The 2015 kick-off was a sour one for the Syrian regime as it lost control over two regions just a few days apart: Bosra-el Cham and Idlib. The region of Bosra el Cham, a region in the province of Deraa characterized by its ancient timbre and strategic status, has been taken by Syrian rebels on the 25th of March 2015. The regime also lost the region of Idlib to Al-Nusra Front, Ahrar al Cham and Soukour al Cham on the 28th of March. Idlib is to the north of Latakia, the Alaouite stronghold of President Bashar al Assad. As clashes between the regime and opposition groups rage on, the humanitarian crisis climbs to new highs. According to the Syrian Observatory for Human Rights, after four years of war, the death toll now exceeds 200,000. In March, the third International Humanitarian Pledging Conference for Syria took place in Kuwait, gathering $3.8B in aid to war-ridden Syria.

The burden of the war is not only materialized in displacements but also manifests in higher prices of basic commodities. Unable to sustain more subsidies, the Syrian government increased the price of one bread loaf from 25 SYP ($0.12) to 35 SYP ($0.17). In an attempt to soften the blow, the state news agency SANA reported that President Bashar al-Assad issued in January a decree granting a SYP 4,000 ($19.09) living compensation on monthly salaries for all state employees. A few days later, the Ministry of Labor granted SYP 4,000 compensation to non-state employees, an amount also exempt from deductions.

Fees on final consumption have been adjusted in accordance with the customs’ fees that have been recently reduced. There were previously 13 categories of customs fees but have now been reduced to 5: 1%, 5%, 10%, 20% and 30%. Extremes such as 0%, 80% and 150% (the last two applied on clothing and passenger cars) have been eliminated. The aim of this modification is to deter importers from evading paying the customs fees, simplify the customs’ system and reduce the impact of a depreciating Syrian pound. For products on which customs fees are 1%, 5%, 10%, 20% and 30%, the consumption fees are 0%, 1%, 2%, 3% and 5%, respectively.

A 20% consumption fee has been imposed on services offered in amusement centers and night clubs and a 5% consumption fee was also set on services in fast-food restaurants. Meanwhile, 3% and 2% consumption fees were enforced on cellular calls and landline calls, respectively. A 10% consumption fee was also enacted on the rental of touristic cars.

Customs’ fees on cement have been reduced from SYP 1,400 ($6.68) to SYP 1,000 ($4.77) per ton and customs fees on mobile phones have been slashed from 15% to 5%. Customs’ fees on cars with a capacity up to 1,600 cc have been reduced from 30% to 10%, and those on cars with a capacity between 1,600 cc and 3,000 cc have also been reduced from 40% to 20%. However, private tourist cars with a capacity of over 3,000 cc saw their customs’ fees rise from 40% to 60%.

External trade has been negatively affected by the conflict but Syria continues to count on its allies to alleviate pressures. Officials have confirmed that the Iranian credit line has not been negatively impacted by the recent slump in oil prices. The main port of Tartous has seen tonnage drop from 1.4 million tons in the first quarter of 2014(Q1 2014) to 1.1 million tons in Q1 2015. 225,000 tons were exported and were mainly made up of phosphate, cars, containers and food products. 831,000 tons were imported and mainly consisted of steel, wood, corn, coal and sugar. Revenues at the Port amounted to SYP 925.3M and officials linked the subdued activity to bad weather conditions that led to the closure of the Port and to weak transit activity to Iraq. On a positive note, experts believe that Syria will not need to import wheat in 2015 due to heavy rainfalls boosting harvest.

The conflict has not only depleted government revenues but has paved the way for tax evasion. Tending to this matter, President Assad issued a decree in 2015 detailing how a supervision committee should be formed. Those who are in the bread production have been exempt from the income tax and from the tax applied on salaries and wages. Companies going public are exempt from the tax on the gains received upon listing their shares only if the subscription rate is no less than 50%. State-owned joint stock companies have also been exempted from the tax applied on their net profits.

Syria is not only struggling to save its trade activities but also to keep its businesses afloat. The Central Bank is now contemplating the idea of reviving operational loans, which have been halted since late 2012. The loans are expected to be short-term loans not exceeding one year with a value ranging between SYP 500,000 ($2,386) and SYP 10M ($47,724). These loans will be granted to industrial factories and priority will be given to those who export more than 60% of their production and to those whose labor costs make up 60% of their overall costs. The Central Bank has however run out of options to keep the Syrian pound afloat since the average quote of the Syrian Pound against the dollar depreciated from 184.20 in January to 201.22 in February and to 209.54 in March.

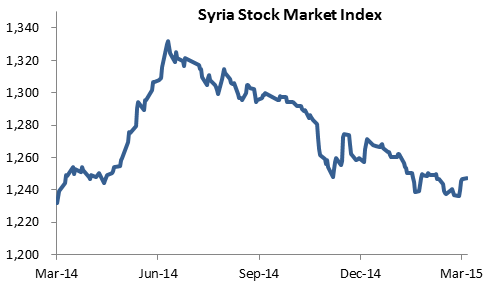

The weighted index of the Damascus Securities Exchange (DWX) settled at 1,242.29 points in March, a 2% monthly drop. The volume of traded shares increased from 351,000 to 689,000 and their value rose from SYP 43M in January to SYP 121M in March. In March, the best performers were Bank of Syria and Overseas (BSO), Syria International Islamic Bank (SIIB), Fransabank Syria and Al Baraka Bank Syria. The bottom performers were Qatar National Bank Syria (QNBS), Cham Bank, International for Trade and Finance (IBTF), Bank BEMO Saudi Fransi and Alahliah for Vegetable Oil (AVOC).