Analyzing Lebanon’s Eurobonds Amid War

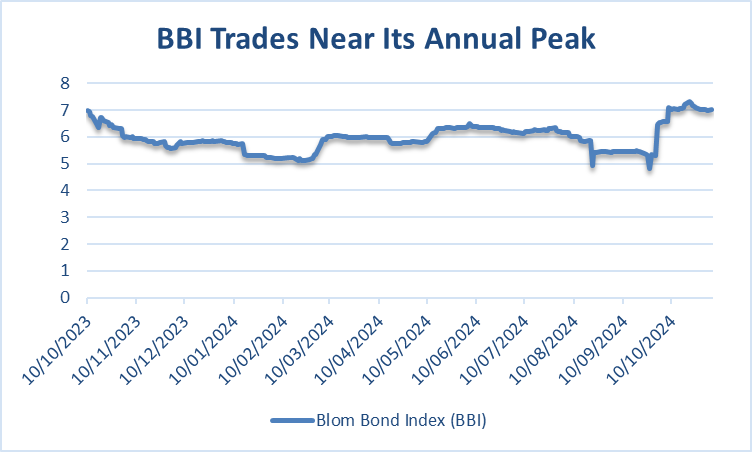

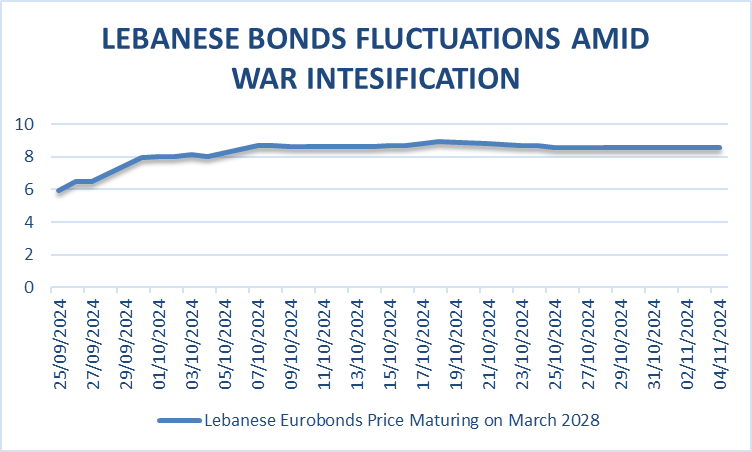

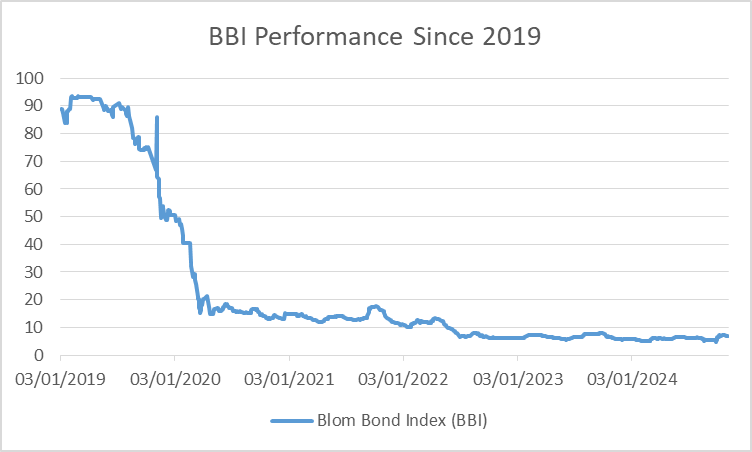

Lebanese Eurobonds have recently gained attention in global financial news. The Blom Bond Index, which tracks these bonds, has traded near its highest level in recent weeks since the start of the Israeli-Hezbollah war, rising from 6 cents to 7 cents. Some bonds even reached up to 9 cents, such as the one maturing in March 2028, recording their highest level in 2 years. This increase was driven by investor optimism that Hezbollah’s weakening could lead to a ceasefire, stabilize the country, prompt necessary reforms, secure an IMF agreement, and end Lebanon’s prolonged bond default. However, this trend did not last for long. Last Friday, the Bloomberg Emerging Market USD Aggregate Total Return Bond index declined, with the Lebanese Government International Bond spreads widening the most. This signifies that the difference in yield between Lebanese bonds and safer benchmarks (like U.S. Treasury bonds) increased significantly. In other words, investors see Lebanese bonds as riskier, demanding higher returns for the increased risk. This volatility raises the question: What should Lebanese Eurobonds be worth?

