Discover today’s performance of BLOM indices, the closing prices of Lebanese stocks and Eurobonds, as well as the exchange rate of major currencies against the LBP.

BLOM Stock Index (BSI) – today’s performance

| Last | Previous | % Change | Y-t-D Change | |

| BSI | 2,024.74 | 2,031.87 | -0.35% | -22.94% |

| Volume | 180,124 | 16,510 | ||

| Val ($) | 1,827,214 | 303,360 |

I): BLOM preferred Shares Index (BPSI): today’s Performance

| Last | Previous | Change | |

| BPSI | 21.01 | 21.01 | 0.00% |

Lebanese Stocks: today’s Trades and Closing Prices

| Last Price ($) | % Change | Volume | VWAP ($) | |

| Solidere A | 86.90 | 3.95% | 6,086 | 85.46 |

| Solidere B | 82.00 | -3.53% | 4,393 | 81.76 |

| Bank Audi | 2.57 | -6.55% | 107,377 | 2.60 |

| Bank Audi GDR | 2.05 | -19.61% | 51,144 | 2.10 |

| BLOM GDR | 5.90 | -9.92% | 4,000 | 5.90 |

| HOLCIM | 76.30% | 0.39% | 7,124 | 76.30 |

Closing Date: July 15, 2025

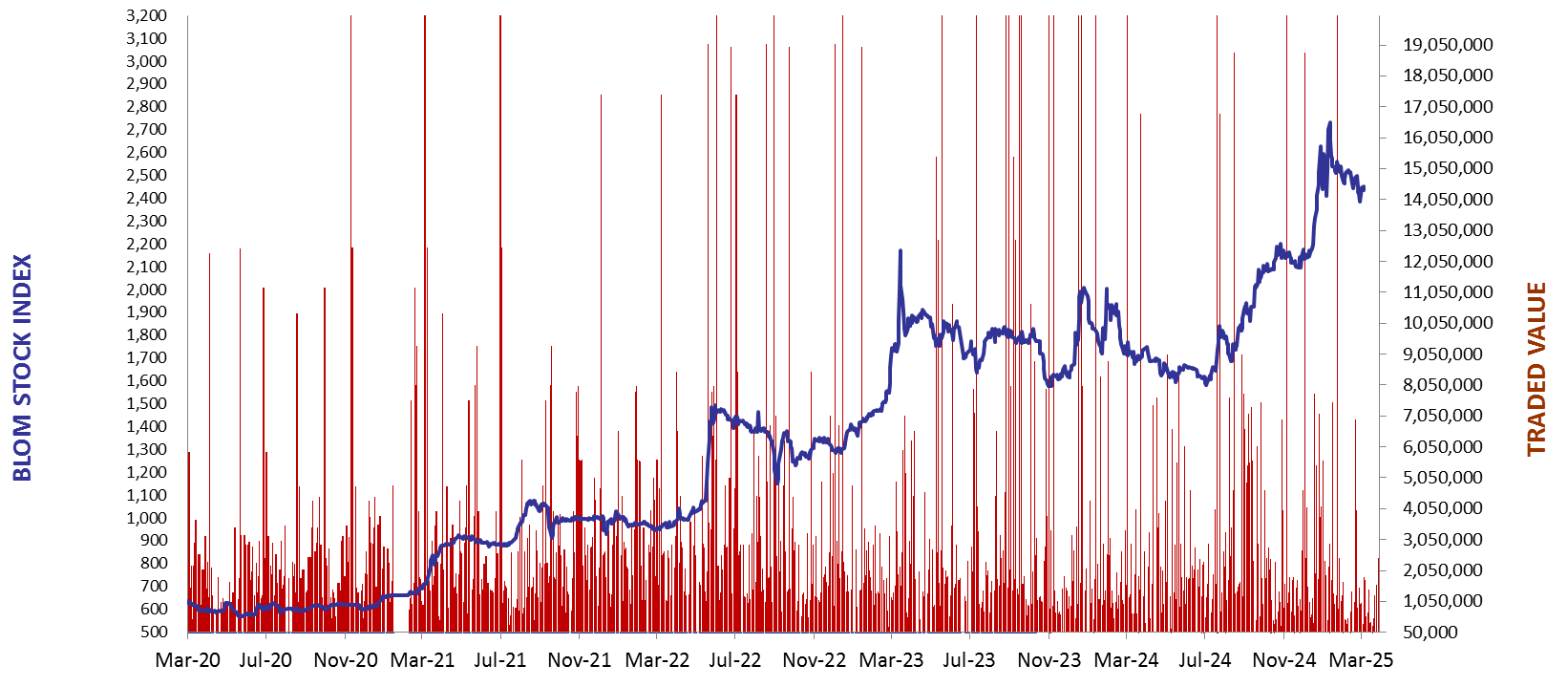

The BLOM Stock Index

BLOM BOND INDEX: Last Session’s Performance

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 20.13 | 20.15 | -0.10% | 51.44% | |

| Weighted Yield | 97.42% | 96.95% | 47 | bps | |

| Duration (Years) | 2.30 | 2.31 | |||

| 5Y Bond Yield | 94.00% | 93.90% | 10 | bps | |

| 5Y Spread* | 9,002 | 8,991 | 11 | bps | |

| 10Y Bond Yield | 63.40% | 63.30% | 10 | bps | |

| 10Y Spread* | 5,897 | 5,887 | 10 | bps |

*spread between Lebanese Eurobonds and US Treasuries

| Price | Yield | Yield Change | |

| 28/11/2026 | 19.40 | 184.66% | 126 |

| 23/03/2027 | 19.40 | 145.92% | 80 |

| 29/11/2027 | 19.39 | 103.10% | 36 |

| 03/11/2028 | 19.40 | 76.26% | 22 |

| 26/02/2030 | 19.45 | 58.77% | 13 |

| 22/04/2031 | 19.43 | 51.89% | 9 |

| 23/03/2032 | 19.46 | 47.70% | 15 |

| 02/11/2035 | 19.48 | 40.00% | 3 |

| 23/03/2037 | 19.45 | 39.56% | 7 |

Closing Date: July 14, 2025

Lebanese Forex Market

| Last Price | Previous | % Change | |

| $/LBP | 89,500 | 89,500 | – |

| €/LBP | 104,598.65 | 104,383.85 | 0.21% |

| £/LBP | 120,395.40 | 120,171.65 | 0.19% |

| NEER | 239.94 | 239.97 | -0.01% |

Closing Date: July 15, 2025