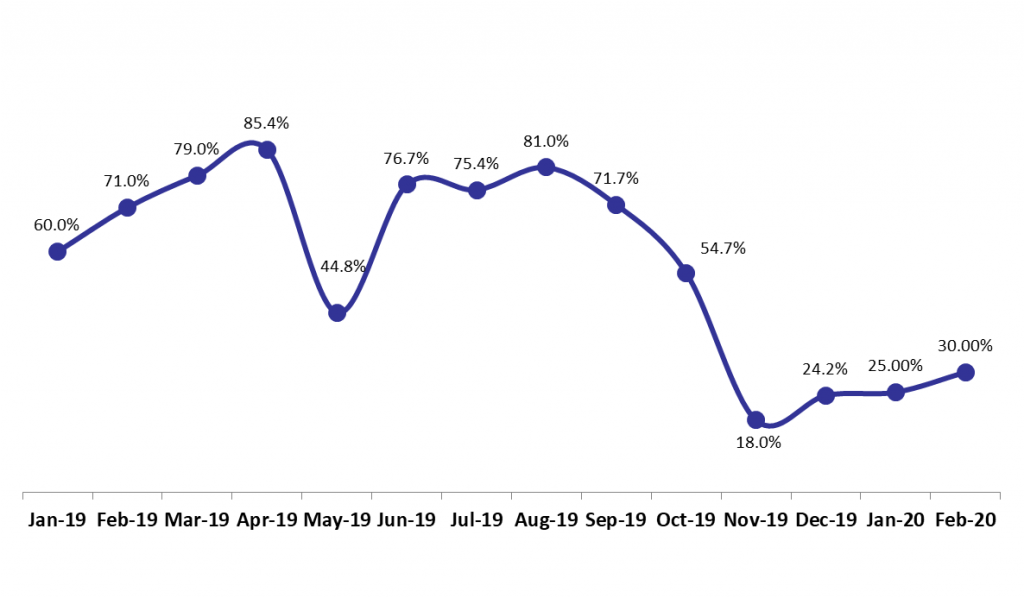

According to Ernst & Young Middle East hotel benchmark survey, the occupancy rate in Beirut’s 4- and 5-star hotels slipped to an all-time low of 28% by February 2020, down from last year’s registered 65% during the same period.

In fact, the first coronavirus case in Lebanon surfaced on February 21st 2020. Within a week, the government imposed entry restrictions for travelers from affected countries, including Iran, China, France and Italy. Moreover, the pandemic had already hit other countries, namely Lebanon’s Arab neighboring states (including but not limited to Dubai, KSA, Bahrain) which historically composed the bulk of tourism and tourist spending for the Lebanese hospitality sector. Therefore, by February 2020, Arab as well as non-Arab states had already imposed tight travel restrictions and/or halted airport activity altogether, in attempts to curb COVID-19. Shortly later, Lebanon followed suit, shutting all airport activity, to-date.

As a result, Beirut’s occupancy rates suffered the most in the region, and so did the Average room rate and Rooms yield which slumped from $192 and $125 by Feb. 2019, to unprecedented lows of $130 and $36 by Feb. 2020, respectively. The impact on Lebanon’s hospitality sector was dramatic, but it was also expected knowing the country was already grappling with civil protests and an economic-financial crisis since October 2019.

On a regional level, the occupancy rates in Dubai overall fell by 3.4 percentage points (pp) year-to-date (YTD) to 82%. By the same token, the Average room rate and Room yields fell by 12.6 pp and 16 pp to stand at $239 and $196, respectively by February 2020. In a nutshell, the slump in Dubai’s hospitality sector is partly attributed to the COVID-19 disruptions and the associated travel restrictions imposed. Nonetheless, the sector’s performance was also deeply impacted by the decline in the number of Chinese tourists to the country, noting these last constitute the largest source market for Dubai.

In its turn Muscat, Oman’s capital, witnessed notable drops across the board. The city’s hotel occupancy rate decreased by 3.2 pp YTD to 65% by Feb. 2020. Accordingly, the Average room rate and Rooms yield fell by 12.8 pp and 16.8 pp to $139 and $91, respectively, over the same period.

Meanwhile, Bahrain’s Manama city managed to maintain its occupancy rate by Feb. 2020 at 53%, similar to the rate recorded during the same period last year. Nevertheless, the Average room rate and Rooms yield recorded notable declines of 5.8 pp each, to stand at $146 and $77, respectively. The subdued performance can be tightly linked to the national response that entailed travel freezes to limit the spread of the disease and multiple event cancellations.

Monthly Occupancy Rates in Beirut’s 4-&5-Star Hotels

Source: BLOMInvest Bank; E&Y Middle East Hotel Benchmark Survey