Demand for Lebanese Eurobonds Fell on Friday

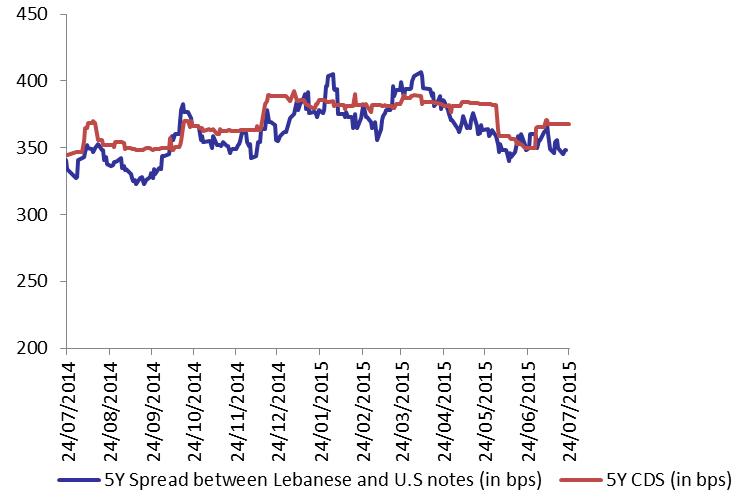

Demand for Lebanese Eurobonds slipped on Friday as the BLOM Bond Index (BBI) ticked down by 0.15% to 107.08. The yields on the 5Y and 10Y Lebanese Eurobonds went up by 5 basis points (bps) and 2 bps to settle at 5.35% and 6.21%, respectively. The spread between the yield on the 5Y Lebanese Eurobonds and its US comparable broadened by 6 bps to 371 as the demand for medium-term US notes slightly progressed. Meanwhile, the Lebanese 5Y Credit Default Swaps (CDS) moved from a previous quote of 355-380 bps t0 356-379 bps.

| Last | Previous | Change | Y-t-D %Change | ||

| BBI | 107.08 | 107.24 | -0.15% | -0.36 | |

| Weighted Yield | 5.49% | 5.45% | 4 | bps | |

| Duration (Years) | 5.09 | 5.10 | -1 | years | |

| 5Y Bond Yield | 5.35% | 5.30% | 5 | bps | |

| 5Y Spread* | 371 | 365 | 6 | bps | |

| 10Y Bond Yield | 6.21% | 6.19% | 2 | bps | |

| 10Y Spread* | 394 | 391 | 3 | bps | |

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.75 | 4.13% | 8 |

| Mar. 2017 | 107.4 | 4.31% | 2 |

| Oct. 2017 | 100.8 | 4.61% | 15 |

| Jun. 2018 | 101.46 | 4.60% | 0 |

| Nov. 2018 | 100.88 | 4.86% | 11 |

| Apr. 2019 | 101.75 | 4.98% | 0 |

| Mar. 2020 | 104.25 | 5.32% | 3 |

| Apr. 2020 | 101.75 | 5.37% | 3 |

| Apr. 2021 | 113 | 5.56% | 5 |

| Oct. 2022 | 101.88 | 5.78% | 2 |

| Jan. 2023 | 100.75 | 5.87% | 4 |

| Dec. 2024 | 106.75 | 6.04% | 2 |

| Feb. 2025 | 100.75 | 6.09% | 3 |

| Nov. 2026 | 102.5 | 6.29% | 2 |

| Nov. 2027 | 103.5 | 6.34% | 1 |

| Feb. 2030 | 101.5 | 6.49% | 1 |