The Institute of International Finance (IIF) published its quarterly report on Lebanon on May 12, 2023 which, besides its analytical discussion of the crisis situation in Lebanon, included arguments from the Virtual Conference on Lebanon that the IIF held on the first week of May, 2023. The main findings of the report are as follows:

– “It has been over three years since the start of the Lebanese crisis, yet no meaningful corrective reforms have been under-taken. Instead, counterproductive policies were introduced that amplified the initial economic and financial crisis to epic proportions, with tragic humanitarian consequences.

– Participants in our virtual conference noted that Lebanon’s current political system did not lend itself to a resolution of a crisis of this magnitude. The majority of the political elite has been in a state of denial and remains mostly concerned with their own narrow interests rather than the well-being of the Lebanese people. Implementation of the IMF’s prior actions is seen by the political elite as threatening to their illicit gains. Furthermore, the nexus between politicians and private sector vested interest groups has been a major hindrance to reforms.

– In addition to political constraints, the severe economic and financial crisis has its roots in a long history of inconsistent macroeconomic policies and failed attempts to address policy distortions in the economy. It is our belief, as well as that of most attendees of our Virtual Conference, that the only hope for Lebanon to address its current economic and financial crisis is to implement a comprehensive adjustment and reform program with the help of the IMF and the World Bank, which can provide technical support and help catalyze broad international financial support.

– The April 7, 2022 staff level agreement with the IMF set laudable objectives and comprehensive reforms to put the economy on a strong and sustained recovery path, though views diverged on certain aspects of the measures proposed. Differing views on how to allocate the financial losses, estimated at $70 billion (more than three times of GDP in 2022), create an additional bottleneck for reaching an agreement on a comprehensive reform agenda. The use of state-owned assets and public real estate could be one option to make deposits available to accounts held by the poor and middle-income groups. However, this should take into consideration budgetary limitations given the dire need to spend more on social safety nets and infrastructure. A few speakers mentioned that the haircuts may also be reduced by the issuance of CDs and future sharing of oil and gas revenues. Audits of the Central Bank of Lebanon (BdL), commercial banks, and fiscal accounts should be completed to provide a solid foundation for a medium-term framework and to determine the external financial gap.

– A public information campaign is needed to explain the benefits of a comprehensive reform program to generate broad-based support and true public ownership is needed for the reform program to succeed. It is unfortunate that capital controls were not imposed by the authorities at the start of the crisis in October 2019, leaving the decision to impose capital restrictions to individual banks. Temporary capital controls are needed to avoid any discretionary power by banks and to limit access to FX that could help address the current account deficit. Lebanon’s political elite must set aside their narrow interests and work towards the election of an independent and reformist president, a cabinet of pro-reformers, and a new BDL Governor, to pave the way to the implementation of reforms.

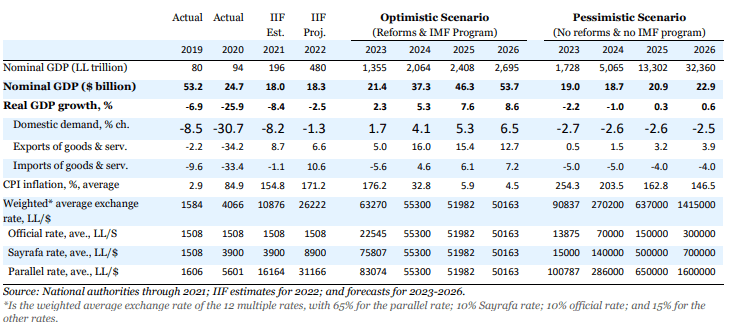

– Given the political uncertainties and willingness to reform, the IIF prepared two scenarios for illustrative purposes:

Optimistic Scenario (low probability): achieve political stability by end-June (including election of a pro-reform President and formation of reform minded cabinet), IMF’s prior actions are implemented, IMF Board approves the EFF arrangement by end-September, external financing becomes available, confidence is restored gradually, strong economic recovery driven by net exports and public investment, single digit inflation achieved within 3 years, debt becomes sustainable with restructuring and fiscal adjustment, and a significant portion of the deposits become accessible.

Pessimistic Scenario (high probability): authorities continue blocking reforms, no IMF agreement, no external support, parallel exchange rate soars, inflation remains in triple digits, reserves diminish further, deposits remain inaccessible, emigration accelerates, and Lebanon disintegrates or, like the Titanic, crashes into the metaphorical iceberg as economic and social conditions deteriorate to the point of provoking civil strife with unimaginable results”.