Daily Capital Markets’ Performance

Discover today’s performance of BLOM indices, the closing prices of Lebanese stocks and Eurobonds, as well as the exchange rate of major currencies against the LBP.

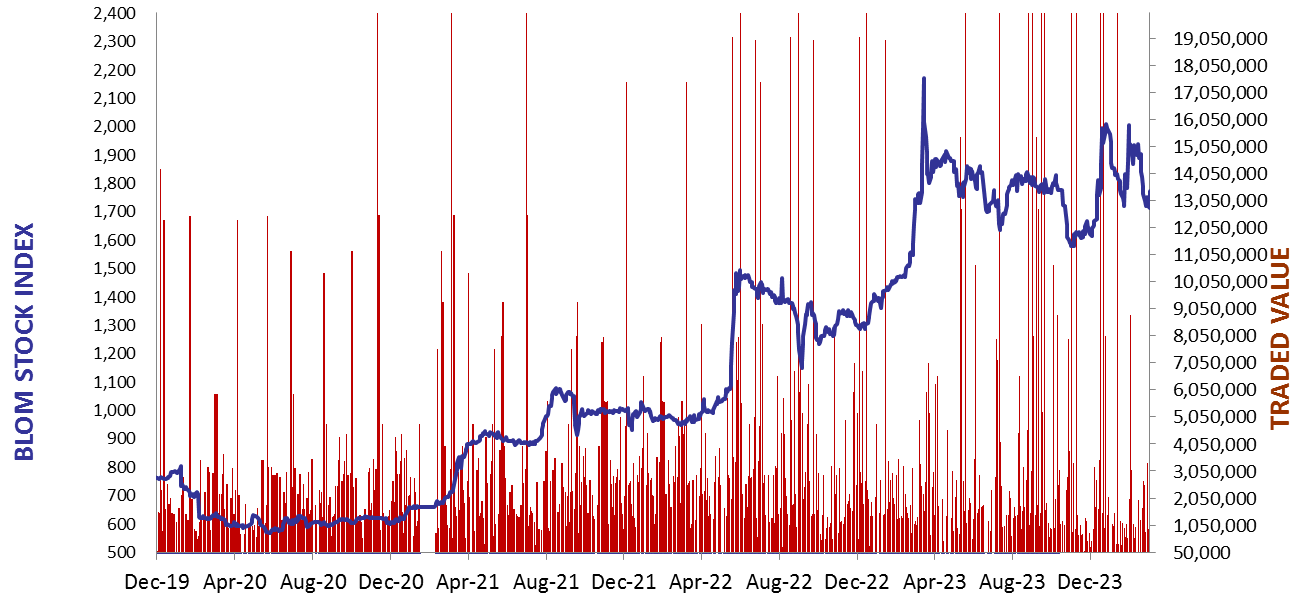

BLOM Stock Index (BSI) – today’s performance

| Last | Previous | % Change | Y-t-D Change | |

| BSI | 1,722.00 | 1,729.31 | -0.42% | -12.72% |

| High | 1,735.17 | 1,773.22 | ||

| Low | 1,710.78 | 1,710.78 | ||

| Volume | 3,815 | 18,785 | ||

| Val ($) | 284,790 | 672,184 |

I): BLOM preferred Shares Index (BPSI): today’s Performance

| Last | Previous | Change | |

| BPSI | 39.62 | 39.62 | 0.00% |

| Volume | |||

| Value |

Lebanese Stocks: today’s Trades and Closing Prices

| Last Price ($) | % Change | Volume | VWAP ($) | |

| Solidere A | 74.65 | -0.99% | 3,815 | 74.65 |

Closing Date: March 11, 2024

The BLOM Stock Index

BLOM BOND INDEX: Last Session’s Performance

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 6.02 | 6.03 | -0.10% | -0.10% | |

| Weighted Yield | 197.83% | 197.22% | 60 | bps | |

| Duration (Years) | 1.31 | 1.31 | |||

| 5Y Bond Yield | 107.40% | 107.40% | 0 | bps | |

| 5Y Spread* | 10,248 | 10,247 | 1 | bps | |

| 10Y Bond Yield | 105.60% | 105.60% | 0 | bps | |

| 10Y Spread* | 10,135 | 10,132 | 3 | bps |

*spread between Lebanese Eurobonds and US Treasuries

| Price | Yield | Yield Change | |

| 26/02/2025 | 6.69 | 662.76% | 245 |

| 12/06/2025 | 6.75 | 419.47% | 408 |

| 28/11/2026 | 6.58 | 176.06% | 23 |

| 23/03/2027 | 6.65 | 163.33% | 20 |

| 29/11/2027 | 6.68 | 136.75% | 9 |

| 03/11/2028 | 6.68 | 118.54% | 10 |

| 26/02/2030 | 6.67 | 107.81% | 0 |

| 22/04/2031 | 6.69 | 105.83% | 5 |

| 23/03/2032 | 6.68 | 105.41% | 7 |

| 02/11/2035 | 6.68 | 103.19% | 5 |

| 23/03/2037 | 6.68 | 107.52% | (5) |

Closing Date: March 08, 2024

Lebanese Forex Market

| Last Price | Previous | % Change | |

| $/LBP | 15,000 | 15,000 | – |

| €/LBP | 16,416.00 | 16,405.50 | 0.06% |

| £/LBP | 19,282.50 | 19,285.50 | -0.02% |

| NEER | 240.76 | 240.67 | 0.04% |

Closing Date: March 11, 2024