The International Monetary Fund (IMF) reports that the Middle East and North Africa (MENA) region is still expected to grow but at a slower pace than previously projected due to conflicts and the prolonged OPEC+ output cuts.

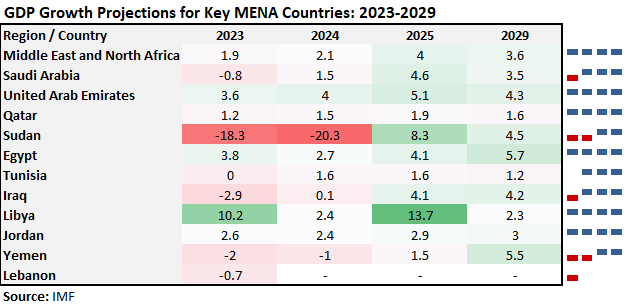

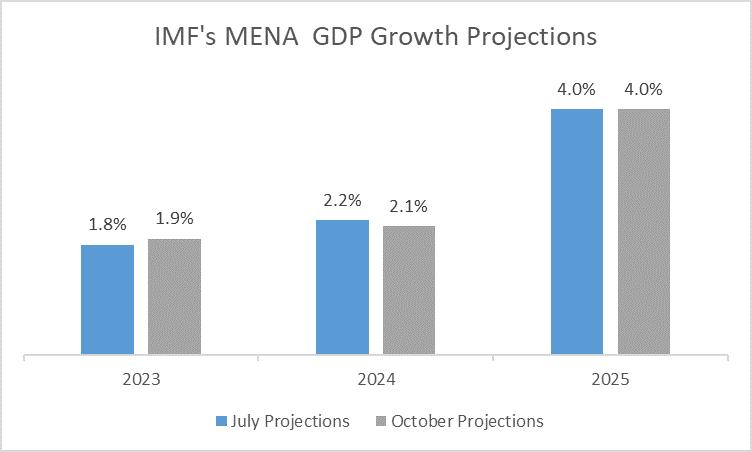

The region’s real gross domestic product (GDP) is projected to grow modestly by 2.1% in 2024, up from 1.9% in 2023, driven mainly by faster growth in Gulf Cooperation Council (GCC) countries. However, 2024’s projection is down 0.6% from July’s forecast due to ongoing conflicts and prolonged OPEC+ output cuts. The uncertainty about when these factors will ease remains high, adding further unpredictability to the 2025 forecast. If these issues ease, growth could reach 4% in 2025 before slowing to 3.6% in 2029.

This year has been particularly tough for the region, marked by devastating human suffering and economic damage. Oil output cuts have further weakened several economies. The escalating conflict in Lebanon has added even more uncertainty.

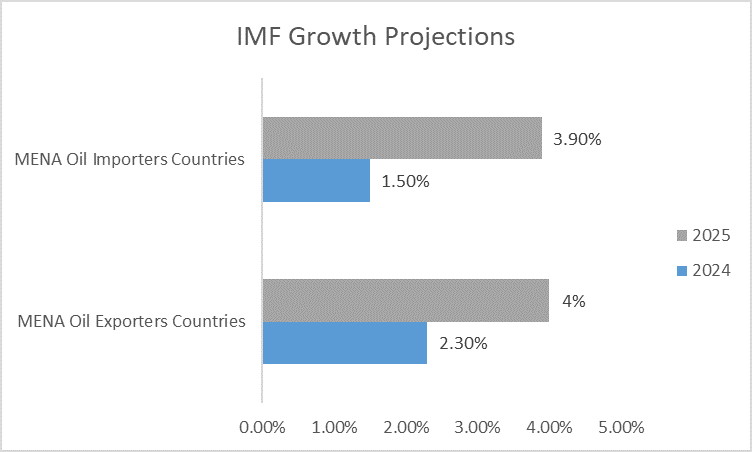

Oil Exporters vs. Importers

The economic growth of MENA oil-exporting countries is expected to increase from 2.3% in 2024 to 4% in 2025, if the voluntary oil output cuts end. Meanwhile, MENA oil-importing economies are projected to grow from 1.5% in 2024 to 3.9% in 2025 if conflicts ease.

Medium-Term Growth Prospects

Over the past two decades, medium-term growth prospects have weakened. Improvement requires steady reforms in governance, job creation—particularly for women and youth—investment promotion, and financial development.

Uncertainty and Risks

Lebanon remains in a particularly difficult situation. IMF highlights the recent escalation of conflict within Lebanon, exacerbating economic uncertainty and risks. Lebanon’s economy contracted by 0.7% in 2023, before the war intensified. Projections for 2024, 2025, and 2029 are missing, underlining the uncertainty about Lebanon’s future amid ongoing turmoil.

He added that the IMF is closely monitoring and assessing the situation. The conflict could impact the region in many ways beyond output, affecting tourism, trade, refugee and migration flows, oil and gas markets, financial markets, and social stability.

Additional concerns include a potential prolonged conflict in Sudan, increased geoeconomic fragmentation, commodity price volatility—especially for oil-exporting countries—high debt and financing needs for emerging markets, and recurrent climate shocks.

Sudan’s Economic Toll vs. Libya’s Projected Boom in 2025

Economic growth in the MENA region was mixed.

Sudan’s economy has taken a significant toll due to ongoing conflict. IMF projections assume the conflict will end by the end of 2024, allowing for reconstruction to begin. The war has caused severe humanitarian and economic damage, with the economy expected to contract by 20.3% in 2024, before getting back to the green zone and growing by 8.3% in 2025. Recovery efforts are crucial for future growth.

Libya, on the other hand, is projected to have the highest growth in the region for 2025 at 13.7%. With oil and gas being critical to its economy, sustained production and improved security have driven growth. However, Libya’s economic growth slowed this year due to political instability and the challenge of surpassing the high growth rate of 10.2% achieved in 2023.

Conclusion

The MENA region shows signals of potential economic recovery with mixed growth prospects for countries. However, the situation is complicated by geopolitical instability, oil market volatility, and weakening medium-term growth prospects. The absence of economic projections for Lebanon serves as a reminder of the uncertainty that continues to affect the region’s future. The IMF emphasizes the need for reforms and stability to foster resilient growth.

Sources: World Economic Outlook (October 2024); World Economic Outlook (July 2024); IMF interview with Jihad Azour, IMF’s Director of Middle East and Central Asia Department

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.