In its latest World Economic Outlook of April 2023, the IMF stated that global economy is on the path to recover but the road is rocky. Overall outlook is uncertain again amid recent financial sector turmoil, elevated inflation, continuous effects of the war in Ukraine, and the pandemic. In short, a tricky phase is ahead with economic growth remains monotonous. The cautious signs of soft landing in early 2023 have retreated although inflation declined but price pressures are proving sticky.

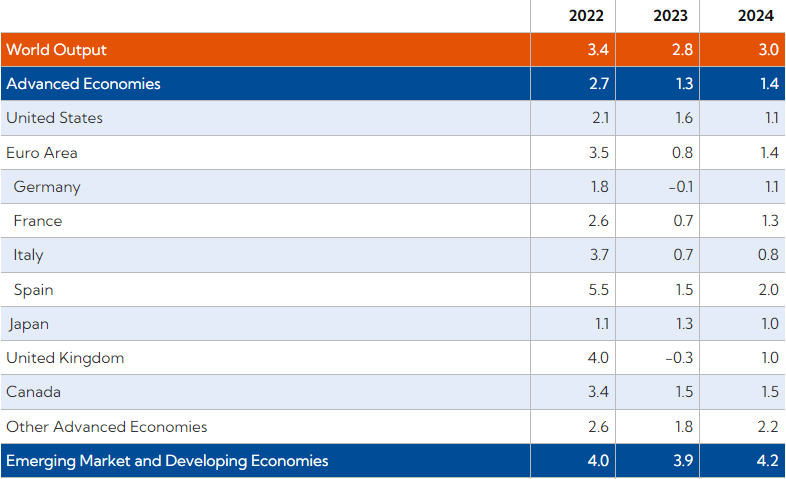

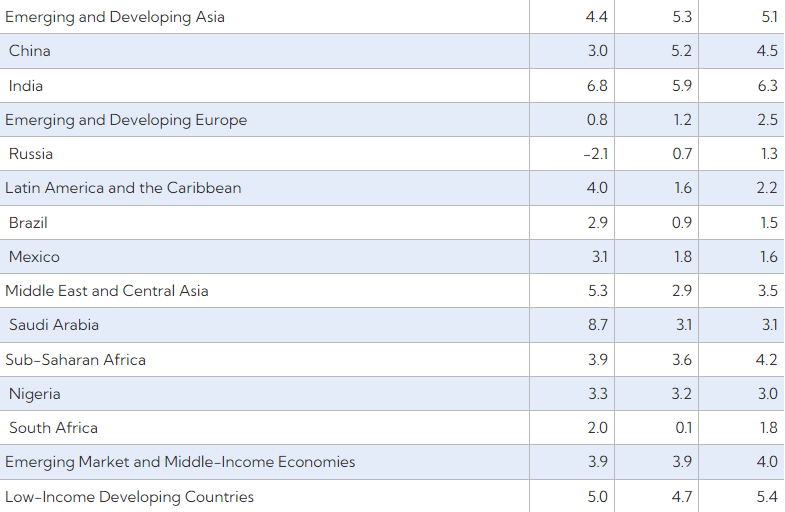

In numbers, IMF report showed that global growth forecast for this year will bottom out at 2.8% before rising modestly to 3% next year. Global inflation will fall, though more slowly than initially anticipated, from 8.7% last year to 7% this year and 4.9% in 2024. The IMF lowered its projection by 0.1 percentage points below its January projections. The revision highlighted that recent banking upheavals imposed more instability on the situation as downside risks would dominate and the road is still rocky. Inflation, in its turn, is still high despite recent softening driven by lower prices of food and energy but core inflation has not yet peaked in many countries. IMF expects year end to year end core inflation to slow to 5.1%, a sizeable upward revision of 0.6% from their January update; however, it seems that Inflation’s return to target is unlikely before 2025 in most cases.

The 2023 economic slowdown would be concentrated in advanced economies, in particular, Euro zone and the UK. Growth in these two areas is forecasted to fall to 0.8% and -0.3% this year before recovering to 1.4% and 1%, respectively. In contrast, several emerging market and developing economies would rebound with growth accelerating from 2.8% in 2022 to 4.5% in 2023. The 2023 labor market would remain very strong and show signs of resilience in most advanced economies. Suggesting stronger than expected demand, hence output and inflation estimates have been revised upwards indicating stronger than expected aggregate demand. This would push policymakers to tighten further or even to stay tighter for longer than currently projected.

IMF’s latest projections also indicate a slowdown in medium-term growth forecasts. 5-years growth projections are down steadily from 4.6% in 2011 to 3% in 2023. This decline mirrors the growth slowdown of some rapidly growing economies such as China or India whose economic growth is projected to stand at 5.2% and 5.9%, respectively. Surprisingly, Saudi Arabia’s growth is anticipated to stand at 3.1% while Japan’s growth is expected to reach 1.3% by 2023.

Lastly, impacts from the sharp and fast rise in interest rates are becoming apparent as financial sector vulnerabilities are at the front line in advanced economies and fears of contagion have risen across the broader financial sector. Furthermore, the report showed that public debt as a ratio to GDP soared across the world and is anticipated to remain elevated, posing a mounting challenge for policymakers. Consequently, risks to the outlook are severely twisted to the downside, with the chance for a hard landing.

Latest World Economic Outlook Growth Projections:

(Real GDP, annual percent change)

Source: IMF, World Economic Outlook, April 2023

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.