Daily Capital Markets’ Performance

Discover today’s performance of BLOM indices, the closing prices of Lebanese stocks and Eurobonds, as well as the exchange rate of major currencies against the LBP.

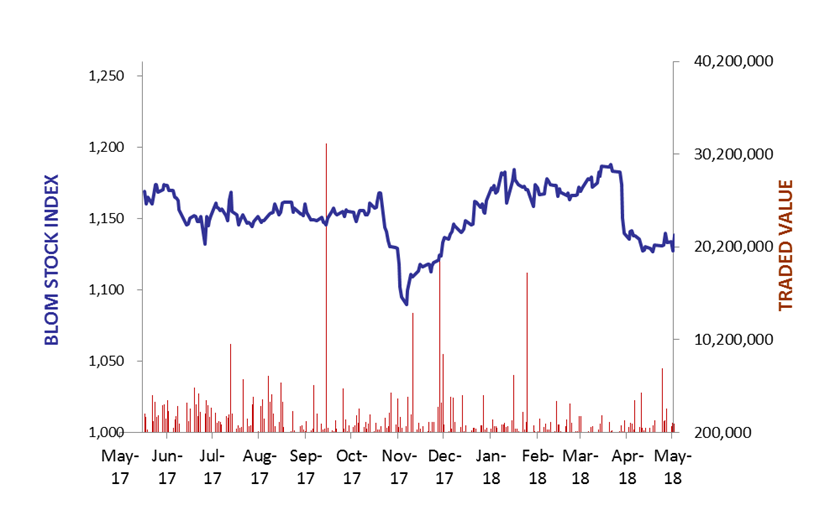

BLOM Stock Index (BSI): Today’s Performance

| Last | Previous | % Change | Y-t-D Change | |

| BSI | 1,103.63 | 1,103.33 | 0.03% | -3.91% |

| High | 1,106.04 | 1,104.39 | ||

| Low | 1,103.33 | 1,100.99 | ||

| Volume | 80,995 | 61,062 | 32.64% | |

| Val ($) | 710,880 | 655,204 | 8.50% |

BLOM preferred Shares Index (BPSI): Today’s Performance

| Last | Previous | Change | |

| BPSI | 100.30 | 100.56 | -0.26% |

| Volume | 134 | 4,600 | |

| Value | 12,730 | 157,500 |

Lebanese Stocks: Today’s Trades and Closing Prices

| Last Price ($) | % Change | Volume | VWAP ($) | |

| Solidere A | 8.26 | -1.67% | 4,754 | 8.26 |

| Solidere B | 8.26 | -2.02% | 1,107 | 8.26 |

| Bank Audi GDR | 5.64 | -0.88% | 32,000 | 5.64 |

| Byblos Bank Listed shares | 1.47 | -2.00% | 300 | 1.47 |

| Byblos Bank Preferred 2009 | 95 | -1.04% | 134 | 95 |

| BLOM – Listed | 10.75 | 2.38% | 400 | 10.75 |

| BLOM GDR | 10.99 | -0.09% | 42,300 | 10.98 |

The BLOM Stock Index

Lebanese Global Depository Receipts: Last session’s Performance

| GDRs | Last Price ($) | Previous Price ($) | % Change | Volume | Value ($) |

| BLOM GDR | 10.8 | 10.9 | -0.9% | 5,140 | 55,653 |

| Audi GDR | 5.4 | 5.5 | -1.8% | 28,170 | 152,808 |

| Byblos GDR | 75 | 75 | 0.0% | – |

Source: London Stock Exchange

Closing Date: 30 May 2018

BLOM BOND INDEX: Last Session’s Performance

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 93.48 | 93.75 | -0.29% | -7.50% | |

| Weighted Yield | 8.60% | 8.57% | 4 | bps | |

| Duration (Years) | 4.82 | 4.83 | |||

| 5Y Bond Yield | 8.50% | 8.44% | 6 | bps | |

| 5Y Spread* | 583 | 586 | -3 | bps | |

| 10Y Bond Yield | 9.29% | 9.18% | 11 | bps | |

| 10Y Spread* | 645 | 641 | 4 | bps | |

*between Lebanese Eurobonds and US Treasuries

Closing Date: 30 May 2018

It’s worth noting that Banque du Liban sold this week $3.022B worth of Eurobonds to be settled by May 30, 2018 through three tranches of payments (nominal value) payable as follows:

- $1.22B on March 20, 2028 maturity with a coupon rate of 7%

- $1.05B on May 17, 2033 maturity with a coupon rate of 8.2%

- $752.5M maturing on May 17, 2033 with a coupon rate of 8.25%

Lebanese Eurobonds: Last Sessions’ Prices and Yields

| Price | Yield | Yield Change | |

| 23/04/2019 | 98.75 | 6.95% | -11 |

| 20/05/2019 | 99.13 | 6.94% | -14 |

| 28/11/2019 | 97.75 | 7.06% | -18 |

| 09/03/2020 | 97.75 | 7.75% | 0 |

| 14/04/2020 | 96.63 | 7.76% | -15 |

| 19/06/2020 | 96.88 | 7.82% | -7 |

| 12/04/2021 | 99.50 | 8.44% | 10 |

| 04/10/2022 | 91.25 | 8.55% | 8 |

| 27/01/2023 | 90.00 | 8.65% | 11 |

| 22/04/2024 | 89.88 | 8.89% | 6 |

| 04/11/2024 | 87.00 | 8.95% | 6 |

| 03/12/2024 | 90.38 | 8.98% | 6 |

| 26/02/2025 | 86.00 | 9.01% | 6 |

| 12/06/2025 | 85.63 | 9.06% | 5 |

| 28/11/2026 | 84.75 | 9.23% | 5 |

| 23/03/2027 | 85.13 | 9.36% | 16 |

| 29/11/2027 | 84.50 | 9.24% | 9 |

| 03/11/2028 | 83.00 | 9.22% | 9 |

| 26/02/2030 | 81.50 | 9.27% | 10 |

| 22/04/2031 | 83.50 | 9.21% | 6 |

| 23/03/2032 | 82.75 | 9.23% | 7 |

| 02/11/2035 | 81.25 | 9.23% | 7 |

| 23/03/2037 | 82.00 | 9.29% | 3 |

| Last Price | Previous | % Change | Y-t-D | |

| $/LBP | 1,514.25 | 1,514.25 | – | |

| €/LBP | 1,760.16 | 1,757.90 | 0.13% | |

| £/LBP | 2,009.50 | 2,003.32 | 0.31% | |

| NEER | 113.67 | 113.79 | -0.10% | 2.48% |

Closing Date: 31 May 2018