Since 2019, Lebanon has been grappling with an economic crisis that has significantly impacted various sectors. The country has witnessed severe inflation, a devaluation of the Lebanese pound, and widespread unemployment, all of which have reshaped the financial landscape. In particular the banking sector, which had long been a pillar of Lebanon’s economy, has been severely affected. The interconnected decline across bank branches, employment, payment cards, and ATM networks reflects both the depth of economic collapse and its profound impact on financial accessibility.

Source: BDL Quarterly Bulletin

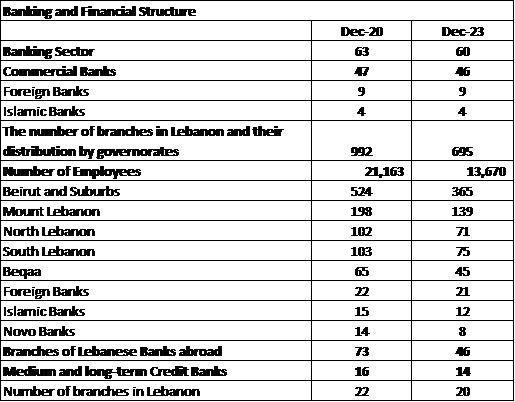

The table above showcases data between December 2020 and December 2023, the number of bank branches in Lebanon dropped from 992 to 695, a 30% reduction. Beirut and its suburbs, the center of financial activity, saw the most significant decline, from 524 to 365 branches. This trend reflects cost-cutting measures taken by banks grappling with liquidity shortages, depositor withdrawals, and systematic mistrust. Internationally, Lebanese banks reduced their global presence, with foreign branches declining from 73 to 46.

The shrinking workforce further underscores the sector’s distress. Employment in commercial banks fell by 35% from 21,366 workers in 2020 to 13,848 in 2023. Both male and female employees were affected, with technicians and executives being most affected, losing over 5,000 positions. In contrast, general management roles remained relatively stable, with a modest decline from 203 to 178 positions, reflecting the concentration of cuts at operational levels.

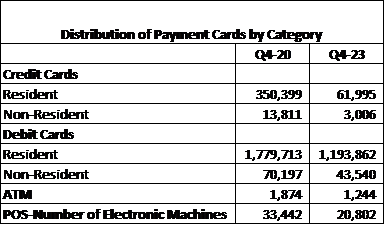

The financial strain is further illustrated by a sharp drop in payment card usage. Resident-issued credit cards fell drastically from 350,399 in Q4 2020 to 61,995 in Q4 2023, an 82% decline, while debit cards decreased by 33%, reflecting a broader retreat from formal banking services. This steep fall mirrors reduced consumer purchasing power, increased reliance on cash, and distrust in financial institutions due to deposit restrictions.

Simultaneously, the ATM network contracted significantly. The number of ATMs shrank by 33%, from 1,874 in Q4 2020 to 1,244 in Q4 2023. Beirut and suburbs again saw the largest reduction, from 672 to 423 ATMs. Regions like Mount Lebanon and North Lebanon also faced similar declines, exacerbating financial exclusion, particularly in rural areas such as Nabatieh and Beqaa, where infrastructure was already limited.

Additionally, a decline in electronic machines such as ATMs and points of sales (POS) terminals, further illustrates the sector’s contraction. From Q4-2020 to Q4-2023, the number of electronic machines dropped by 38%, from 33,442 to 20,802. This decrease further contributes to diminished access to formal banking.

Source: BDL Quarterly Bulletin

The interconnected declines in branch availability, workforce size, payment card usage, and ATM networks are clear indicators of Lebanon’s systematic financial collapse. Banks have been forced to scale back operations due to liquidity shortages, hyperinflation, and depositor mistrust, leading to reduced financial accessibility for citizens. This contraction has pushed many towards informal financial systems and cash based transactions.

By: Jana Boumatar

Disclaimer :

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.