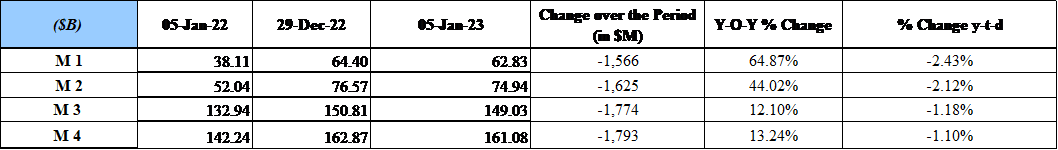

BDL’s latest statistics on money supply revealed that Broad Money (M3) decreased by LBP 2,674B ($ 1,774M) to stand at LBP 224,669B ($ 149.03B) by the week ending January 05, 2023. Furthermore, on an annual basis, M3 added 12.10% year-over-year but retreated by 1.18% since year-start (YTD).

In details, M1 decreased by LBP 2,360B ($ 1,566M) by a week to settle at LBP 94,723B ($ 62.83B) by January 05, 2022; due to a decrease in currency in circulation of LBP 7,253 billion and an increase in demand deposits of LBP 4,893 billion.

In turn, total deposits (excluding Demand deposits) fell by LBP 314.08B ($ 208.34M), owing to a drop in Terms and saving deposits by LBP 89B ($59.03M) and in deposits denominated in foreign currencies by USD 149M.

As such, the rate of broad money dollarization decreased from 49.23% in the week ending December 29, 2022 to 49.71% in the week ending January 05, 2023.

Looking at interest rates, the average rate on deposits in LBP at commercial banks decreased from 1.03% in January 2022 to 0.73% in January 2023. Similarly, the average rate on deposits in USD at commercial banks decreased from 0.18% in January 2022 to 0.09% in January 2023. In its turn, the average lending rate in LBP and USD, at commercial banks, went down from 6.4% and 6.15% in January 2022 to 5.61% and 5.38%, respectively, in January 2023.

Analytically, the money supply M3 can be derived from combining the balance sheet of BDL with the balance sheet of banks to arrive at the monetary survey of the banking system. The resulting M3 would be equal to the sum of: net foreign assets (NFA), credit to the private sector (CPS), net credit to the public sector (NCPS), and other items net (OIN). Latest data show that in January 2023, M3 stood at $149.59B, 14.47% higher than January 2022; NFA were $12.54B, less by 15.24% YOY; CPS was $19.56B, less by 25.6% YOY; NCPS was $18.11B, less by 44.45% annually; and OIN were $99.38B, higher by an annual 74.37%, and comprising mostly (in BDL’s terminology) other assets which include open market operations and seigniorage, considered to be a controversial account by some.

In its treasury bills (T-Bills) auction dating January 05, 2023, the Ministry of Finance (MoF) raised LBP 17,226M ($11.42M) through the issuance of notes maturing in 1 year with a yield standing at 4.5%.

Source: BDL; MoF

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.