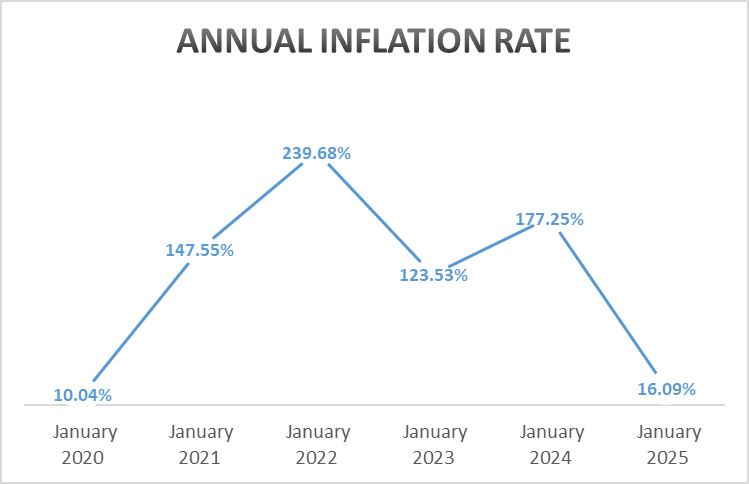

Lebanon’s Inflation Eases to 16.09% Annually in January 2025

Lebanon’s annual inflation rate slowed to 16.09% in January 2025, down from December 2024’s three-month peak of 18.1%, according to the Central Administration of Statistics (CAS). On a monthly basis, the Consumer Price Index (CPI) rose by 1.10% in January 2025.

The easing of inflation rates over the past year and a half is partly due to increased dollarization in the economy and the stabilization of the exchange rate at around 89,500 LBP per USD. However, the ongoing political and military tensions in the Middle East continue to impact Red Sea shipping traffic, posing a threat to supply chains. This disruption could increase shipping costs, and consequently drive up inflation.

Source: CAS, BLOMINVEST Bank

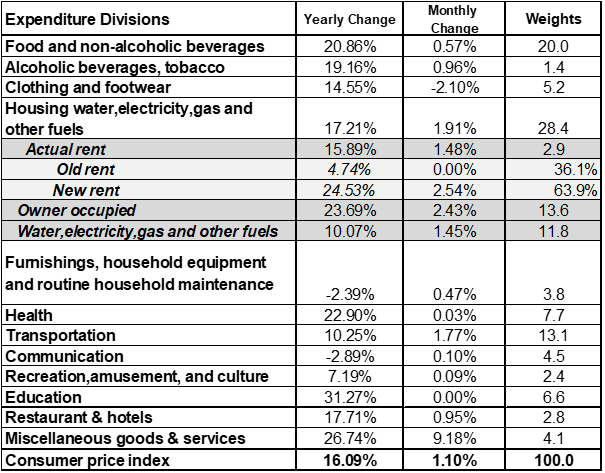

Most Notable Price Changes Across Various Categories:

- Food and Non-Alcoholic Beverages: Prices increased by 20.86% annually as the war severely damaged the agriculture sector, which reduced the supply of agricultural products.

- Alcoholic Beverages and Tobacco: The war damaged tobacco farming areas, particularly the ones near the Lebanese borders, limiting supply, while heightened stress levels boosted consumption, resulting in a 19.16% yearly price increase.

- Housing Water, Electricity, Gas and Other Fuels: This category saw a 17.21% yearly increase. New rental prices surged by 24.53% annually as displaced individuals hesitated to return home due to ongoing ceasefire breaches and the uninhabitable condition of many homes post-war. Additionally, many people prepaid their rents for six months or even a year before the ceasefire deal was made

Here is a breakdown of the CPI on an annual and monthly basis:

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.