The cumulative activity at Rafic Hariri International Airport rose by 10.38% year-on-year (YoY) during the first nine months of 2025 to 5,406,264 travelers. This increase Read More

BDL compiled August 2025 data using the two below sources as per the IMF recommendation to align with the International Norms: The ?Sixth Read More

Banque Du Liban (BDL) recently released its Macroeconomic Review for the first half of 2025, offering a comprehensive assessment of Lebanon’s economic Read More

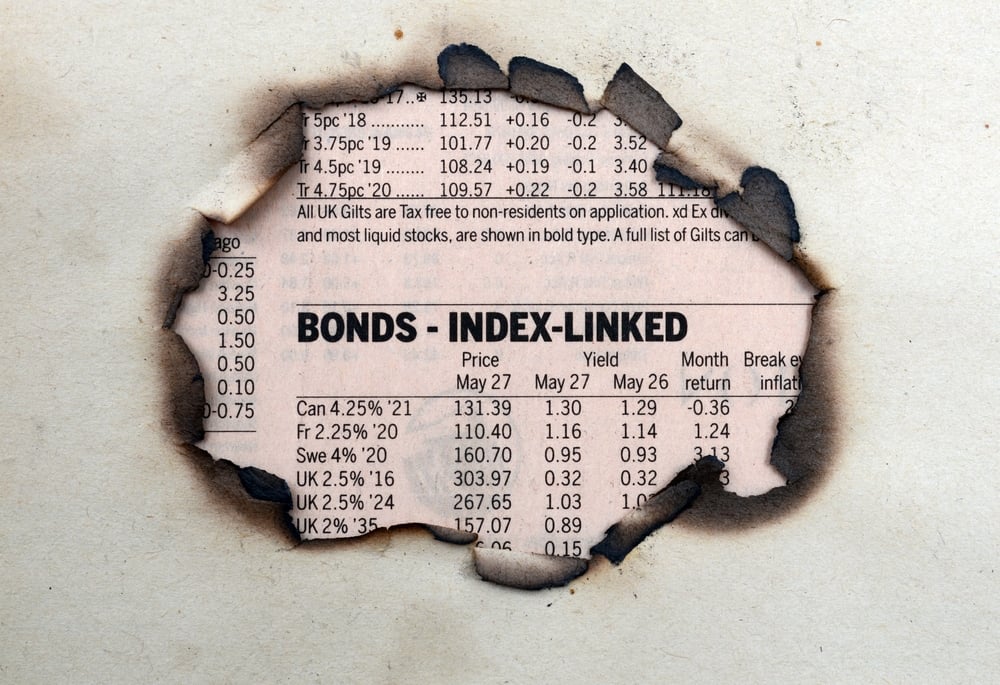

Lebanese Eurobonds surged 12.72% this week amid renewed optimism around regional stability and Lebanon’s slow-moving but active engagement with the IMF. Meanwhile, Read More

The dollar surged despite a U.S. government shutdown, while gold and silver rallied on safe-haven flows. Political shakeups in France and Read More

An IMF mission, which visited Lebanon from September 22 to 25, concluded without a final agreement on a program, despite acknowledging progress on Read More

The BLOM Bond Index (BBI), which tracks Lebanese government Eurobonds (excluding coupon payments), fell by 6.9% in the week ending September 25, 2025, to 23.04 points. Read More

The Fed’s rate cut shook currency and commodity markets this week, sending the dollar lower and gold to record highs. While Read More

Discover today’s performance of BLOM indices, the closing prices of Lebanese stocks and Eurobonds, as well as the exchange rate of Read More

BDL’s latest statistics on money supply revealed that Broad Money (M3) decreased by LBP 12,871.65 billion to stand at LBP 6,081,861 billion ($67.95 billion) Read More