Discover today’s performance of BLOM indices, the closing prices of Lebanese stocks and Eurobonds, as well as the exchange rate of major currencies against the LBP.

BLOM Stock Index (BSI) – today’s performance

| Last | Previous | % Change | Y-t-D Change | |

| BSI | 2,043.77 | 2,073.69 | -1.44% | -22.22% |

| Volume | 17,740 | 90,891 | ||

| Val ($) | 232,043 | 374,416 |

I): BLOM preferred Shares Index (BPSI): today’s Performance

| Last | Previous | Change | |

| BPSI | 27.52 | 27.52 | 0.00% |

| Volume | |||

| Value |

Lebanese Stocks: today’s Trades and Closing Prices

| Last Price ($) | % Change | Volume | VWAP ($) | |

| Solidere A | 87.00 | -3.33% | 200 | 87.00 |

| Solidere B | 85.00 | 0.00% | 1,680 | 85.00 |

| BLC Bank Pref D | 3.00 | 0.00% | 1,750 | 3.00 |

| Bank Audi | 2.62 | 0.00% | 4,000 | 2.60 |

| BLOM GDR | 5.21 | -1.70% | 10,010 | 5.20 |

| CB (N) | 40.00 | 0.00% | 100 | 40.00 |

Closing Date: April 22, 2025

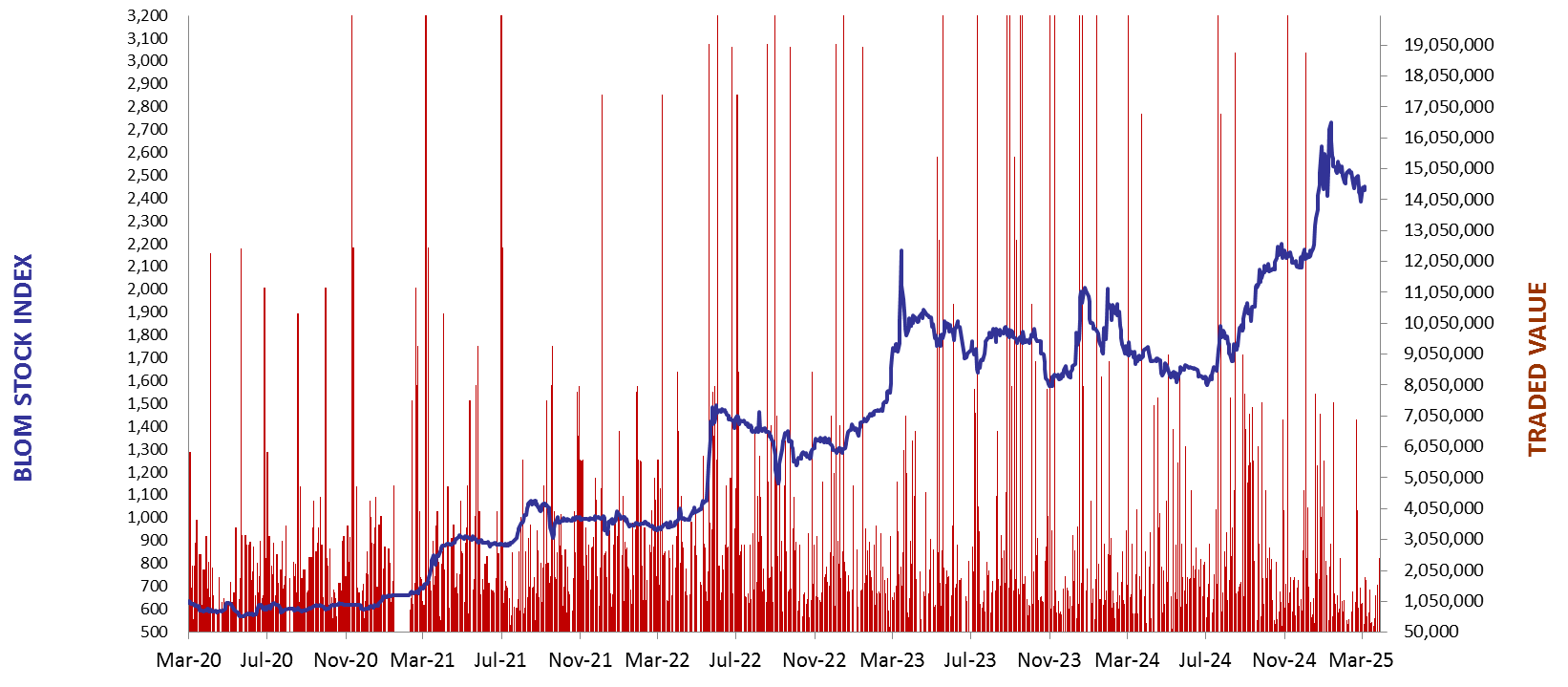

The BLOM Stock Index

BLOM BOND INDEX: Last Session’s Performance

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 17.77 | 16.95 | 4.87% | 33.74% | |

| Weighted Yield | 95.13% | 98.36% | -322 | bps | |

| Duration (Years) | 2.28 | 2.24 | |||

| 5Y Bond Yield | 95.20% | 97.90% | -270 | bps | |

| 5Y Spread* | 9,125 | 9,399 | -274 | bps | |

| 10Y Bond Yield | 66.50% | 68.40% | -190 | bps | |

| 10Y Spread* | 6,216 | 6,411 | -195 | bps |

*spread between Lebanese Eurobonds and US Treasuries

| Price | Yield | Yield Change | |

| 28/11/2026 | 17.13 | 168.22% | (501) |

| 23/03/2027 | 17.24 | 138.73% | (569) |

| 29/11/2027 | 17.07 | 102.94% | (323) |

| 03/11/2028 | 17.18 | 78.50% | (234) |

| 26/02/2030 | 17.09 | 62.06% | (187) |

| 22/04/2031 | 17.19 | 55.51% | (179) |

| 23/03/2032 | 17.24 | 51.31% | (195) |

| 02/11/2035 | 17.15 | 44.24% | (163) |

| 23/03/2037 | 17.18 | 43.97% | (193) |

Closing Date: April 17, 2025

Lebanese Forex Market

| Last Price | Previous | % Change | |

| $/LBP | 89,500 | 89,500 | – |

| €/LBP | 102,951.85 | 103,059.25 | -0.10% |

| £/LBP | 119,679.40 | 119,742.05 | -0.05% |

| NEER | 237.22 | 237.13 | 0.04% |

Closing Date: April 22, 2025