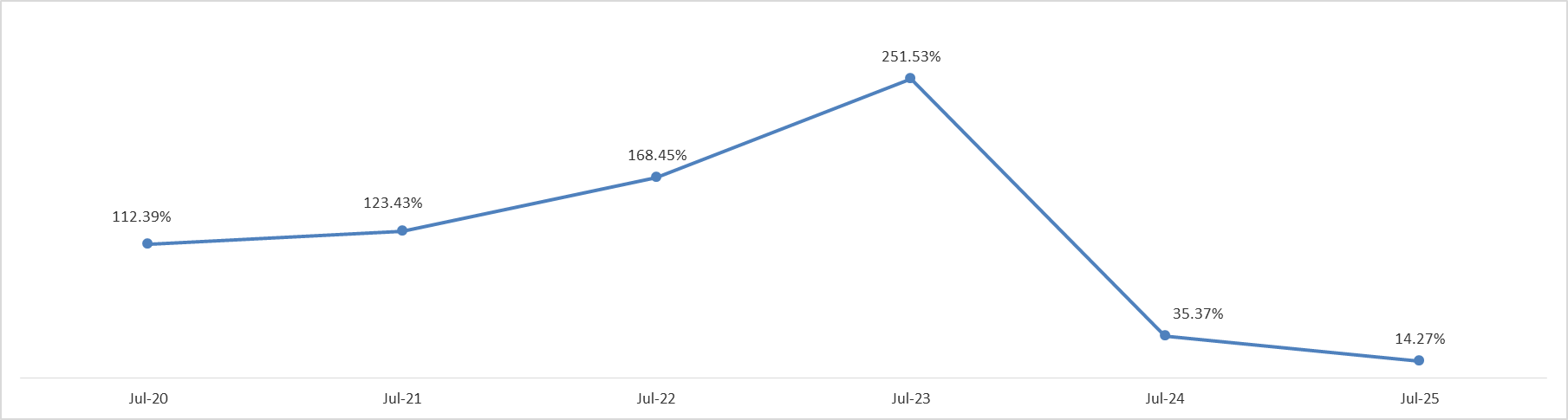

Lebanon’s Inflation Rate increased by 14.27% YOY in July 2025

Lebanon’s annual inflation rate decreased to 14.27% in July 2025, from 15.00% in June 2025 according to the Central Administration of Statistics (CAS). The average decrease in inflation in last year-and-a-half resulted from the increase of dollarization rates by businesses and to the stability of the exchange rate especially since August 2023. Moreover, the Iran-Israel war ended at the end of June; thus the situation in the red sea calmed in July 2025. This resulted in marginal decrease in inflation. Inflation in Lebanon is still higher than that of emerging markets, and this might be partially related to “snob effect” but we cannot be sure about it. Snob effect is a microeconomic concept in which demand for a good increase due to its uniqueness or expensiveness, especially when it comes to luxury food and hospitality products.

Source: CAS, BLOMINVEST

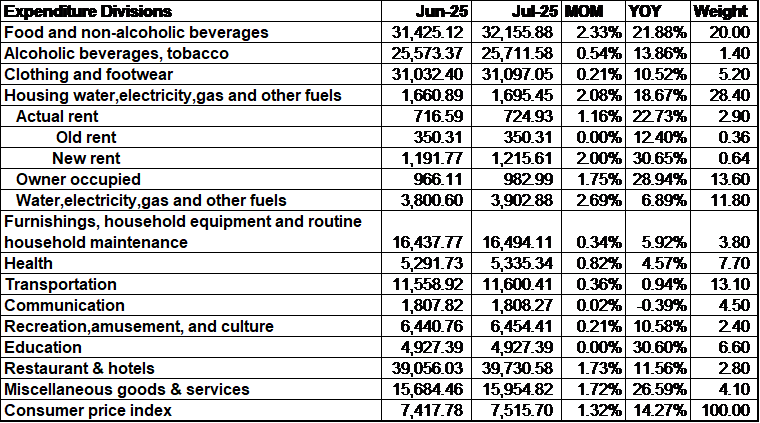

In details, it is worthwhile to note that Education (6.6% of CPI) increased by 30.60% YOY, Owner Occupied (13.6% of CPI) soared by 28.94% YOY, and Food and Non-alcoholic Beverages (20% of CPI) rose by 21.88% YOY during the same period.

The “New Rent” increased yearly by 30.08% despite that the cease-fire agreement started in November 27th, 2024 as some displaced people who lost their houses are hesitant to return to their villages as Israel is still breaching the cease-fire agreement in addition to the fact that most of them have paid the rent for a year in advance.

On a monthly basis, Consumer Price Index (Inflation) increased between June 2025 and July 2025 by 1.32%.

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.