GS: Revisiting Lebanon Debt Recovery Values

On December 2nd, 2024 Goldman Sachs published its CEEMEA Economics Analyst Report, Revisiting Lebanon Debt Recovery Values, in which it revisits its previous January 2019 estimates of Lebanese debt recovery values[1]. The reason behind the new estimates is that Lebanon’s defaulted Eurobonds have more than doubled in value since mid-September (6.2 cents to around 13.47 cents currently); besides there has been new political developments in Lebanon, most noticeably the end of the war with Israel and the setting of a date, in early January 2025, to elect a new President for the republic.

The reports’ methodology for calculating recovery values consists of three steps: 1) Estimating the haircut: the required haircut on all external debt would bring the public finances to a sustainable level; and this is assumed to be a debt/GDP ratio of below 80% ten years after the debt restructuring; 2) Applying the haircut to outstanding debt: the haircut is applied to the total projected outstanding debt stock at the time of the restructuring, around $47.3 billion in 2025, which includes principal and past due interest (PDI) on defaulted debt and $2.9 billion in zero-coupon bonds to pay back depositors in the event of bank resolution; 3) Taking the Net Present Value (NPV): it is assumed that the new bonds issued in the restructuring carry a tenor of 10 years and a coupon of 8%; also assumed is an exit yield of 12% to discount the cash flow from these bonds to arrive at the NPV of the restructured bonds, which in turn would represent the current recovery value.

Moreover, for the restructuring process to be implemented, the report stipulates the following political developments: A permanent end to the conflict with Israel; Election of a new president; Formation of new government; Completion of the IMF prior actions as per the April 2022 Staff Level Agreement; Parallel discussion with bondholders; Final approval of an IMF program. In addition, for the Debt Sustainability Analysis (DSA), the following economic assumptions are adopted: a flat primary balance until restructuring, and that this rises to 2% of GDP within four years of an IMF deal; a sharp rebound in growth post-restructuring where output converges to the pre-2019 trend in around a decade; a sharp step depreciation post-restructuring as a result of the conversion of a significant portion of domestic dollar deposits into Lebanese Lira (Lirification), but a steady moderate (3% per year) depreciation in the Lira thereafter; a post-restructuring spike in inflation due to the high FX pass-through in the near term , but with inflation stabilizing later at around 4% per year.

Under these conditions, the DSA reveals that, for the debt/GDP ratio to settle around 80% ten years after restructuring, a 75% haircut to the outstanding debt stock is required (a write-off of roughly $35bn of the country’s outstanding external debt).

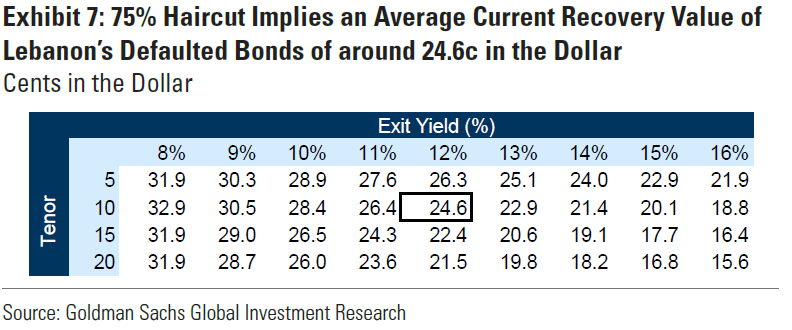

As such, the 75% haircut is then applied to the outstanding amount for each of the 30 defaulted Lebanese Eurobonds to calculate bond-holder claims post-restructuring. Assuming then that this claim is met with the issuance of a new 10-year bond carrying a coupon of 8%, the net present value of each bond is calculated using the ‘exit yield’ as the discount rate. This is the recovery value, and will differ from bond to bond depending on the corresponding defaulted bond’s payment profile. Also, the exit yield is not observable and can vary widely at the time of the restructuring. The higher the exit yield relative to the coupon, the deeper the discount factor will be and the lower the recovery value, as shown in the table above.

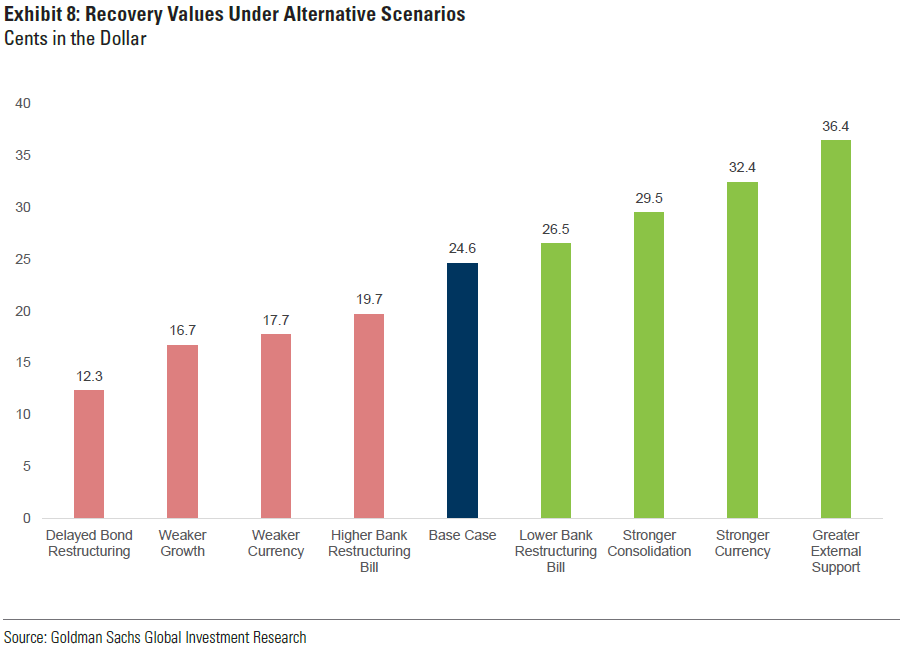

As interesting, the report conducts stress tests for downside and upside risks. The downside risks are: Delay in bond restructuring; Weaker growth; Larger, more persistent depreciation; Higher banking system restructuring bill. As for the upside risks: Lower banking system restructuring bill; Stronger fiscal consolidation; Stronger currency; Greater external support. And as we can see from the above bars chart, the recovery values increase with the upside risks and vice versa.

Overall the estimates seem reasonable, although we can differ on how valid are some of the assumptions (especially for the exchange rate and the primary balance). And the report is a welcome harbinger for a state of affairs that we all look forward to happen, and happen soon.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.

[1] The report was prepared by Farouk Soussa and Vinayak Iyer