derived from combining the balance sheet of BDL with the balance sheet of banks to arrive at the monetary survey of the banking system. The resulting M3 would be equal to the sum of: net foreign assets (NFA), credit to the private sector (CPS), net credit to the public sector (NCPS), and other items net (OIN). Latest data show that in November 2022, M3 stood at $147.08B, 11.74% higher than Novemver 2021; NFA were $11.63B, less by 25.32% YOY; CPS was $21.09B, less by 22.69% YOY; NCPS was $22.34B, less by 35.05% annually; and OIN were $92B, higher by an annual 69.31%, and comprising mostly (in BDL’s terminology) other assets which include open market operations and seigniorage, considered to be a controversial account by some.

In its treasury bills (T-Bills) auction dating November 10, 2022, the Ministry of Finance (MoF) raised LBP 51.808B ($34.36M) through the issuance of T-Bills maturing in 3 months (3M). In addition, the yield on 3 M T-Bills stood at 3.5%.

Source: BDL; MoF