Probable Scenarios for Bond Prices

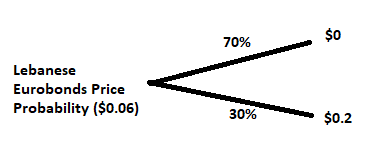

Oussama Nasr, a former derivatives banker, analyzed this bond rally in the Financial Times (October 28, 2024). He explained that the price of 6 cents reflects two possible outcomes:

- Dysfunction and Default: Lebanon remains a near-failed state, eventually defaulting on its bonds again.

- Stability and Payment: Lebanon achieves some stability and prosperity, eventually paying off its debt, potentially raising bond prices to 20 cents.

The probability model for Lebanese Eurobonds at a price of $0.06 initially showed a 70% chance of the bonds being worth $0 and a 30% chance of being worth $0.20.

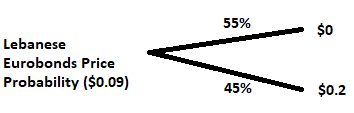

However, the recent increase in bond prices, reaching up to 9 cents for some bonds, suggests that the probability of the bonds being worth $0 has decreased from 70% to 55%, while the probability of being worth $0.20 has increased from 30% to 45%. This shift indicates increased investor optimism for Lebanon’s stability and economic improvement, despite the ongoing violence and Israeli ground operations.

Investor Optimism vs. Credit Agencies Pessimism

Credit agencies, however, are less optimistic:

Adding to these challenges, Lebanon was recently placed on the FATF grey list, exacerbating financial system instability.

The Challenges of Trading Lebanese Eurobonds

It is also important to keep in mind that trading volumes for Lebanese Eurobonds are extremely low, meaning prices can be influenced by just a few deals. Junk bonds, like these, often respond to minor signs of improvement in a country’s situation.

Low trading volumes also mean that selling significant amounts of bonds when prices rise can be difficult.

Given Lebanon’s governance issues, political deadlock, lack of a tax base, and economic instability, few international investors are interested in Lebanese Eurobonds. These investors typically aim to increase their holdings and potentially raise lawsuits against Lebanon. Lebanese banks, therefore, still hold a substantial share of these bonds.

Options Theory Explanation

Nasr also used options theory to explain the bond price surge. The value of an option increases with higher volatility, especially for out-of-the-money options (those with no current value). These options are cheap because they have low chances of being exercised, but their payoffs can be high if conditions improve. This might explain the rise in bond prices to nearly 9 cents, despite still being well below their values before the 2020 default.

Lebanese Bonds prices have been extremely volatile recently. On Friday, Lebanon Government International Bond spreads tightened the most compared to other constituents of the Bloomberg Emerging Market Index. However, on Monday, Lebanese Eurobonds spreads widened the most.

If debt securities really act like options, what are the potential outcomes of investing in Lebanese Eurobonds?

- High Potential Returns: They are cheap and can sometimes yield very high returns.

- High Risk of Loss: They have a high chance of losing all value if reforms and debt restructuring fail in Lebanon.

How High Can Returns Get?

To answer this question, Nasr used the example of buying a one-year call option on Microsoft stock, allowing you to buy it at $100. If the current price is $80 and the stock’s volatility is 20%, the option might cost around $1 due to the low chance of the stock exceeding $100. There’s about an 85% chance you’d lose your money. But if the stock price rises to $105, you could make a 400% profit because the $4 gain (105 – 100 – $1 option cost) is 400% of the $1 investment (option price).

Applying this to Lebanese Eurobonds, if the price doesn’t change but volatility doubles from 20% to 40%, the bond’s value could increase five times. This means if the bond’s initial value was $0.06, it could rise to $0.3. This is because the increased volatility makes the potential for large price swings more likely, which raises the bond’s value despite the existing risks.

Possible War Outcomes and Bond Payments

Most importantly, in what scenarios could bond payments happen?

| Potential Scenarios | Bond Payments Possibility |

| Israel weakens Hezbollah, leading to reforms and an IMF agreement. | Likely |

| Hezbollah fights Israel to a standstill, becoming stronger but cooperative, leading to reforms and an IMF agreement. | Likely |

| Hezbollah becomes stronger but no reforms or IMF agreement occur. | Unlikely |

| Israel weakens Hezbollah, but Lebanese factions fail to reconcile, resulting in no IMF agreement. | Unlikely |

| Israel damages Hezbollah, but it remains powerful, obstructing reforms and an IMF agreement. | Unlikely |

Conclusion

The recent rise in Lebanese Eurobonds shows a mix of hope and risk. There’s a chance for big returns if Lebanon can find stability and make needed reforms, but the threat of losing everything seems the most likely outcome in this uncertain environment. Can an unanticipated event change this course? In Lebanon, where uncertainty is always present, the answer is hard to find.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.