Between December 19 and December 31, 2025, the Nominal Effective Exchange Rate (NEER) of the Lebanese pound edged up by 0.1%. The U.S. dollar weakened Read More

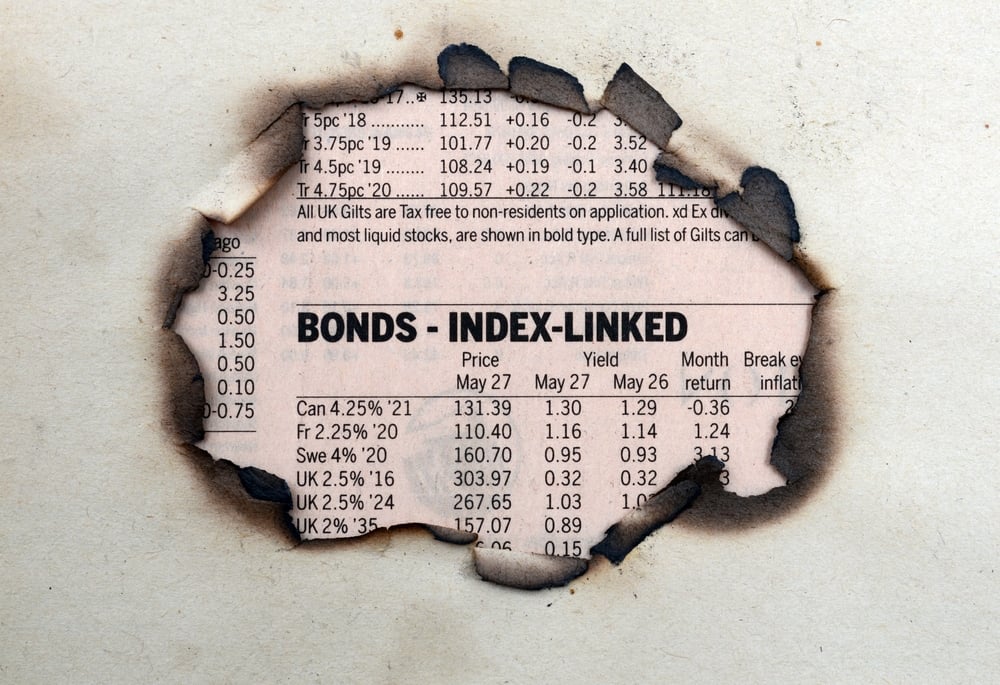

Discover today’s performance of BLOM indices, the closing prices of Eurobonds and the exchange rate of major currencies against the LBP.Read More

According to market sources, Cumulative Lebanese car market expanded by 59% year over year (YoY) by November 2025 to 12,067 cars. On a monthly basis, 1,150 Read More

Discover today’s performance of BLOM indices, the closing prices of Lebanese stocks and Eurobonds.Read More

Discover today’s performance of BLOM indices, the closing prices of Lebanese stocks and Eurobonds.Read More

Lebanon saw a cumulative 17.86% year-on-year (YoY) drop in construction permits to 8,324 permits by November 2025. The decline is largely attributed to ongoing insecurity, Read More

The BLOM Bond Index (BBI), which tracks Lebanese government Eurobonds (excluding coupon payments), fell by 1.19% in the week ending December 18, 2025, to 24.31 points. Read More

Discover today’s performance of BLOM indices, the closing prices of Lebanese stocks and Eurobonds, as well as the exchange rate of Read More

The Federal Reserve’s easing pressured the dollar, but lifted gold and silver prices. Still, analysts expect both metals to drop in 2026, Read More

Discover today’s performance of BLOM indices, the closing prices of Lebanese stocks and Eurobonds, as well as the exchange rate of Read More