In the Economic Digest published in this Blog on February 23, 2023, titled “Preliminary Observations on Lebanese Monetary Aggregates and Monetary Policy during the Crisis”, we mentioned that the Sayrafa platform – which was activated vigorously in December 2021 – was intended to absorb LBP liquidity and slow down the depreciation of the exchange rate. We want to empirically prove that in this new economic digest.

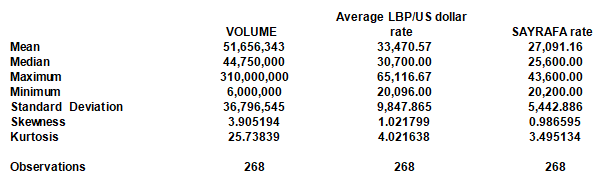

There are 3 variables: the parallel market rate againat the US dollar in LBP is the dependent variable; the Sayrafa trading volume in US dollars and the Sayrafa rate in LBP are the two independent variables. All figures are daily: they run from December 16, 2021 to February 10, 2023. Table 1 below presents the descriptive statistics on these 3 variables. The average daily turnover of Sayrafa was around $ 51.6 million, while the average market or parallel exchange rate was 33,470 LBP and the average Sayraf rate was 27,091 LBP.

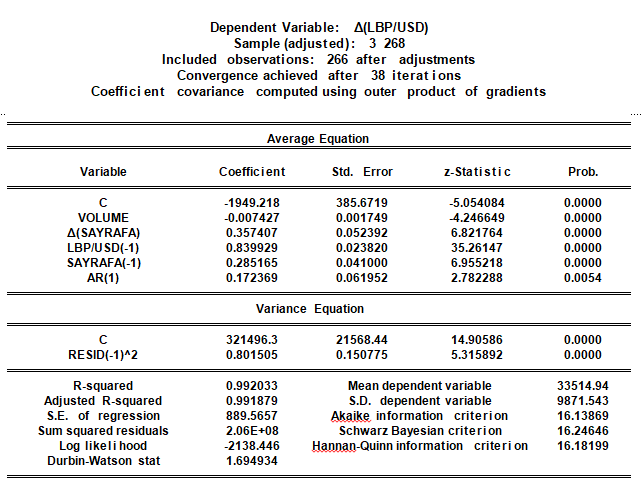

A preliminary test is conducted to determine whether these variables are stationary in distribution. With very low margins of error both the parallel rate and the Sayrafa rate are found to follow a random walk, i.e. a non-stationary time series process, while the volume variable is a well-behaved statistical series. This is as expected because asset prices change randomly with an equal uptick and down-pick probabilities of 0.5. Also, parameter stability is supported. And there is no indication that the regression residuals in Table 2 are not independently and identically distributed. It follows that, although parsimonious, the regression is well specified.

The results are presented in Table 2. The impact of Sayrafa volume on the parallel rate carries a negative coefficient of -0.007427, and with high statistical evidence. As trading volume increases, or as demand for US dollars is met through the Sayrafa platform, the change in the parallel rate will be less and so the exchange rate will depreciate less. More specifically, a 1,000 USD increase in Sayrafa volume will slow the depreciation of the exchange rate by 0.0074 LBP. And because of statistical stationarity conditions this effect is constant through time and holds for both the short run and the long run.

The effect on the parallel rate of the Sayrafa rate is positive in the short run, and stands at 0.357407, and stands at 1.7815 (=0.285165/0.160071) in the long run (and that the effect takes around 5.25 months to adjust fully). This result is to be expected as an upward change in the Sayrafa rate will drive the parallel rate upwards too and cause it to depreciate further.

The regression results run to Februray 10, 2023, because in early February BDL restricted Sayrafa to public employees only because it was depleting its FX reserves. Since then, average Sayrafa transactions fell to $23.6 million (less than half what it was previously) and the average parallel market rate rose to a high 80,300 LBP, while the average Sayrafa rate stood at 44,390 LBP only. That restriction marked a “new regime” for the determination of market exchange rates. What is more, the shortfall in Sayrafe transactions also coincided with renewed uncertainty arising from the confrontation between commercial banks and the excesses of Judge Aoun and from the lack of progress in electing a new president. Only when – at the least – we see resolution of these issues will the parallel exchange rate see more stability and cease its rapid depreciations.

Table 1: Summary statistics

Table 2: Multiple regression analysis with the change in the average of the Lebanese pound per US dollar Δ(LBP/USD) parallel rate as the dependent variable and trading volume (VOLUME, in 1000s), and the Sayrafa (SAYRAFA) rate as the independent variables together with an autoregressive residual AR(1).

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.